TaxAudit Blog

Keeping you up-to-date on tax issues that may affect your life.

-

Learn how the new 2025 No Tax on Tips rule works, who qualifies, income limits, and how tip‑based workers can save more on federal taxes. Read More ›

-

The previously-owned clean vehicle tax credit ends after Sept. 30, 2025. Understand key rules, deadlines, and what the change means for buyers and taxpayers. Read More ›

-

Discover how HSA accounts and Medicare affect eligibility, contributions, and timing to avoid costly penalties during retirement planning. Read More ›

-

Wondering how long to keep tax returns and tax records? Follow IRS record retention rules to stay organized, compliant, and audit-ready. Read More ›

-

Learn the correct tax filing status for widows or widowers without dependents, including key IRS rules and financial implications. Read More ›

-

Learn how the adoption tax credit works, income limits, and new refundable rules under the One Big Beautiful Bill Act. Read More ›

-

Learn why the IRS is ending Direct File under the Big Beautiful Bill Act and what free tax filing options remain for taxpayers. Read More ›

-

Learn how often the IRS can levy your bank account, what triggers it, and steps to stop repeated levies. Act fast to protect your funds. Read More ›

-

Learn when the no-tax-on-overtime rule starts, who qualifies, income limits, and how to claim your deduction under the new legislation. Read More ›

-

Learn the four types of IRS Innocent Spouse Relief to avoid paying for your spouse’s tax mistakes. Find out which option fits your situation. Read More ›

-

Learn what IRS Notice CP134B means, why you received it, and how to resolve payroll tax discrepancies to avoid penalties. Read More ›

-

Overwhelmed by IRS debt? See how TaxAudit helped Jane reduce $31K by 90% and regain peace of mind. Get expert help today. Read More ›

-

IRS Letter 797 explains the Earned Income Tax Credit (EITC)—a refundable tax benefit that could mean a bigger refund. Learn why it’s good news. Read More ›

-

Learn if the IRS can garnish Social Security benefits, the limits on levies, and steps to protect your income from tax collection. Read More ›

-

Learn what Form 1099-NEC is, who must file it, and how the One Big Beautiful Bill impacts reporting thresholds for non-employee compensation starting in 2026. Read More ›

-

Learn what IRS Letter 474C means, why you received it, and how to respond with confidence. Get expert tips to resolve tax issues quickly and effectively. Read More ›

-

Learn how gambling losses are taxed under the new 2026 rules and what records you need to claim deductions on your tax return. Read More ›

-

Received IRS Notice 106C? Learn what “Claim Partially Disallowed” means and how to respond if your Employee Retention Credit claim was audited. Read More ›

-

Explore how Trump Savings Accounts for Newborns work, including eligibility, contribution limits, tax rules, and long-term investment potential. Read More ›

-

IRS Letter 4870 alerts you that your e-filed tax payment was rejected. Learn what it means and how to respond quickly to avoid penalties. Read More ›

-

Discover how changes to the SALT deduction can reduce your federal tax bill—especially if you live in a high-tax state or itemize deductions. Read More ›

-

Learn what IRS Notice CP15 means, why you received it, and how to respond or dispute the penalty to avoid further charges and resolve the issue. Read More ›

-

IRS audit? TaxAudit helped settle $900K for $8,100. Learn how expert defense and debt relief can turn stress into savings. Read More ›

-

If you’ve received an IRS CP215 Notice, Notice of Penalty Charge, you're not alone, and with the right steps, you can resolve the issue. Read More ›

-

IRS Form 3531, titled ”Request for Signature or Missing Information to Complete Return,” is a notification that your tax return cannot be processed. Read More ›

-

Learn how 529 plans can now cover private school and homeschool expenses—up to $20,000 per student annually starting in 2026. Read More ›

-

Received IRS Letter CP3219A? Learn what it means, why you got it, and how to respond before the deadline to avoid a tax bill. Read More ›

-

Learn if daycare is tax deductible and how the Child and Dependent Care Credit can help reduce your tax bill if you meet key IRS criteria. Read More ›

-

Discover tax rules, loopholes, and pitfalls for Airbnb and short-term rentals to reduce liability and maximize deductions legally. Read More ›

-

Need Tax Debt Help? Owe IRS taxes? Don’t panic. Payment plans and Offers in Compromise can help settle your debt affordably. Free consults available. Read More ›

-

Married couples who are not living together can file their taxes as Married Filing Jointly, Married Filing Separately, or Head of Household filing status. Read More ›

-

IRS Letter 4364C explains changes to your Amended Return. Learn what it means, what to expect next, and how to respond effectively. Read More ›

-

Received IRS Notice CP504B? Learn what it means, how to respond, and what the IRS can seize or levy if you don’t resolve your tax debt. Read More ›

-

Taxpayers have two ways to calculate their home office deduction. With the Simplified Method, you multiply the square footage of your home office by $5. Read More ›

-

Have you just received an IRS CP24 Notice and do not know what to do? No need to fear! Let's go over what an IRS CP24 Notice is and how to respond. Read More ›

-

One of the most common notices the IRS sends out is IRS Letter 2645C, also known as a “stall letter.” This notice does not typically require further action. Read More ›

-

For the following two years after the year of your spouse’s death, you may be able to file your tax return as a Qualifying Surviving Spouse (QSS). Read More ›

-

An IRS Letter 12C is requesting additional information to verify the claims made on your tax return. The request is typically included in the fourth paragraph. Read More ›

-

What expenses do you incur because of your ridesharing gig, like Uber, can you deduct? How do you properly report and keep track of them in case of an audit? Read More ›

-

Let’s discuss the differences between IRS liens and levies and how you can resolve each of them. IRS liens and levies refer to two completely different things. Read More ›

-

Most changes to filing status are allowed with an amendment, assuming you meet the requirements of the new filing status. You have 3 years to file an amendment. Read More ›

-

The Head of Household filing status applies to taxpayers who are responsible for the care of another who is their dependent. You must pass three tests. Read More ›

-

IRS Notice CP75 is common for returns having refundable credits, such as the Earned Income Tax Credit. Every year, about 270,000 taxpayers receive the letter. Read More ›

-

Digital assets received via an airdrop, such as cryptocurrency or NFTs, are taxable to the recipient and includable on their income tax return. Read More ›

-

Some but not all tax debt relief companies are illegitimate. Those who are legit can provide relief and results that give you peace. Let's look at red flags. Read More ›

-

The actual amount of interest paid on loans taken from foreign lenders may be eligible for the student loan interest deduction. Let's explore more. Read More ›

-

A CP14I is issued when the IRS believes you did not withdraw the required minimum distribution from your IRA or made excess contributions to an IRA. Read More ›

-

Each stock option has its own characteristics and reporting is not the same. If there is employee withholding, the employer submits to the taxing authority. Read More ›

-

Let's look at the basics of disaster distributions and a new rule that’s empowering survivors of domestic violence to access their funds more safely. Read More ›

-

What happens if an employer withholds federal income, Social Security, and Medicare taxes on behalf of the employee but does not give the taxes to the IRS? Read More ›

-

If you are legally separated by the end of the tax year, you must file as Single unless you qualify to file as Head of Household. Read More ›

-

Let's explore disaster distributions from retirement accounts. Do you need to repay them? Are there anyother tax implications you might want to consider? Read More ›

-

Once your child turns 17 they no longer qualify you for the child tax credit, but many tax benefits can still be claimed with that child as your dependent. Read More ›

-

Withdrawing from your pension or IRA accounts can have unexpected consequences for your taxes and overall financial health in retirement. Let's take a look. Read More ›

-

The financial side of being a traveling nurse, especially when it comes to per diem payments and tax deductions, feels like a maze with hidden traps every turn. Read More ›

-

The Tax Code offers two tax credits for college tuition paid. Each credit has different requirements, which determines the benefit an individual is eligible. Read More ›

-

Does Hurricane Milton or Helene qualify as a diaster loss for tax purposes? What are the tax implications of natural disasters taxpayers should be aware of? Read More ›

