Four Ways to Start "Paying Off" an IRS Tax Lien

June, 09 2021 by Jean Lee Scherkey, EA

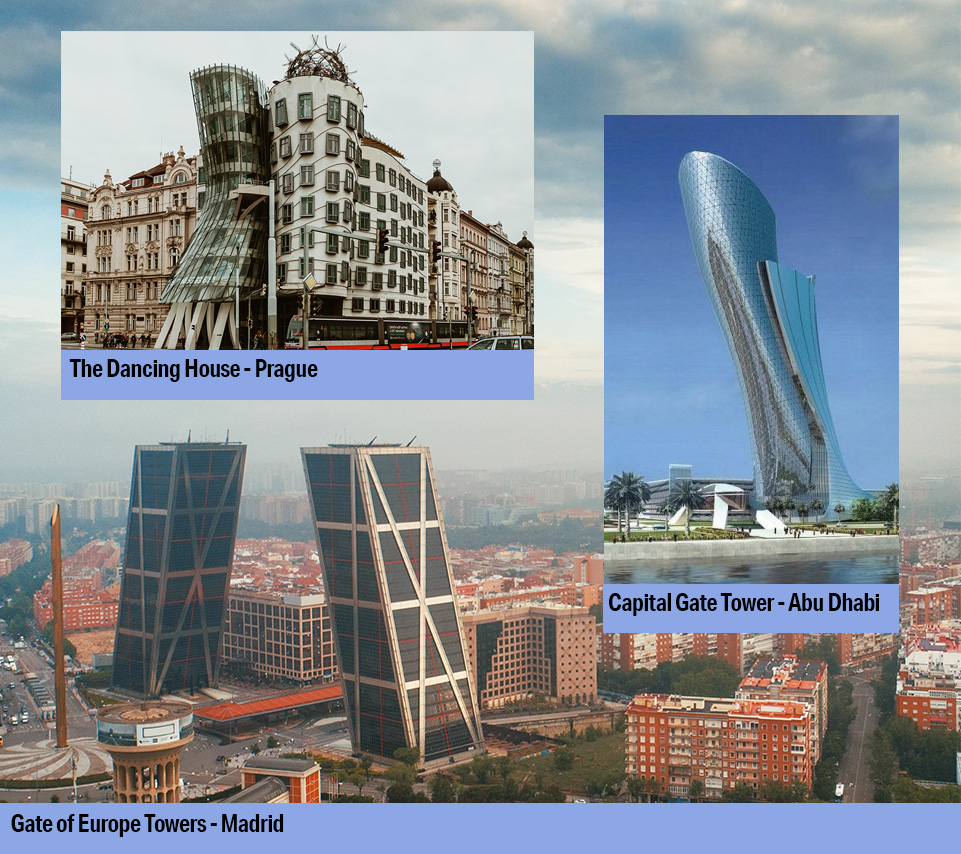

The Dancing House in Prague, Capital Gate Tower in Abu Dhabi, and Gate of Europe Towers in Madrid, are all leaning feats of architecture genius. Goodness knows many of us have been grateful to lean against a wall or other sturdy object when our right foot zigs while the left zags.  However, when the IRS leans on a taxpayer with an overdue tax liability by placing a lien on their assets, the taxpayer's finances can falter.

However, when the IRS leans on a taxpayer with an overdue tax liability by placing a lien on their assets, the taxpayer's finances can falter.

A common misconception people have about a lien is that the lien needs to be "paid off" before being lifted or removed. Actually, it is not the lien that is paid off. A lien is when the IRS makes a legal claim to property as security for the payment of tax debt, such as filing a lien with the taxpayer's county in which they own a home. What is paid off is the underlying tax debt. Many people also interchange the words "lien" and "levy" when they are two distinct enforcement actions. A levy is the actual seizure of property to satisfy the tax debt.

The IRS issues many liens, but that does not mean they will seize the property. Instead, they are using the lien placed on the property as security against the tax due. When a lien is in place, the property cannot be sold or transferred without resolving the underlying debt first. Under many circumstances, a lien will stay on the property until the debt is fully paid, settled, or expired, at which time the taxpayer can file a request for lien removal. The most common lien the IRS places on a taxpayer's property is their primary home or other real property they may own, such as a rental or second home.

When Liens Usually Are Not Issued

Unless there is an extraordinary circumstance, the IRS generally does not file a Notice of Federal Tax Lien (NFTL) if the taxpayer's total balance due is less than $2,500. In most cases, the IRS will issue a Notice of Federal Tax Lien when the taxpayer's total balance from all of their tax debts is $10,000 or more. However, there are circumstances where a lien may be filed for liability amounts that are $10,000 or less. For example, if the tax collection is in jeopardy, the IRS may file a lien even if the amount is under $10,000 or even $2,500. The IRS may also place a lien on a taxpayer's assets if the taxpayer resides outside of the United States.

Usually, the IRS will not issue a lien if a taxpayer enters into one of the following payment arrangements:

- Extension of Time to Pay (ETP) - Otherwise known as a short-term payment plan, the taxpayer agrees to pay the balance due within 120 days.

- Entering into a Guaranteed Installment Agreement (GIA) or Streamlined Installment Agreement (SLIA) - As long as the taxpayer enters into one of these plans before the IRS issues a Notice of Federal Tax Lien, a lien should not be issued. (Again, if the IRS determines collecting the tax is in jeopardy, then a lien may be issued.) If the IRS has already issued the lien, entering into an installment agreement will not release the lien.

