IRS Notice CP3219A | What It Is and How to Respond

September 23, 2025 by Kate Ferreira

If you have found yourself on this page because you received IRS Letter 3219A – welcome! Any time you receive something from the IRS, it can cause stress—but don’t panic! Let’s break it down in simple terms.

What Is IRS Notice CP3219A?

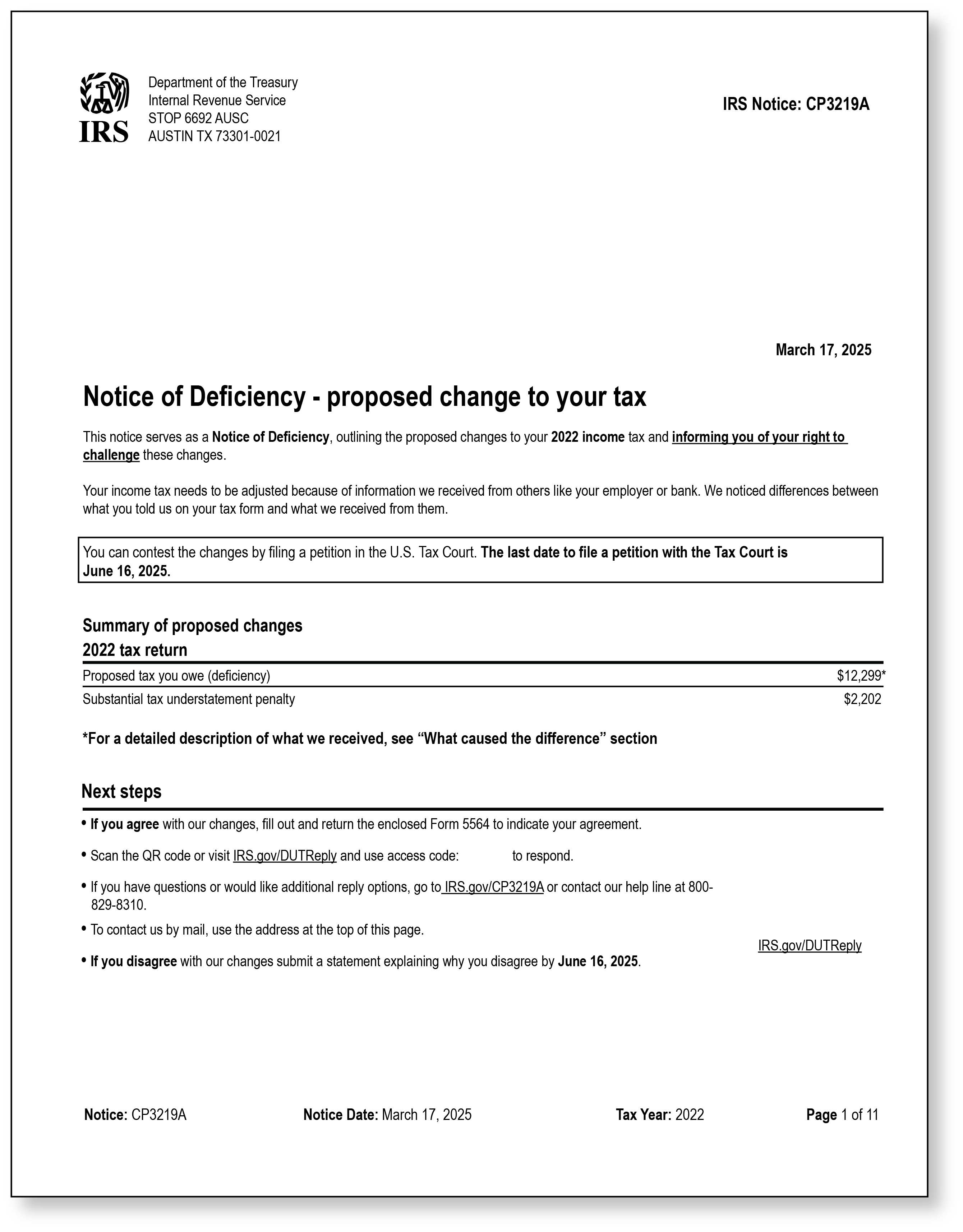

An IRS Notice CP3219A, also known as a Notice of Deficiency or a “90-Day Letter,” is a formal letter from the IRS indicating they believe you owe additional income tax. The IRS is required by statute to send you this letter when there's a mismatch between the income or deductions you reported on your tax return and information the IRS received from other sources (like employers or banks), and proposed adjustments have been made to your tax return.

This letter is usually sent in response to previous audit notices or IRS letters. If you did not respond to the previous letters, or the IRS believes the issue is still unresolved, a CP3219A will be the last notice you will receive before the proposed tax balance becomes assessed and due. This letter explains how the amount was calculated and your options regarding handling the notice, including the drop-dead due date to file a petition with the Tax Court – more on this later.