-

If you use your vehicle for your independent contractor business, you may be able to take a deduction on Schedule C for the business use of that vehicle. Read More ›

-

Per diem payments for contractors can either be taxable or non-taxable, depending on whether they fall under accountable or non-accountable plans. Read More ›

-

Yes, moving expenses can be tax deductible, but only if you meet the requirements of one of the circumstances noted in this article. Let's explore more. Read More ›

-

Self-employed taxpayers can claim per diem deductions for business travel, provided that the circumstances of their travel meet certain conditions. Read More ›

-

Congress enacted the SECURE 2.0 Act of 2022 (SECURE 2.0), which adjusted some of the contributions you can make to your retirement plans. Read More ›

-

What does the balance sheet represent in your tax return? A balance sheet is a financial statement that reports a company's assets, liabilities, and equity. Read More ›

-

How much the IRS charges for a payment plan or Installment Agreement depends upon the amount of debt owed, type of agreement, and other factors. Let's explore. Read More ›

-

The Saver’s Tax Credit is available to qualifying taxpayers who make eligible contributions to an IRA, qualified employer retirement plan, or ABLE account. Read More ›

-

The fastest way to check the amount of Montana estimated taxes you already paid is through the Montana Department of Revenue’s (DOR) TransAction Portal (TAP). Read More ›

-

Per diem allowances are generally not taxable to employees. However, there are some instances in which a per diem becomes taxable. Let's look at some examples. Read More ›

-

Yes, interest you pay on business and personal credit cards may be deductible, but the amount you can deduct depends on the type of purchases you have made. Read More ›

-

IRS notice CP79 has two variations - a CP79 and a CP79A. It is important to note which one you have in your hands to better understand what is next. Read More ›

-

If my son is doing fire fighting training with no pay, is he considered to be a student for taxes? Can I get a tax credit or deduction with unpaid training? Read More ›

-

You're liable for estimated tax payments if your Connecticut income tax will be $1,000 or more and tax withheld will be less than your required annual payment. Read More ›

-

If you have changed jobs multiple times and are now looking at retiring, you may be overlooking retirement accounts you had with previous employers. Read More ›

-

Federal estimated tax voucher #4 list in mail. What actions should I take in filing my tax return? The IRS began accepting 2024 income tax returns on 1/27/25. Read More ›

-

There is a catch to the allowance for rental losses. The $25,000 limit is reduced by $1 for every $2 your modified adjusted gross income exceeds $100,000. Read More ›

-

The IRS may determine your business is a hobby, limiting what you can deduct as expenses. This is particularly true if the activity consistently loses money. Read More ›

-

Yes, car insurance can be tax deductible for self-employed taxpayers, Armed Forces reservists, qualified performing artists, and some government officials. Read More ›

-

PMI, funding fees, and guarantee fees can be deductible if you qualify. One qualification is your mortgage loan must have been taken out between 2007 and 2021. Read More ›

-

A tax lien occurs when the IRS makes a legal claim to your property to settle a tax debt. There are options if you can't pay the total amount or disagree. Read More ›

-

The IRS treats payroll tax liability lapses as a very serious offense and makes it a priority within their enforcement wing to collect these amounts. Read More ›

-

My child’s Social Security number was used on another tax return. What do I do? It is prudent to file an IRS identity theft affidavit as soon as possible. Read More ›

-

Let's talk about small businesses and one of the most common tax issues they face: making sure their payroll tax is taken care of timely and properly. Read More ›

-

If you have qualified student loan interest, you may be able to take a tax deduction for a portion of what you paid on your federal income tax return. Read More ›

-

In this article we will discuss some key issues related to whether life insurance is tax deductible and a few potential tax benefits of life insurance. Read More ›

-

A levy is when the IRS is permitted to garnish someone’s wages, bank accounts, property (such as a house or car), investments, etc. to satisfy a tax debt. Read More ›

-

If you find yourself in need of making estimated payments, I hope this guide is just what you need to tackle paying them in the Commonwealth of Massachusetts. Read More ›

-

Currently Not Collectible (CNC) is when the IRS determines that you are financially unable to pay the tax debt that you owe, so they put your debt on hold. Read More ›

-

A nonrefundable tax credit lowers your tax liability but not below zero. Therefore, a nonrefundable tax credit cannot be used to create a tax refund. Read More ›

-

What is beneficial ownership information reporting? If you aren’t certain whether it applies to you, this blog may help clarify the reporting requirement. Read More ›

-

Whether you can settle your tax debt through an offer in compromise will depend on what the IRS deems is your collection potential, or ability to pay. Read More ›

-

Penalty abatement is the process of requesting the IRS remove penalties (this is called abatement). You need to demonstrate that there is a "reasonable" cause. Read More ›

-

Child support is not deductible for tax purposes. Child support payments are also not required to be reported as income by any person receiving them. Read More ›

-

How many of you double-check the beneficiaries of your retirement accounts? Failing to do so can have significant unintended consequences for your heirs. Read More ›

-

Credits can either be refundable or non-refundable. Refundable tax credits can result in a refund if the credit amount is more than the taxes you owe. Read More ›

-

Due to seriously delinquent taxes,you could receive an IRS letter stating that your passport is being revoked or your passport application is being denied. Read More ›

-

What is an Audit Reconsideration? If a taxpayer goes through the audit process but disagrees with the results, they can request an Audit Reconsideration. Read More ›

-

If you received a letter from an IRS Revenue Officer, you might be wondering what that means and what steps you should take next. Read More ›

-

There is a very good chance you can deduct mortgage interest on a second home – but it depends on the details of your situation. Let's explore more. Read More ›

-

When certain medical expenses aren’t covered by a health insurance plan or have a high deductible, the IRS allows a tax deduction on the individual tax return. Read More ›

-

Yes, you may be able to deduct mileage and gas on your taxes, but only if you meet certain conditions. Please allow me to explain. Read More ›

-

What if your spouse filed a return and failed to report income or overstated deductions – and you had no idea? This is where Innocent Spouse Relief comes in. Read More ›

-

The amount of tax debt relief a person can receive depends on their financial situation. Many options are available to those who have outstanding tax debt. Read More ›

-

The losses you incur from your gambling activities may be tax deductible, but the total amount of your deduction cannot exceed the amount of gambling income. Read More ›

-

Estimated tax payments must be made when the estimated taxes owed by a Montana taxpayer – after any withholding and nonrefundable credits – is more than $500. Read More ›

-

Taxpayers cannot always pay the full amount they owe to the IRS. Taxpayers can use an installment agreement to pay off their debt over time. Read More ›

-

It generally takes six months to two years to resolve a tax relief case. However, it can take longer than two years depending on the complexity of the issue. Read More ›

-

If you are facing wage garnishment or are worried that the IRS may enact this levy on your wages, continue reading to learn more about it and how to stop it. Read More ›

-

Whether a taxpayer files a tax return in any given state is generally based on the source of the income, but their tax home is usually where they are domiciled. Read More ›

-

Utah does not require quarterly estimated tax payments by taxpayers who file a Utah tax return. However, taxpayers can make a prepayment at any time. Read More ›

-

The short answer is YES. Minors who are employed and earn income are generally subject to federal withholding taxes, just like adult employees. Read More ›

-

Our service costs generally range between $1,000 and $5,000, depending on multiple factors including the complexity and the estimated time it takes to resolve. Read More ›

-

Oregon taxpayers who expect to owe more than $1,000 after taxes already withheld and allowable credits must make estimated tax payments. Read More ›

-

Because the distributions from a Roth IRA are usually not taxable, contributions you make to them are also not deductible. Read More ›

-

Taxpayers who file a Kentucky tax return and expect to owe more than $500 (after any taxes withheld and allowable credits) must make estimated tax payments. Read More ›

-

To answer this question, an individual must first determine whether they are considered a resident alien or a nonresident alien for U.S. income tax purposes. Read More ›

-

Yes, tax relief is available for state taxes. Most states have put programs into place to assist taxpayers who are unable to pay their tax balance due in full. Read More ›

