About IRS Audit Notice 106C | Claim Partially Disallowed

October 22, 2025 by Charla Suaste

If you're a business owner who recently claimed the Employee Retention Credit (ERC) and have now received an IRS notice, you're not alone. The IRS is actively auditing ERC claims, and receiving a letter can be confusing and alarming. In this blog post, we'll break down what IRS Notice 106C is and what you should do if you've received one.

What is IRS Notice 106C?

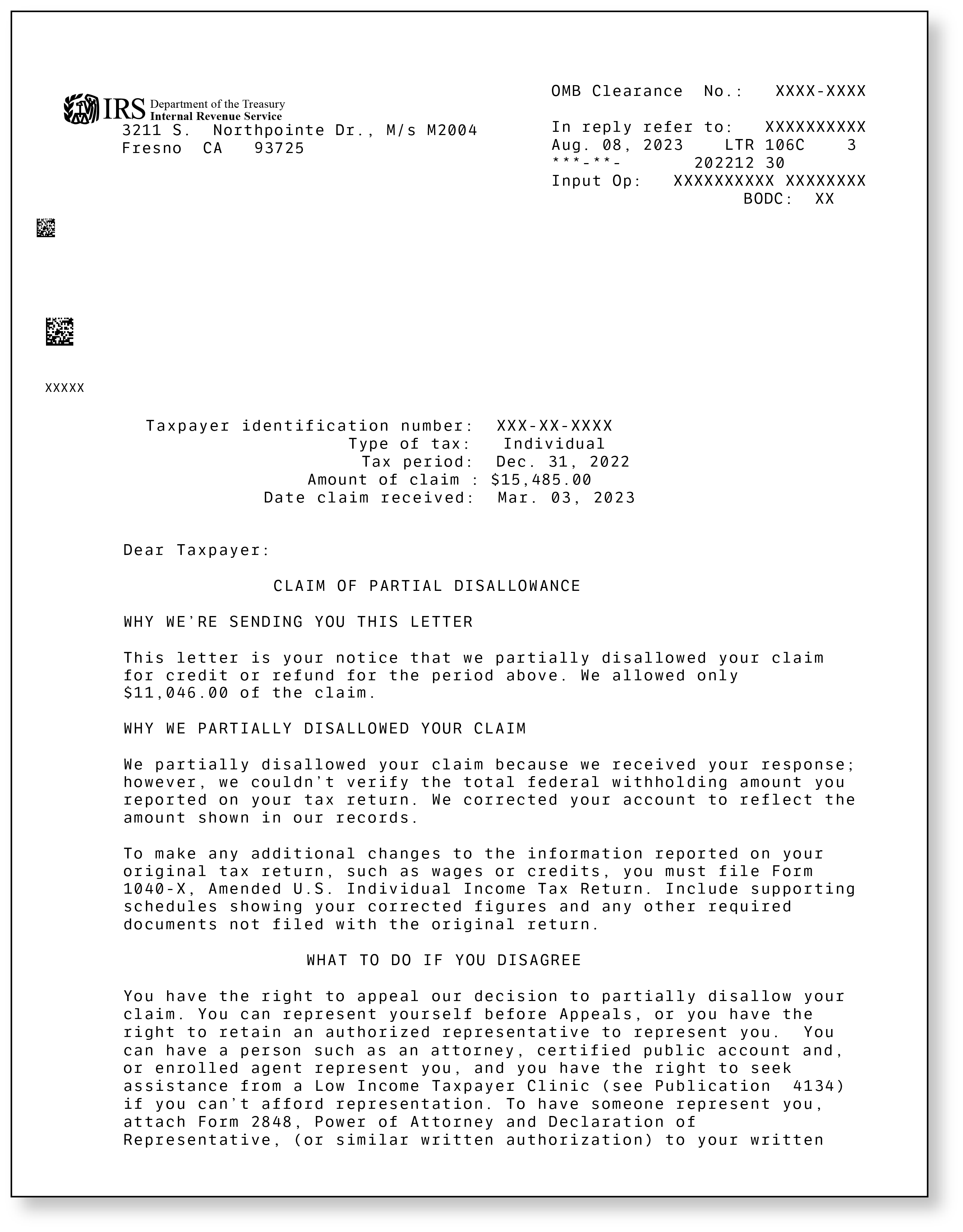

IRS Notice 106C, titled "Claim Partially Disallowed," is an official communication from the IRS stating that your claim for the Employee Retention Credit has been partially or fully denied for a specific tax period. It will detail the tax period in question, the amount of the credit that was disallowed, and a brief reason for the disallowance. The IRS sends this letter when they believe that the amount of ERC you claimed exceeds the credit limits allowed by law. For 2020, the credit was up to $5,000 per employee for the year, and for 2021, it was up to $7,000 per employee per quarter. The notice is essentially the IRS saying, "Based on our review, you weren't entitled to the full amount you claimed."

What to Do Next

First, don't panic. Take a deep breath and carefully read the notice. This is a critical first step. The notice will explain the reason for the disallowance and your right to appeal the decision. It will also provide you with a timeframe to respond or file a lawsuit to challenge the denial.

Once you understand the letter, your next step is to gather all the documentation related to your ERC claim. This includes payroll records, tax filings (like Form 941-X), and any other supporting documents you used to calculate the credit. You'll need to review your records to see if there's a discrepancy between your calculation and the IRS's determination.

If, upon review of the IRS letter and your documentation, you determine that the IRS is correct, there is nothing you need to do at this time. However, if you disagree with the IRS’ assessment, you can dispute the letter by submitting documentation to the address listed on the notice. This must be done within two years of the date of the notice. You also have the option to appeal the disallowance to the IRS Independent Office of Appeals or file suit with the U.S. District Court that has jurisdiction or with the U.S. Court of Federal Claims. Either way, do not delay in taking action. Filing an appeal or suit process can take some time, so you want to get this process started as soon as possible.

How TaxAudit Can Help

If you have Audit Defense with TaxAudit, you should call us as soon as possible. As soon as you receive this notice, we can take the lead and work with the IRS on your behalf. Our experienced tax professionals can review your situation, assess the IRS's claim, and determine the best course of action.

We understand how complex and overwhelming tax audits can be, especially when they involve a program as intricate as the ERC. Having a team of experts on your side can make all the difference. We will communicate directly with the IRS, handle all correspondence, and work to get your case resolved. With TaxAudit, you won't have to face the IRS alone.