(If you continue to ignore this particular letter, the letter you receive AFTER a CP3219A will be a bill, which is much more difficult to dispute.)

Why Would You Get This Notice?

The IRS might send you a CP3219A because:

- You did not respond to a prior notice sent about this issue.

- You responded to a previous audit or inquiry, but the IRS did not receive or respond to your correspondence and is now issuing you a CP3219A.

- Despite responding to previous inquiries, you and the IRS could not come to an agreement, and the IRS is now issuing the Notice of Deficiency.

There are a variety of reasons why the IRS is proposing an assessment of additional tax due and ultimately issuing you a CP3219A. Some of these reasons include:

- They received information from another source (like your employer or a bank) that doesn’t match what you put on your tax return.

- You forgot to report income.

- There was a mistake on your tax return, such as a missing or added “zero”, or a misplaced comma in the amount entered on your return.

- The IRS thinks you claimed something you shouldn’t have, like a credit or deduction.

Basically, the IRS is saying, “Hey, before this proposed tax due becomes assessed and we send you a bill, please review this notice and let us know right away if you don’t agree.

What Should You Do If You Received This Notice?

First, read the notice carefully and in its entirety. To find out what information the IRS received that was different from what was reported on your return, review the “What caused the differences” section of the notice.

Second, determine if you agree with the proposed changes. For example, did you inadvertently forget to include income from one of your jobs during the tax year? We recommend looking at your tax documents and the tax return you filed for the year in question and then compare the information with the notice. You may even want to download an IRS Wage and Income Transcript for the tax year and review what was reported to the IRS. For more information on IRS Wage and Income Transcripts and how to obtain one, please review the IRS webpage titled “Transcript types for individuals and ways to order them.”

Third, and most importantly, do not ignore this letter. You will want to take action as soon as possible. In the paragraphs below, we have provided recommendations for the next steps, depending on your unique situation.

How Do You Respond?

You have 90 days from the date of the notice to respond. If you happen to be out of the country, then you have 150 days to respond. This due date is crucial, as there are no extensions. Even if you are one minute late faxing your response, the IRS will deny your submission and assess the tax due. Depending on your circumstances, you have two options in the way you respond.

You agree with the IRS: If you think that the notice is correct, you will want to follow the instructions on the notice on how to respond. You will need to complete and sign Form 5564, Notice of Deficiency – Waiver, which is included in CP3219A. It is important to read the enclosed Form 5564, Notice of Deficiency – Waiver, as the amount on that form might not match your previous notice amount due. This may be because certain items cannot be challenged in Tax Court. For additional information, click here.

You disagree with the IRS: If you think they made a mistake, you have the opportunity to respond. It is important to respond right away, as the notice has a firm 90-day deadline that cannot be extended. If you have additional information to provide, you will want to provide copies of the documentation for consideration to the IRS. You must have documentation that supports your position. Without documentation, it will be hard to convince the IRS to reverse the proposed assessment. Be sure to include a signed statement that supports your position, as this is required. The IRS website, lists several ways to reply regarding CP3219A notices. You can also call the number listed on the notice and speak to an IRS representative.

If the information that the IRS received from other parties is incorrect, you will want to contact the business or person who reported the information to the IRS. These parties should be listed on your notice. You will want to ask them to correct the income document or write a statement advising that what was provided is an error. Be sure to let the IRS know that you are working on receiving the corrections or statement, so they are aware of the work being done. You should keep written records of your efforts and the results.

Remember, you have only 90 days to resolve the issue with the IRS. Due to the significant staff reductions implemented by the Department of Government Efficiency (DOGE), response times at the IRS are delayed. Even if you sent the IRS a reply, disagreeing with the proposed assessment and included copies of substantial documentation confirming your position, if the IRS has not responded, you must file a petition with the U.S. Tax Court by the due date. Filing the petition preserves your right to challenge the proposed increase in tax before it becomes an assessed balance due. One of the benefits of petitioning the Tax Court is that you can contest the IRS’s changes without having to make a payment towards the proposed tax due. For more information on how to file a petition, please visit the United States Tax Court website.

If you want to challenge the proposed changes in Tax Court, you will want to follow the instructions listed on the notice. To file a petition with the U.S. Tax Court, click here.

How TaxAudit Can Help

If you’re not sure what to do, don’t go at it alone. Tax notices can be confusing and overwhelming. If you have Audit Defense with TaxAudit, good news! This is exactly the kind of notice we help with. Our team can guide you through the process, explain what the IRS is saying, and help you respond the right way. We’ll deal with the IRS so you don’t have to. Simply click here to get started.