-

Louisiana taxpayers who expect to owe $1,000 for single ($2,000 for joint) or more, must make a declaration of estimated income and pay estimated tax payments. Read More ›

-

Wisconsin taxpayers who expect to owe more than $500 after withheld taxes and allowable credits should make estimated tax payments or increase withholding. Read More ›

-

We will be talking about whether the “pennies on the dollar” claims for tax debt relief that you hear on radio or late-night TV ads are real. Read More ›

-

Taxpayers who file a Virginia tax return and expect to owe $150 or more over any taxes already withheld might need to file estimated tax payments. Read More ›

-

An Audit Reconsideration requests the IRS reopen a previously closed audit case. It can be requested after the audit occurrs and the tax remains unpaid. Read More ›

-

Regardless of whether they are a Michigan resident, taxpayers who expect to owe more than $500 when they file their MI-1040, must make estimated tax payments. Read More ›

-

Yes, Tax Debt Relief is available for businesses. Read more about tax debt issues businesses face such as Employment Tax Issues, Trust Fund Taxes, etc. Read More ›

-

Let's talk about how the Tax Debt Relief process at TaxAudit works so you can decide if our company is the best for you. Read More ›

-

The first thing you want to do when choosing a tax debt relief company is confirm you are speaking to a licensed tax professional - EA, CPA, or tax attorney. Read More ›

-

Do you have tax debt? Would repaying this debt cause you financial hardship? If so, you may be eligible for Currently Not Collectible status through the IRS. Read More ›

-

You are an influencer and have a large enough following that you are making money from your online posting. What kinds of expenses can you deduct on your taxes? Read More ›

-

In Illinois you may not be subject to the penalty if you pay at least 90% of this year's tax or 100% of last year's tax in four equal timely installments. Read More ›

-

If you estimate that you will owe more than $400 in New Jersey income tax at the end of the year, you are required to make estimated payments. Read More ›

-

IRS Letter 525 is sent to let you know that your tax return was reviewed. A wise taxpayer should proceed with caution, yet swiftly, from this point forward. Read More ›

-

Both a tax deduction and a tax credit reduce the amount you may owe on your return, and possibly increase your refund. But how they get there is different. Read More ›

-

An IRS levy is the actual seizure of property you own. An IRS lien is a public document that notifies any creditors that the IRS has a right to your property. Read More ›

-

A CP08 is to let taxpayers know that they may qualify for the Additional Child Tax Credit and, in turn, could be eligible to receive a refund. Read More ›

-

You received a letter from the State of Colorado stating you do not qualify for a state sales tax refund because your return was filed after the deadline. Read More ›

-

The IRS has issued a CP11A notice because they believe there was a miscalculation on your tax return for the year in question and made changes to reflect this. Read More ›

-

What happens if your spouse overstated the deductions claimed on the return or substantially understated the income? Are you still liable for the tax due? Read More ›

-

Alimony payments may indeed be tax deductible if the divorce or separation instrument under which they are made was executed prior to 2019. Read More ›

-

Most states that have income taxes offer a credit for taxes paid to another state on the same income, although how that credit is calculated is not identical. Read More ›

-

IRS notice CP05A is sent by the IRS to inform taxpayers that they need more information about the submitted income tax return before a tax refund can be issued. Read More ›

-

You received an IRS CP87A because someone else filed a tax return and claimed the same dependent or qualifying child that you claimed on your tax return. Read More ›

-

Per the collection statute expiration date, the IRS generally has 10 years from the date they assess your tax balance to collect taxes owed. Read More ›

-

The PA Dept of Revenue expects you to make PA Estimated Tax payments if you make more than $9,500 of taxable income that has not had taxes withheld from it. Read More ›

-

When you give assets to family members, they are subject to the gift tax exclusion amount, currently $17,000 per year. If your gift exceeds this amount... Read More ›

-

If you can show that there was “reasonable” cause for the understatement or for failure to file or pay on time, you may be able to get those penalties abated. Read More ›

-

In most circumstances, you must file an amended return within 3 years from the date you filed your original return or 2 years from the date you paid the tax. Read More ›

-

One of the most valuable tools to protect yourself against IRS collection actions – particularly against liens and levies – is a collection due process hearing. Read More ›

-

Receiving notice of an IRS levy can cause a lot of anxiety. How you can prevent an IRS levy from occurring or release a levy once it has occurred? Read More ›

-

When shares of a limited partnership held in a SEP-IRA are completely sold are the gains subject to recapture as ordinary income as shown on the K-1 taxable? Read More ›

-

Two siblings were listed on the title of a home with their mother. She died and the siblings sold the home and distributed the funds to the other siblings. Read More ›

-

Groceries you buy for your household are a personal expense and are not deductible. But there are numerous cases in which food can be deductible. Read More ›

-

IRS CP53 and 53A letters are issued because the IRS was unable to issue your refund by direct deposit. There are several reasons why this may occur. Read More ›

-

Creating your IRS online account starts with a simple trip to the IRS website. You will need an email address, a smartphone with a working camera, and an ID. Read More ›

-

An amended IRS tax return refund can take in the region of 20 weeks to receive. The Where’s My Amended Return? Tool allows taxpayers to check the status. Read More ›

-

Fortunately, there are a myriad of tools available for taxpayers who want to tackle their tax debt issues and dispute the collection actions taken by the IRS. Read More ›

-

The general deadline for an amended tax return is 3 years from when the original return was filed or 2 years from when the tax was paid, whichever is later. Read More ›

-

An IRS Installment Agreement can be very easy or complicated, depending on your circumstances. Read More ›

-

There is no tax benefit for applying to enter a college. However, many benefits are available when your application has been accepted and after you enroll. Read More ›

-

IRS notice CP523 informs you the IRS intends to terminate your installment agreement or payment plan because they haven't received one or more monthly payments. Read More ›

-

An IRS Offer Compromise is an attempt to settle your tax liability with the IRS for less than what is owed. There are three types of Offers in Compromise. Read More ›

-

If you happen to miss one of your quarterly estimated tax payments, all is not lost. As soon as you remember, go ahead and make the quarterly payment late. Read More ›

-

If you’ve received an IRS deficiency or IRS determination and disagree with the changes, how can you dispute them? Read on because we’re here to help! Read More ›

-

The IRS assessment period is at least six years if enough income was omitted. If the the omission of income was deliberate, the IRS has all the time they want. Read More ›

-

Kenneling a dog for work travel is considered a personal expense. However, I wonder if the answer is different if I make income from my dog? Read More ›

-

How do I write off solar panels for rental properties when I claim as a real state professional to run a rental business? Read More ›

-

Whether you can deduct credit card interest on your taxes depends on the use of a credit card. Are you using it for personal, business, or perhaps both? Read More ›

-

IRS Notice CP21A is a letter that the IRS issues when changes have been made to a tax return by the taxpayer, usually after they have filed an amended return. Read More ›

-

The deductibility of origination fees on your taxes from buying a new home is dependent upon a few factors - the main factor being if itemize your deductions. Read More ›

-

Rentals are considered to be special passive activities and the amount of loss you can use in any year is limited to $25,000, if your AGI is under $100,000. Read More ›

-

A CP518 notice is issued by the IRS to taxpayers because they have no record of a tax return being filed for the year listed on the notice. Read More ›

-

While homeschooling, can you deduct the cost of classes for skills that the homeschooling parent doesn’t possess, such as ballet classes or piano lessons? Read More ›

-

A number of different software applications that use a smartphone have become available for the purpose of recording business and personal mileage. Read More ›

-

If you received an IRS notice CP521, it is because you entered into an installment agreement with the IRS for taxes owed and your monthly payment is now due. Read More ›

-

You can use the US tax code to reduce the impact of foreign taxes you have paid or incurred depending on the country or countries involved. Read More ›

-

An IRS Notice CP45 is a letter the IRS sends to notify you that your request to apply your overpayment to your next year’s estimated taxes cannot be granted. Read More ›

