If you have received an IRS Notice CP21A in the mail and you are not sure what your next steps should be – read ahead.

Whenever we receive a letter from the IRS or state taxing agency, there can be a lot of confusion around why we received it, what the next steps are, and what to do if we do not agree. Below, we will touch on all these questions and more regarding IRS Notice CP21A.

First, what is an IRS Notice CP21A?

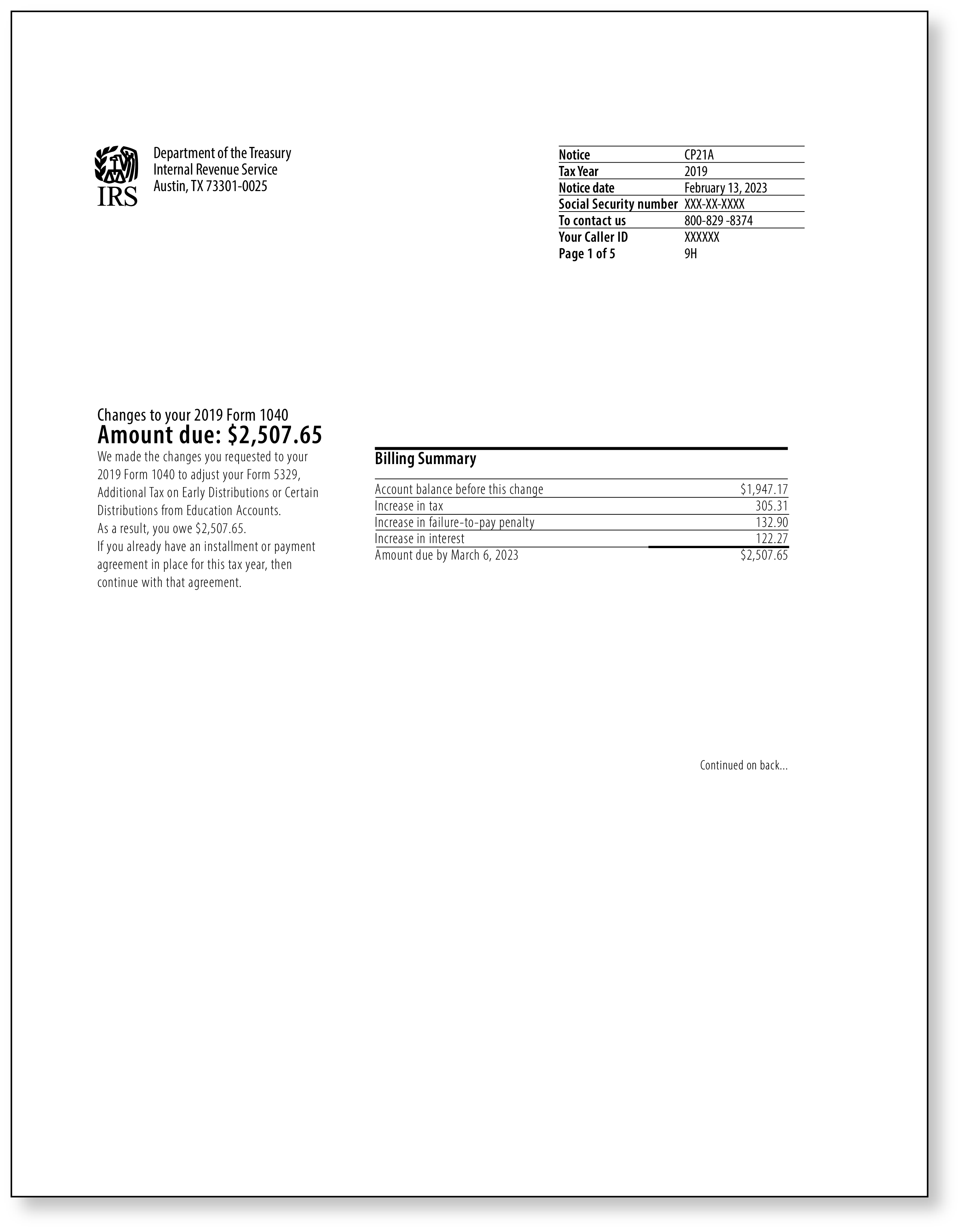

An IRS Notice CP21A is a letter that the IRS issues when changes have been made to a tax return by the taxpayer, usually after they have filed an amended return. The letter is meant to notify you that the IRS has made the requested changes and, as a result, you now owe a balance.

What is the first thing I need to do?

The first thing to do in any situation, especially one that involves an IRS notice, is to take a deep breath and not panic. It is going to be okay, and you are going to get through it! The next thing you want to do is read the notice carefully and in its entirety. The notice will list the changes made and how much you owe because of these changes.

I have read the notice – now what?

While reading the notice, keep in mind there are two likely scenarios that will play out.

Scenario A: What to do if you agree with the CP21A notice.

Scenario A is that you agree with the changes and the amount owed. You will want to make plans to pay the balance due. On the notice, there will be a payment coupon with a due date. If you are able to make the full payment by the due date, then do that, and you should be good to go. Payments can be made either by mail or

online via the IRS website. However, if you are unable to pay the balance in full, you will want to set up payment arrangements. This can be done by calling the IRS phone number listed on your notice, or

by visiting the IRS website to learn more about payment plans and options. If you would like to get set up on a payment plan,

click here to apply online.

If Scenario A does not sound like you – and you do not agree with the changes and/or the amount due presented by the IRS, then you will likely fall into Scenario B.

Scenario B: What to do if you do not agree with the CP21A notice or proposed amount due.

If you do not agree with the changes and/or the amount due, you will want to call the IRS at the phone number listed on your notice. Discuss any questions or concerns you have. Be sure to have a copy of your notice as well as a copy of both the originally filed tax return and the amended return for the tax year in question.

There are several reasons why you may not agree with the notice or proposed amount due. For example, you filed an amended return and requested the changes shown on the notice, but one or two other changes or credits may have been inadvertently omitted by the IRS, causing the balance due to be more than you anticipated.

If you do not remember sending in a request for change to the IRS, you can call the toll-free number listed on the top right corner of the IRS notice to discuss. It is important to follow up with the IRS in this case as these changes might be a sign of possible identity theft. For more information on identity theft, please visit the IRS “

Taxpayer guide to identity theft” webpage.

I purchased Audit Defense with TaxAudit, can you guys help me?

If you have an audit defense membership for the year of the notice, this is the type of letter that we can advise on! Simply call our Customer Service Department at 800-922-8348 or

click here to report the CP21A Notice and we will get a case started for you!