Appealing a Notice of Federal Tax Lien

The IRS is required to notify the taxpayer within five business days after placing a lien on a taxpayer's property. The taxpayer then has thirty days after the five business days to request a hearing with appeals, called a Collection Due Process hearing. The lien notice generally will notify the taxpayer when the 30-day period expires. Lien notices can be mailed, left at the taxpayer's home or business, or handed to the taxpayer. When mailed, the IRS uses the last known address on file. If you missed the window to request a Collection Due Process hearing, you are not out of options. You may qualify to request a Collection Appeal Program Hearing or Equivalent Hearing.

Methods to Resolve a Tax Lien

Once a lien is filed, there are four methods available to taxpayers to resolve the lien. The four methods (also referred to as remedies) include:

- Lien Release - A lien release removes the IRS's interest from the property and can be requested by contacting the IRS by telephone or sending a letter to request the lien be released. A lien usually self-releases within thirty days after the debt is satisfied or the time the IRS has to collect the tax has expired. However, the taxpayer can contact the IRS Centralized Lien Operations (CLO) to confirm the lien release. If a taxpayer needs to show proof of the lien release, they can request Form 668(Z), IRS' Certificate of Release of a Federal Tax Lien. When the tax is paid by a credit/debit card, the lien will release within one hundred twenty days. Paying by cashier's check can expedite the release. When a lien self-releases, the taxpayer will not receive a Release of Federal Tax Lien notice. Ways that a lien can be released are:

- The tax debt is paid in full.

- The time the IRS has to collect the debt has expired. The date that the IRS is no longer permitted to collect an overdue tax liability is called the Collection Statute of Expiration Date (CSED). Generally, the IRS has ten years from the date the tax is assessed to collect the tax due.

- The underlying tax due was satisfied through a settlement, such as an Offer in Compromise, and the taxpayer has paid off the offer amount.

- The underlying tax due is discharged in bankruptcy.

- The taxpayer obtained a surety bond to secure the debt.

- The lien was issued in error. For example, the taxpayer was a victim of tax identity theft, and the tax due does not belong to them.

- Lien Withdrawal - A lien withdrawal is not the same as a lien release. Some of the ways a lien can be withdrawn are:

- The withdrawal of the lien will facilitate the collection of the liability.

- A lien can also be withdrawn when a taxpayer has been compliant in filing all required income and information tax returns for three years. A lien can be withdrawn if it helps the taxpayer be current on their estimated tax payment and federal tax deposits.

- The taxpayer owes $25,000 or less and enters into a Direct Debit Installment Agreement where the entire balance due is paid within sixty months (five years) or before the time the IRS has for collecting the tax debt expires. During the installment agreement duration, the taxpayer must be in full compliance with all other filing and payment requirements. Additionally, the taxpayer must make three consecutive direct debit payments before the lien is withdrawn. If the taxpayer has defaulted on the current or a previous installment agreement, this option is not available.

Even though a withdrawal removes the lien from the public record, the taxpayer is still liable for the underlying tax liability. A lien withdrawal may be requested by submitting Form 12277, Application for the Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien (Internal Revenue Code Section 6323(j).

- Lien Subordination - A lien subordination means that the IRS agrees to make the federal tax lien secondary to a non-IRS lien, such as a mortgage. For example, the IRS may agree to subordinate their lien if the taxpayer is attempting to refinance their home and will be using the refinancing proceeds to pay off the taxes due. The IRS will only agree to a lien subordination if it is in the government's best interest. The taxpayer should be ready to clearly explain and provide documentation of why agreeing to subordinate a lien will be beneficial to the IRS in resolving the tax liability. A lien subordination can be requested by submitting Form 14134, Application for Certificate of Subordination for Federal Tax Lien to the IRS Consolidated Advisory Group. IRS Publication 784, Instructions on How to Apply for a Certificate of Subordination of Federal Tax Lien contains information on preparing and submitting Form 14134. A copy of this form is included in the publication.

- Lien Discharge - A discharge removes the lien from a specific property to be transferred to another party. Generally, the IRS will only agree with a lien discharge if it is in the government's best interest. A lien discharge may be requested under these five conditions:

- The remaining property the taxpayer owns has a fair market value that is double the amount of the federal tax lien plus other debtors that prioritize the federal tax lien.

- An amount not less than the value of the government's interest in the property is paid in partial satisfaction of the liability. The taxpayer must not have any ownership or other kind of interest in the property after the transaction.

- The property the IRS placed a lien on has no value. After the transaction, the taxpayer must not have any ownership interest in the property.

- The property is subject to a short sale, and the income from the short sale is divided the same way as before the property was sold. After the short sale, the taxpayer must not have any ownership in the property that was sold.

- A third-party owner of the property, who is not the taxpayer, deposits the value of the government's interest in the property in cash or provides an acceptable bond.

Even though credit bureaus no longer list IRS liens on a taxpayer's credit reports, a lien is still a matter of public record – which means that lenders can still access the information - and that can make applying for credit a challenge. A lien can also impact a taxpayer's ability to secure a loan for an auto or other asset. Furthermore, scammers can access this information. Taxpayers with liens have fallen victim to identity thieves and other unsavory characters who have taken advantage of this information and preyed upon the taxpayer. For these reasons, it is essential to remedy a lien as soon as possible.

The great Bill Withers penned and sang the quintessentially inspirational song, "Lean on Me." Knowing that there are family, friends, and even strangers in the world who are willing to support another person in their time of need keeps hope alive that better days are ahead. The tax practitioners at TaxAudit's Tax Debt Relief Assistance understand the complexities of federal tax liens and empathize with the anxiety and uncertainty they cause. Lean on our broad experience and contact us today.