-

Much like the IRS, California’s taxing agency, the California Franchise Tax Board (or CA-FTB), expects to collect your owed taxes throughout the tax year. Read More ›

-

Similar to the IRS, New York’s taxing agency, the New York State Department of Tax and Finance, expects to collect your owed taxes throughout the tax year. Read More ›

-

You can deduct an unpaid invoice as a business expense if all the following are true: (1) You have already included the amount of the invoice as income… Read More ›

-

As the law currently stands for individual taxpayers, starting in the 2026 tax year, you will be able to deduct estate planning fees related to tax planning. Read More ›

-

A child who qualifies as a dependent on their parent’s tax return will need to file a tax return in certain situations. Let's explore when they need to file. Read More ›

-

IRS Letter 105C notifies you that the IRS did not allow the credit or refund you claimed. Usually, Letter 105C will explain why your claim was disallowed. Read More ›

-

Now that the pandemic is officially over, can I still deduct the cost of masks and hand sanitizer for my classroom or place of business? Let's find out. Read More ›

-

IRS Notice CP10 is issued when the IRS believes there was a miscalculation on your tax return. This results in changes that affect your estimated tax payments. Read More ›

-

An IRS CP16 typically informs you that the IRS believes a miscalculation or other error was made on your return, and they have adjusted your refund. Read More ›

-

If you want to deduct your first-class airfares, be aware that the IRS may question you about these expenses and will make its decision based on each trip. Read More ›

-

A CP75D is issued when the IRS needs you to verify your income and/or withholding. This could affect whether you receive a refund or owe the IRS additional tax. Read More ›

-

Yes, you can. Provided that the baby in question is your dependent, there is a whole host of tax benefits you can take advantage of to offset your expenses. Read More ›

-

IRS letter CP91 states that the IRS may seize up to 15% of your Social Security because you have an unpaid tax balance due. What can you do if you get a CP91? Read More ›

-

Your GoFundMe donations can be deductible provided that they are being sent to the correct type of organization - a registered 501(c)(3) organization. Read More ›

-

The deduction of any expenses, including snacks for riders from rideshare drivers, depends on your personal facts and circumstances. Let's explore more. Read More ›

-

My mom passed away about a year ago, and I inherited two IRAs. Can I roll over one of the IRAs into the other inherited IRA if it is done by direct transfer? Read More ›

-

IRS Notice CP25 informs you that there was a difference between the estimated tax payments you reported and the amount that the IRS posted to your account. Read More ›

-

Tax law does allow business owners to use the gifts they made to clients to increase their deductions from taxable income, but there is a dollar amount limit. Read More ›

-

The deductibility of an IRA contribution is affected by your filing status and your Modified Adjusted Gross Income and is subject to certain limits. Read More ›

-

As a rideshare driver you can likely deduct your carwash expenses on your taxes. But, as always, certain conditions have to be met. Allow me to explain. Read More ›

-

With all the required tuition, books, and fees for college students, not to mention the cost of room and board - what education expenses are tax deductible? Read More ›

-

Under some circumstances, you can indeed deduct off-campus housing on your taxes while attending college – but the amount of the benefit is limited. Read More ›

-

Are there situations where travel expenses are tax deductible? Yes. In this blog, we will discuss five situations where travel expenses are deductible. Read More ›

-

The IRS regards your personal driver’s license as a nondeductible expense. A commercial driver’s license that is required for your business may be deductible. Read More ›

-

The good news is that you can roll your 401(k) twice in one year and into an IRA without penalty, provided you take a few simple precautions. Read More ›

-

Can you claim a depreciation deduction for Section 1250 residential property in the year the property is sold? When it comes to taxes, details matter. Read More ›

-

An IRS Notice CP32A is informing you that your refund check has not been claimed. To resolve this notice, you must call to request a new refund check. Read More ›

-

IRS Notice CP21C is sent out when a taxpayer requests to make a change to their tax return. The notice informs the taxpayer that the change has been completed. Read More ›

-

Details regarding the disposition of grouping of activities in order to more easily satisfy the material participation requirements for the RE Pro status. Read More ›

-

IRS CP06A notice asks you to verify the Premium Tax Credit you claimed on your tax return with documentation. How should you properly respond to this notice? Read More ›

-

Notice CP14H is issued by the IRS to inform you of your unpaid shared responsibility payment that is due and to request that payment. How should you respond? Read More ›

-

IRS Notice CP21E informs taxpayers that an audit was recently done on their tax return and the IRS determined that those changes resulted in additional tax due. Read More ›

-

The good news is there are many different expenses that you may be able to deduct in relation to your dog-walking job – but your shoes may not be among them. Read More ›

-

The taxpayer owed over $30,000 in back tax debt that she couldn’t afford to pay. Not knowing what to do, the taxpayer contacted TaxAudit for help. Read More ›

-

The short answer is yes, you can deduct education expenses for your dependents, but some limitations and qualifications must be met. Let's explore more. Read More ›

-

You just received an IRS Notice CP90 - Intent to Levy and Unpaid Taxes - in the mail. Don't panic. Let's walk through the letter and determine your next steps. Read More ›

-

They received an IRS tax notice demanding payment for over $600,000 in tax, interest, and penalties. Not knowing what to do, they contacted TaxAudit for help. Read More ›

-

IRS CP22E notice is the result of a recently completed audit. Because of the changes made to your tax return during the examination, you now have a balance due. Read More ›

-

Tax law does not allow us to claim last year’s expenses on this year’s return, but does allow us to amend our returns to include missing deductions. Read More ›

-

The good news is that, at tax time, taxpayers can often deduct part or all of the premiums they pay for long-term insurance for themselves or a dependent. Read More ›

-

If you have a pending tax bill, putting the IRS and a bond payment together might be what works for you. How can a bond payment help you with the IRS? Read More ›

-

My minor daughter was a beneficiary for her uncle's savings account. Does she need to report it as income? Are there tax implications if she gifts the money? Read More ›

-

One of the most common notices we see at TaxAudit is the IRS Letter 3219C – also called a Notice of Deficiency. What is this notice? Why did you receive it? Read More ›

-

Whether you use your second home for personal or business purposes, the interest you pay on the mortgage may very well be deductible on your tax return. Read More ›

-

Yes, you can deduct educator expenses if you are what the IRS calls an “eligible educator.” However, there are certain limitations and conditions involved. Read More ›

-

Thirty days from the date of the IRS Notice CP90, the IRS has the right to begin taking assets. This can include bank accounts, wages, and retirement accounts. Read More ›

-

Yes, the tax code allows you as an individual to deduct the sales tax you paid during your tax year but, first, you must meet certain conditions. Read More ›

-

The IRS will calculate your interest and penalties daily and add them to the amount of tax debt you owe. Tax debt increases each day at an annual rate of 7.25%. Read More ›

-

If you are self-employed, you may be able to deduct your home office internet expenses on your taxes. Let's review the guidelines for an internet deduction. Read More ›

-

Many taxpayers use a written logbook that they keep in their vehicle or a software application on their smartphone to track their deductable miles. Read More ›

-

A tax refund offset can indeed be reversed – but it is not a simple matter. It would be much better for taxpayers to prevent the offset from happening. Read More ›

-

IRS CP80 notice explains you have a credit on your account for the tax year in question but have not filed a return. The credit will apply to any amount due. Read More ›

-

The answer to the question "Can I Deduct Federal Taxes Paid?" is maybe – it all depends on where you live or what you do for a living. Let's explore more. Read More ›

-

IRS Notice CP60 informs taxpayers a payment was posted to their account in error. The IRS removed the payment and the taxpayer now owes additional tax. Read More ›

-

The IRS is required to send out these notices to any taxpayer who has filed a return and has a balance due that has not been paid. Read More ›

-

Rest assured that there are extensive resources available to help a taxpayer who owes more taxes than he or she can pay. Let explore some options. Read More ›

