In December, Congress passed the most significant - and perhaps the most confusing - tax bill we've seen in over three decades, earning a stamp of approval from the President just in time for tax season. Though the new plan will not affect the filing of our 2017 taxes, it does introduce some significant game changers going forward.

One noticeable change is the elimination of personal and dependent exemptions. Initially, the exemption amount was thought to increase from the current $4,050 to $4,150 in 2018, making its eradication both unexpected and a bit disappointing. On the other hand, the Child Tax Credit rose from $1,000 to $2,000 per child, bumping the refundable portion of the credit up from $1,100 to $1,400.

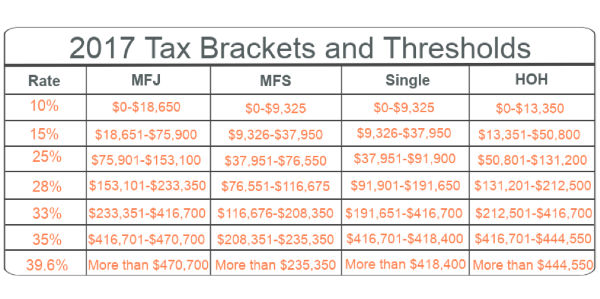

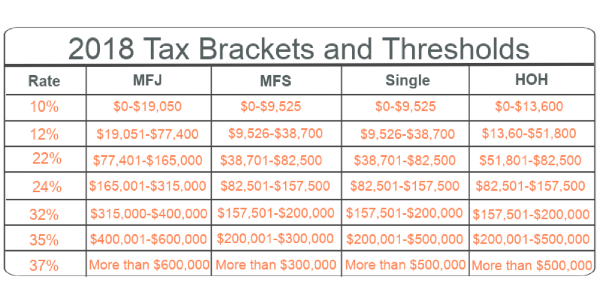

The new bill also lowers some current tax rates, which changes the income thresholds at which the rates apply. Below is a comparison chart outlining the differences between existing brackets and thresholds compared against the new brackets and thresholds.

For more information on tax law changes feel free to visit the IRS.gov, or check in monthly as we tackle all things tax!