-

The Department of Treasury is authorized by the U.S. tax code to withhold part or all of a taxpayer’s Federal tax refund to pay past-due debt of $25 or more. Read More ›

-

Generally speaking, to deduct donations or contributions to your church, you must itemize your deductions on Schedule A (Form 1040). Read More ›

-

An IRS Notice CP49 is a letter from the IRS informing you that they used all or part of your tax refund to pay a past-due tax debt that you have. Read More ›

-

HOA fees are not deductible for a property used as your private home all year. But there may be a deduction for those who use their home for business purposes. Read More ›

-

An IRS CP501 is an official notice from the IRS Collections Unit that is sent to taxpayers to inform them that they have an outstanding debt. Read More ›

-

According to the Federal tax laws, unreimbursed COBRA payments are deductible as medical expenses on your tax return if you qualify to itemize your deductions. Read More ›

-

There is a very good chance that you can deduct your Medicare Premiums that you paid on your taxes. As always, there are different conditions that must be met. Read More ›

-

There are many ways taxpayers can deal with getting their tax debts settled but the best path for each taxpayer depends on the circumstances of their case. Read More ›

-

IRS letter 4800C is typically asking for verification of items you claimed on your tax return, such as credits, wages, and withholding. Read More ›

-

Dental expenses (if qualifying) can be included on Schedule A, Itemized Deductions - Medical and Dental Expenses, subject to a 7.5% Adjusted Gross Income. Read More ›

-

A tax refund offset occurs when the Federal Government’s Treasury Offset Program withholds part or all of an expected Federal tax refund to pay past-due debt. Read More ›

-

Kindergarten tuition is not deductible because the costs to attend are considered educational expenses. However, qualifying childcare expenses are deductible. Read More ›

-

What if you want to claim the Child Tax Credit, but your name is not on the birth certificate? This may be time to consider an IRS approved paternity test. Read More ›

-

How does the IRS determine what your primary residence has been to claim the exception or exclusion after selling a house? Let's go over the ownership tests. Read More ›

-

A CP30 notice is sent to inform you that your anticipated refund has been reduced. The IRS will outline why your refund was reduced and list the new amount. Read More ›

-

Yes, you can indeed receive a tax benefit for installing new energy efficient windows on your house – provided that certain conditions are met. Read More ›

-

Whether you can write off karate classes on your taxes relies heavily on your personal circumstances. Let's explore more. Read More ›

-

The State of Mississippi’s Department of Revenue (DOR) provides a number of different methods for you to deal with your tax problems and get your debt resolved. Read More ›

-

If you meet the conditions for the home office deduction, you are allowed to deduct a portion of your home insurance premium. Read More ›

-

Even though the amount you owe the State of New York Taxation Department seems overwhelming in terms of your ability to pay, there are some options open to you. Read More ›

-

I'm inheriting $44,000 from my father's house being sold in New York. I just want to know how much tax, if any, would I have to pay in South Carolina. Thank You Read More ›

-

IRS CP23 letter notifies you of a change to your return due to a difference between the amount of estimated tax payments and the amount posted to your account. Read More ›

-

There are some tax-saving opportunities available for graduate school tuition, like the credits for undergraduate expenses. They each have some limitations. Read More ›

-

The IRS sends out a CP14 notice to notify a taxpayer when they have unpaid taxes and/or penalties and interest. What should you do if you get a CP14? Read More ›

-

When it comes to medications, you can only deduct the amounts that you pay for medicines or drugs that have been prescribed for you by a doctor. Read More ›

-

In 2023 the tax returns are due April 18th for most taxpayers. However, if you live in California, Alabama, or Georgia your taxes may be due at a later date. Read More ›

-

My brother's wife died and he was left with the house. He gifted (no exchange of money) me the house and I sold it. How do I report capital gains? Read More ›

-

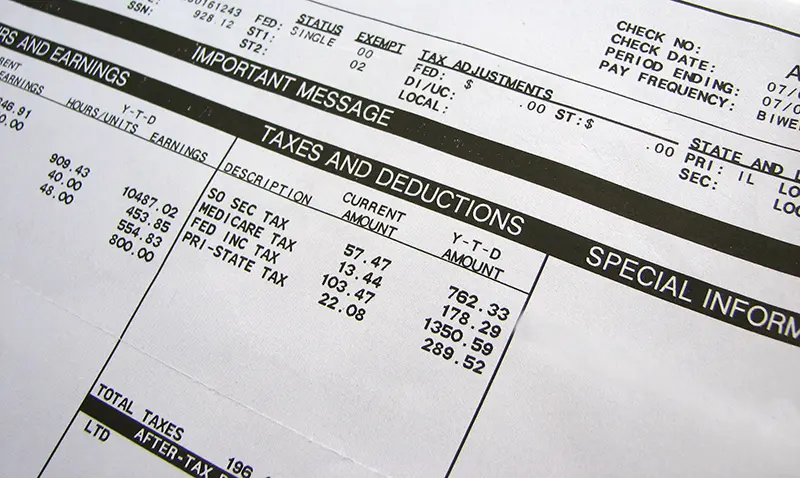

The biggest chunk that will be deducted from your paycheck is most likely taxes, both federal and state. Federal taxes include income tax and FICA. Read More ›

-

Can Grandparents take a deduction for paying the preschool tuition costs when the child still lives with the parents? To qualify you must meet the following. Read More ›

-

The IRS CP22A notice is letting you know that changes were made to your filed tax return, and because of this, there is now a balance owed. Read More ›

-

While some legal settlements can be excluded, either in full or partially, the vast majority of legal settlements will be considered to be taxable income. Read More ›

-

Generally, the costs of moving or disposing of items are considered personal expenses and are not deductible, even though removing the items are required. Read More ›

-

Tax audits can be stressful, but they can yield valuable results such as unexpected refunds, beneficial education, and the peace of mind of being compliant. Read More ›

-

The IRS wants to get paid but it understands a lot of folks cannot pay in full right away, so the IRS created several ways to work with taxpayers who owe money. Read More ›

-

Writing off the purchase of solar panels for your sole proprietorship can be complicated, but we will try to highlight some of the options for you to consider. Read More ›

-

Falling behind on your California payroll tax payments effects not only your employees, but also on your business operations as the EDD imposes penalties. Read More ›

-

If the IRS hasn't debited your accound payment, the first step is to contact your bank to see if the payment has been taken from your account. Read More ›

-

To claim a dependent on your tax return (and all the credits that come with that dependent), your child must meet a set of requirements. Read More ›

-

Because of changes to tax law in 2018, Schedule A deductions for advisory-type expenses will not be available until 2026 at the earliest. Read More ›

-

The IRS is billed you $4,000 due to a $8,000 capital gain or dividend. You don’t know what the $8,000 is from and believe if inherited it should be tax free. Read More ›

-

IRS letter CP13 states a miscalculation was made on your tax return and that you do not owe any additional tax, but you will no longer be receiving a refund. Read More ›

-

Employees cannot deduct dry-cleaning costs on federal taxes until 2026, but self-employed individuals can take the deduction by meeting 3 qualifying tests. Read More ›

-

Fortunately, the short answer to the original question is yes, Illinois state payroll tax debt can quite possibly be reduced. Read More ›

-

The IRS has the power to impose some very strong penalties for businesses that fall behind in their obligations to make the scheduled payroll tax deposits. Read More ›

-

CP11 explains that the IRS has made changes to your return in order to correct a miscalculation made while filing your taxes and additional taxes are due. Read More ›

-

You cannot claim yourself as a dependent. It can be helpful for you find out who actually can claim you as a dependent and whether or not they intend to do so. Read More ›

-

CP504 is one of the scariest notices you can receive as it is considered a final notice, warning that the IRS is preparing to levy (or seize) a property. Read More ›

-

When considering using retirement funds to help pay for a new home, there are generally two common options taxpayers can consider: A 401(k) plan or an IRA. Read More ›

-

An Offer in Compromise may help certain taxpayers who cannot pay their tax debt to the California Franchise Tax Board in full. Let's review the requirements. Read More ›

-

Yes, you can deduct your business meals – but there are conditions that must be met. Under normal circumstances, qualifying business meals are 50% deductible. Read More ›

-

The IRS sends letter 4464C to inform you they have chosen to verify your return accuracy. It's sent after a return has been filed but before a refund is issued. Read More ›

-

Medical expenses are deductible, but whether or not you can claim this deduction depends entirely on the amount you spent and the amount you earned. Read More ›

-

The IRS has established payment programs to allow a personal or business debt to be paid off over an agreed period of time. Here's how to set up a payment plan. Read More ›

-

The length of a tax audit depends on many factors and can go on for months or even years. You don't have to face a tax audit alone though - TaxAudit can help! Read More ›

-

Not all IRS letters are bad news, and the CP09 is one of them. The IRS noticed you did not claim the Earned Income Credit and believe you might qualify for it. Read More ›

-

A large tax refund alone will not necessarily generate a tax audit, but if the reason why you received a large refund is questionable the IRS may peek closely. Read More ›

-

Taxpayers receive an IRS CP503 because they have an unpaid tax debt. This is the 2nd notice the IRS sends taxpayers that they have an outstanding balance due. Read More ›

-

You can likely deduct your out-of-pocket assisted living expenses on your Form 1040 tax return. But, as always, there are some conditions that have to be met. Read More ›

-

As with most tax questions, the answer to this question can be a little complicated. Dependent adult children will fall into one of two categories. Read More ›

-

Is investing in real property, particularly rental property, a good idea for your retirement investments, especially your traditional IRA or Roth IRA? Read More ›

-

I had a friend do my taxes last year! And she has not contacted me since!! I feel in my gut that she has gotten it and used it and or my identity?? Read More ›

-

You can indeed arrange IRS payments. You can negotiate a plan with the IRS to pay your debt off in either a short-term or long-term series of installments. Read More ›

-

Are attorney’s fees deductible on my tax return? The answer, like a lot of answers to tax questions is: Sometimes yes, sometimes no. Let's explore more. Read More ›

-

The IRS likely sent you a CP14 prematurely. The IRS may have received your payment, but it hasn't been fully processed due to the IRS enormous backlog of work. Read More ›

-

Accountant fees for a business purpose are generally deductible, but when those fees are incurred for a personal purpose, they are currently not deductible. Read More ›

-

My wife will be inheriting her father's home. We intend to sell our home and invest the proceeds to remodel this inherited property. What is the tax process? Read More ›

-

Can you negotiate to avoid a wage garnishment before it starts? Can you negotiate the amount of the wage garnishment? Let's explore the answers. Read More ›

-

The qualified business income deduction is calculated by taking the income and losses from all your business activities and netting them into one amount. Read More ›

-

You owe money to the IRS and you can’t pay it all off right now. Let's explore different payment plan options based on your tax situation. Read More ›

-

The IRS treats payroll tax debt seriously. Any employer or employee whose job it is to collect and pay the taxes, but willfully fails, can be held responsible. Read More ›

-

The costs of utilities can indeed be deductible under certain circumstances, so let us talk about those occasions when you can deduct your utility expenses. Read More ›

-

Yes – there are quite a few different personal and business taxes you may be able to deduct. But, as always, it depends on your particular situation. Read More ›

-

For most taxpayers bank fees are not deductible. However, taxpayers who operate their own business may be able to deduct bank fees. Read More ›

-

Electing to group properties together into one activity to qualify for real estate professional status comes with some disadvantages. Let's explore more. Read More ›

-

Now that you have received a notice from the IRS, you want to know if you are still going to get your tax refund. The answer is – maybe. Ler's explore more. Read More ›

-

Your son does not need to report or pay tax on the $70,000 you gifted him from the inheritance your wife received from her mother’s probate! Let's explore more. Read More ›

-

There is a very good chance you can get a deduction on your taxes for the State sales taxes that you had to pay on your new car, truck, van, or other vehicle. Read More ›

-

If the IRS applies your payment to the wrong tax year, they will generally fix the issue once they know the problem. Let's learn more. Read More ›

-

What can cause a tax audit? Let’s talk about some of the primary triggers that may cause you to receive an audit or other notice. Read More ›

-

Making sure your tax return is correct, even if that means amending your return, is better than having an incorrect return and hoping the IRS doesn’t notice! Read More ›

-

Do we actually know what a tax audit is, why they exist, and what we can do to prepare for one? Let's explore the answer to these tax audit questions. Read More ›

-

The IRS has an Offer in Compromise program to allow qualified taxpayers settle their tax debt for less than the full amount owed. Here's what you should know. Read More ›

-

The answer to “Can I Deduct Property Taxes?” is not simple. Hopefully, this article will give you a better understanding of when you can deduct property taxes. Read More ›

-

Yes, you can deduct interest on your business and personal credit cards to the extent that the interest relates to business expenses. Let's explore more. Read More ›

-

A taxpayer can seek relief from a spouse's tax burden by applying for the Innocent Spouse program or the Injured Spouse program, depending on the circumstances. Read More ›

-

When someone other than a spouse inherits an IRA, the IRA is considered an inherited IRA and the rules are stricter than when a surviving spouse acquires it. Read More ›

-

Cryptocurrency is not treated as money for U.S. federal income tax purposes, but rather as property so tax rules that apply to property apply to cryptocurrency. Read More ›

-

The IRS uses an annually updated wage garnishment table to determine how much the taxpayer needs to live on and then the IRS takes the rest. Read More ›

-

If you review the CP12 notice and do not believe it is correct, it is vital to contact the IRS within 60 days of the date on the notice to request an abatement. Read More ›

-

Yes, you can deduct a portion of your home rent for your home office on taxes – but as always , this benefit is only available if certain conditions are met. Read More ›

-

We sold my wife's parents' house. Do we have to pay taxes on it if we put it in a money market account in our name? It depends on a taxpayer's circumstances. Read More ›

-

A tax audit is a formal examination of an income tax return. The IRS conducts tax audits to ensure the information on a tax return and amount paid is correct. Read More ›

-

Real estate professionals can claim unlimited losses on rental properties they materially participate in but there are many rules involved in qualifying as one. Read More ›

-

If your rental property is incurring losses, those losses may be limited on your taxes based on other income you receive. Let's explore more. Read More ›

-

If the IRS notices that you filed an amended return, will that cause them to inspect your tax return more closely and trigger a full-blown tax audit? Read More ›

-

The IRS offers a series of payment plan options for those individuals and businesses who need more time to pay their tax debt. Read More ›

-

The good news for other farmers is that, under certain conditions, the tax code allows for the deduction of farm expenses even if they are greater than income. Read More ›

-

The IRS will always notify you by mail if your tax return is selected for audit. The IRS will not initiate an audit by a phone call, email, or text message. Read More ›

-

The IRS takes payroll tax debts very seriously and has the power to impose some very strong penalties for businesses who fall behind in this area. Read More ›

-

"Winning a tax audit,” simply means that you’ve paid the IRS no more than you rightfully owe. This is where the professionals at TaxAudit come in to help! Read More ›

-

If you have ever gone through an audit with the IRS or are just curious why the IRS audits tax returns in to begin with – you are in the right place. Read More ›

-

Two payroll tax deferral programs were launched in 2020 in an attempt to relieve the cash flow squeeze that was affecting both businesses and their employees. Read More ›

-

The surprising answer is yes – you can deduct some of your wedding expenses from your taxes under certain circumstances. Let's take a closer look. Read More ›

-

Certain categories of employees can claim the deduction for unreimbursed employee business expenses, but not all. Let's explore some examples. Read More ›

-

The IRS has a fixed amount of time to try to get you to pay your tax debt. This fixed period is known as the “statute of limitations,” which generally 10 years. Read More ›

-

The gap between what taxpayers owe versus what they actually pay looms large. IRS audits are an attempt to collect the funds required to close this gap. Read More ›

-

If you owe the IRS money for taxes and have not been able to pay or make other arrangements, the IRS has the legal right to seize some of your possessions. Read More ›

-

State agencies who collect income tax can audit your tax return. One of the most common reasons for a state audit is the audit of your federal tax return. Read More ›

-

Insurance policies may cover part of nursing home costs and the unreimbursed expenses can often be deducted on a Form 1040 individual tax return. Read More ›

-

Rent can be deductible, but it depends on what is rented, the purpose of the rental, who receives the rental payments, and the terms of the rental agreement. Read More ›

-

Yes, the IRS does offer payment plans to those taxpayers who owe taxes. The IRS offers a series of payment plan options for those who need more time to pay. Read More ›

-

Since the government considers your vehicle to be just another piece of property, so is there a tax deduction for the theft of your car? Let's find out. Read More ›

-

There are some parts of the tax code that, in fact, can allow tuition fees to be fully deductible. However, in most cases you cannot deduct private tuition. Read More ›

-

If you suffered economic losses, you may have a net operating loss (NOL) on your taxes. Getting audited by the IRS for an NOL can be complicated. Read More ›

-

You received an IRS notice CP162 in the mail. You are probably wondering why you received this notice and what it means – we are here to answer your questions. Read More ›

-

We had a water leak in our home. The clean up used chemicals which caused us to get rid of our clothing, bedding, and furniture. Is this deductible? Read More ›

-

If you’ve been lucky enough to never receive a love letter from the IRS, you’ve probably wondered: What is it like to go through a tax audit? Read More ›

-

The IRS sends out lots of different types of letters to taxpayers and one such letter is the CP21B. If you have received a CP21B letter, what do you need to do? Read More ›

-

If you volunteer for an organization, do you get a tax deduction for your time or talent? Let's also look at volunteering use of property and other expenses. Read More ›

-

With TurboTax Audit Defense if you receive a letter from the IRS or state tax agency, simply contact TaxAudit that you’ve received IRS correspondence for help. Read More ›

-

If you have audit protection, you don’t have to panic when you get a letter from the IRS. Instead, you can call TaxAudit right away, so we can step in to help! Read More ›

-

First, the essential concept to understand is that cryptocurrency is not treated as money for U.S. federal income tax purposes but is treated as property. Read More ›

-

What is Audit Defense? And is it worth it? Let's provide some clarity about exactly what you are getting when you purchase Audit Defense from TurboTax! Read More ›

-

You’d like to know if you can file an amended tax return to claim the Recovery Rebate Credit if you did not receive the economic stimulus payment. Read More ›

-

I received 3 1099 forms - 1 for interest and two from houses which were sold in the months after his passing. Is the estate required to file a return? Read More ›

-

If the IRS is taking your refund, sometimes you need a qualified tax professional who understands IRS collection procedures to intercede on your behalf. Read More ›

-

As the person wrapping up your loved one’s financial affairs, you know at the very least you will need to file their final individual income tax return. Read More ›

-

When you owe money to the IRS, they can take a variety of actions against you to collect the balance due. You can repay the IRS debt using unemployment checks. Read More ›

-

Communicating with the IRS to work out a payment plan, put a hold on your account, or even negotiate a lesser amount due may help delay or avoid the IRS levy. Read More ›

-

Whether an amount paid for taxes as the result of an IRS or state tax audit is deductible depends on the type of taxes involved. Let's explore more… Read More ›

-

Father died 30 years ago. Stepmother just sold house and children split father's portion of sale (after filing of an affidavit of heirship). Do we owe taxes? Read More ›

-

TaxAudit specializes in tax relief help, and we are so confident in our ability to help taxpayers navigate tax debt - we believe we have it down to a science. Read More ›

-

The 2021 expense limit for this credit is $8,000 for one qualifying child, and $16,000 for two or more qualifying children. The credit is a % of those expenses. Read More ›

-

Is there relief from the government in the form of a tax break? Like many things in taxes, this can depend on different things, such as what caused the fire. Read More ›

-

You received an IRS Notice CP12 because the IRS corrected one or more mistakes they believe were made on your tax return. What do you need to do? Read More ›

-

For many taxpayers who operate small businesses, the qualified business income deduction can be an excellent way to reduce your income taxes. Read More ›

-

TaxAudit provides Tax Debt Relief services that make dealing with the IRS or state less stressful. We know the the laws regarding taxes and tax debt collection. Read More ›

-

You asked if you could deduct tuition expenses for enrollment in a graduate degree program as a job-related education expense on federal and NY state taxes. Read More ›

-

You asked whether the mortgage payments that your ex paid on the house you received in the divorce are taxable. This answer depends on your specific situation. Read More ›

-

To know if your home inheritance is taxable income you will need to start by figuring out what your step up in basis is - the property value when someone dies. Read More ›

-

Now that you have your Letter 6475, what should you do with it? The letter will inform you of the amount that the IRS paid to you for the third EIP payment. Read More ›

-

My fiancé has recently been incarcerated. Prior to arrest he filled on pandemic unemployment, but I did not. How should I file taxes this year? Read More ›

-

There are many options for managing your small business tax debt. A tax resolution specialist from TaxAudit can guide you in choosing the best approach. Read More ›

-

Trade or business property is considered section 1231 property. For taxation purposes, section 1245 or 1250 applies depending on the property’s characteristics. Read More ›

-

To claim a child for this credit, the child has to meet several tests. Biology isn’t a disqualifier in claiming dependents, but other factors must be met. Read More ›

-

One of the best ways to check the status of your refund is on the IRS website. Your tax professional may also be able to give you a timeframe for your refund. Read More ›

-

Yes! Audit Defense is worth it. Not only do audit defense members get help with IRS and state correspondences – there are a variety of other benefits. Read More ›

-

If you are one of the millions of taxpayers who use TurboTax to file their taxes, you may have asked: Can I deduct my TurboTax purchase? In short: it depends! Read More ›

-

The IRS will issue Letter 6419 to provide the total amount of advance credit that was paid to the taxpayer - keep this letter for your 2021 tax return! Read More ›

-

If you find yourself with tax debt due to unpaid payroll taxes, you may have options to help settle the debt. Let’s review some payroll tax debt relief options. Read More ›

-

If you have a large tax bill, figuring out your options for getting out of tax debt can be stressful. Thankfully, there’s a proven approach you can follow. Read More ›

-

Many taxpayers who owe back taxes look for a way to get their tax debt forgiven. The availability of tax debt forgiveness depends on a variety of factors. Read More ›

-

You open your mail and see IRS Letter 5071C. What on earth does this letter mean? Are you being audited? Why did you receive this letter in the mail? Read More ›

-

The IRS has several courses of actions they can take to collect funds owed to them. The three most common are liens, levies, and garnishments. Read More ›

-

You received an IRS Letter 5071C for a tax year in which you never filed a tax return. It is likely that someone might have filed a tax return in your name. Read More ›

-

If you’re struggling with back taxes, you may be able to qualify for assistance under an IRS initiative called Fresh Start. Here are 3 ways to be eligible. Read More ›

-

Yes, the length of time the IRS is allowed to collect a tax debt is generally limited to 10 years. Is waiting out this period a strategy for resolving tax debt? Read More ›

-

When a taxpayer fails to file their return, the IRS will come knocking usually in the form of a notice of tax due for back taxes. Back tax help is available. Read More ›

-

If you qualify, Innocent Spouse Relief can help remove or particialy remove a tax burden from an innocent spouse. Read More ›

-

Estimated tax payments are additional payments that taxpayers may make on a quarterly basis to cover any additional taxes that may be due. Read More ›

-

Generally, the IRS can take up to 3 years from the date you filed to review your return. In certain situations the statute of limitations can be extended. Read More ›

-

A taxpayer with a sole proprietorship and reports business income and expenses on a Schedule C may claim a prorated amount of the Audit Defense Membership. Read More ›

-

As a military member do you have the same tax filing deadline as U.S. citizens? Are there tax filing extensions available for deployed members of the services? Read More ›

-

Taxpayers who are behind on their federal taxes may be surprised to know that their Social Security benefits are ripe for the picking by the IRS. Read More ›

-

Yes, TurboTax Audit Defense It is absolutely worth it. Those who have audit defense do not have to panic or make frantic calls upon receipt of IRS tax notices. Read More ›

-

The most important thing about having audit defense, in my opinion, is peace of mind. Your tax professional will help you navigate the waters of a tax audit. Read More ›

-

If you are a small business owner, you may have heard about net operating losses. If you have one, it may create a reduction in your taxes in other years. Read More ›

-

The first thing to do when you get audited by the IRS is to not panic! It be scary but with the right tools and resources you will be able to get through it. Read More ›

-

Absolutely! Now’s let’s chat about how and why audit defense works. Any taxpayer may be subject to receiving an audit or notice in the mail. Read More ›

-

Recently, the IRS sent many taxpayers a confusing set of letters. The follow-up notice, Letter 6470, notifies the taxpayer of their legal rights to appeal. Read More ›

-

Rest assured the IRS has no advance knowledge that you have elected to have representation in the case of an audit through Audit Defense. Read More ›

-

You might be questioning if TurboTax Audit Defense is any good as you file your tax return through TurboTax. Yes, you want audit defense and it is worth it! Read More ›

-

Back taxes are defined as taxes that were not paid in the year they were due. Penalties and interest may also get tacked onto back taxes if they remain unpaid. Read More ›

-

One way to find out how much money you owe the IRS is to use the IRS Online Account tool, which allows you to view helpful information about how much you owe. Read More ›

-

Audit Defense means you will have professional representation in the case of receiving an audit notice from the IRS or any state income taxing agency. Read More ›

-

With over 1,700 years of combined Tax Professional experience, TaxAudit's Tax Pros have expert knowledge when dealing with the IRS and State tax agencies. Read More ›

-

If you haven’t received a notice from the IRS, but think you might owe money to the IRS, you can also utilize the IRS' Online Account tool. Read More ›

-

One of the frequently asked questions we get from our customers is, “Can I buy audit defense for tax returns filed in previous years?” The short answer is: Yes! Read More ›

-

Under certain circumstances you can indeed claim a tax benefit for preschool tuition - called the Child and Dependent Care Expenses tax credit. Read More ›

-

New Jersey, NJ imposes a tax on the beneficiaries of estates. The tax return requires the tax be paid by the estate on behalf of all the estate’s beneficiaries. Read More ›

-

The terms ‘audit support’ and ‘audit defense’ may sound like the same thing for the average taxpayer. But in the world of taxes, they can be very different. Read More ›

-

My Aunt died and the bank sold her house. The bank sent me a check for "excess proceeds" from the house sale. Do I owe any tax on this money? Read More ›

-

As long as you used the home as your main residence for at least 730 days during the last 5 years, you may be allowed to exclude up to $500,000 of capital gain. Read More ›

-

It seems like a simple idea: convert that account to a Roth and you can withdraw the money tax-free in future years. But is it a good idea for you? Read More ›

-

I could not have been more pleased with TaxAudit services. I highly recommend this service for anyone who does their own taxes. Read More ›

-

Whether you will be taxed on the money received from a trust will depend on the type of trust and the instructions laid out, the assets titled, and more. Read More ›

-

You are responsible for paying the taxes on the amount realized in the sale. The buyer is generally not required to withhold income taxes on the proceeds. Read More ›

-

As taxpayers, we are personally responsible for filing our returns both on time and accurately. Failure to do one or both can result in significant penalties. Read More ›

-

Generally, the IRS has ten years from the date tax is assessed to collect a delinquent tax liability. However, the answer is not that straight forward. Read More ›

-

Can you inherit an IRA and not pay tax? Individual retirement accounts can transfer to a beneficiary without immediate tax consequences if no money is withdrawn Read More ›

-

An RMD is a required minimum distribution from a retirement account such as a Traditional IRA or defined contribution plan (like a 401k). Read More ›

-

Yes, TaxAudit is a good company that has been providing clients with A+ rated tax representation services since 1988. TaxAudit truly cares for its clients. Read More ›

-

There are hundreds of different types of letters and notices you can receive from the IRS. Let's focus on a few of the more common IRS notice types we see. Read More ›

-

A lien is when the IRS makes a legal claim to property as security for the payment of tax debt. There are many methods to resolve an IRS tax lien. Read More ›

-

The fastest answer is how far back do you need to file? How deep do you want or need to dig into your records to get your taxes up-to-date with the IRS? Read More ›

-

The results of the Tax Cuts and Jobs Act have made brokerage fees non-deductible for any returns filed between 2018 to 2025. Read More ›

-

You are ready to begin the process of preparing your back taxes – but you realize your records are lost. Never fear. There are ways to rebuild your records. Read More ›

-

There are several tax benefits which you might want to anticipate before you file your 2021 tax return next year. Here is a summary of some of the tax changes. Read More ›

-

If you are under audit, it is acceptable to submit your current tax return. Just be mindful that you may have to amend it once the previous year's audit closes. Read More ›

-

An incarcerated person can actually e-file for themselves online if they have internet access in prison. If they are unable to do so, you can do it for them. Read More ›

-

Put simply, your audit defense membership is valid as long as your tax return is eligible to be selected for audit or review by the IRS or State! Read More ›

-

If you operate a business from inside your home, the home office deduction can be one of the largest deductions you can take as a tax write-off. Read More ›

-

My wife drives to transport our granddaughter to our house to watch for the day. Is this to-and-from mileage deductible as a job-related expense? Read More ›

-

When you prepare your federal income tax return, your business may incur a loss. Here are the tax implications if you have suffered a net operating loss. Read More ›

-

As a self-employed taxpayer, you can deduct your business-related parking fees as an expense on Schedule C, Profit and Loss from Business. Read More ›

-

I had investment capital losses of over 17,000 dollars, yet my Schedule D is only allowing a $3,000 loss. Can I take the additional losses in future tax years? Read More ›

-

I inherited a property located in foreign country from non-US relative, do I need to file 1099-S? I did not receive 1099-S since the property is not in USA. Read More ›

-

The IRS encourages electronic filing to avoid processing delays. However, you may mail your IRS and state returns in. You can find the address required here. Read More ›

-

Well, the truth of the matter is that an attorney is not always needed but, in some cases, one is absolutely required. So, how do you know when that might be? Read More ›

-

The IRS takes payroll tax delinquency seriously – so seriously that IRS Revenue Officers have closed down businesses for not paying them. Tax help is available. Read More ›

-

When you filed your tax returns through TurboTax, you decided to opt in and purchase Audit Defense. If you get a future IRS letter, how does Audit Defense work? Read More ›

-

The thought of owing the IRS money can be a scary thought – especially if you’re not sure you do! The IRS has provided tools to help taxpayers like you! Read More ›

-

Your audit defense membership with TaxAudit provides expert representation for each tax return year for which you have a membership. Read More ›

-

The IRS denied your request, so what now? What if you do not have resources to pay the additional tax that may not have been yours to begin with? Read More ›

-

There are several different tax breaks available for solar panels used either in the home or in a business. Let’s look at a couple of examples. Read More ›

-

For IRA contribution purposes, certain third-party sick pay does qualify as compensation. But, there are instances where it is not considered compensation. Read More ›

-

Why doesn't my IRS account show I owe money if I received a Notice of Deficiency? A Notice of Deficiency represents an estimated amount due and isn't finalized. Read More ›

-

When you inherit real property, like a home, then for tax purposes the beneficiaries receive what is called a “stepped-up” basis. Read More ›

-

When you are relieved of debt through the cancellation of debt, that amount is considered to be income to you, even though you did not receive cash. Read More ›

-

The IRS has not issued guidance on whether an EIP distribution will be placed on hold if a taxpayer’s 2020 return is audited to question dependents. Read More ›

-

You can "deduct" real estate taxes paid over the course of owning a piece of land in the year the land is sold, if the land was vacant, but there is a catch. Read More ›

-