IRS 3219C Letter | Notice of Deficiency | How to Respond

July, 27 2023 by Charla Suaste

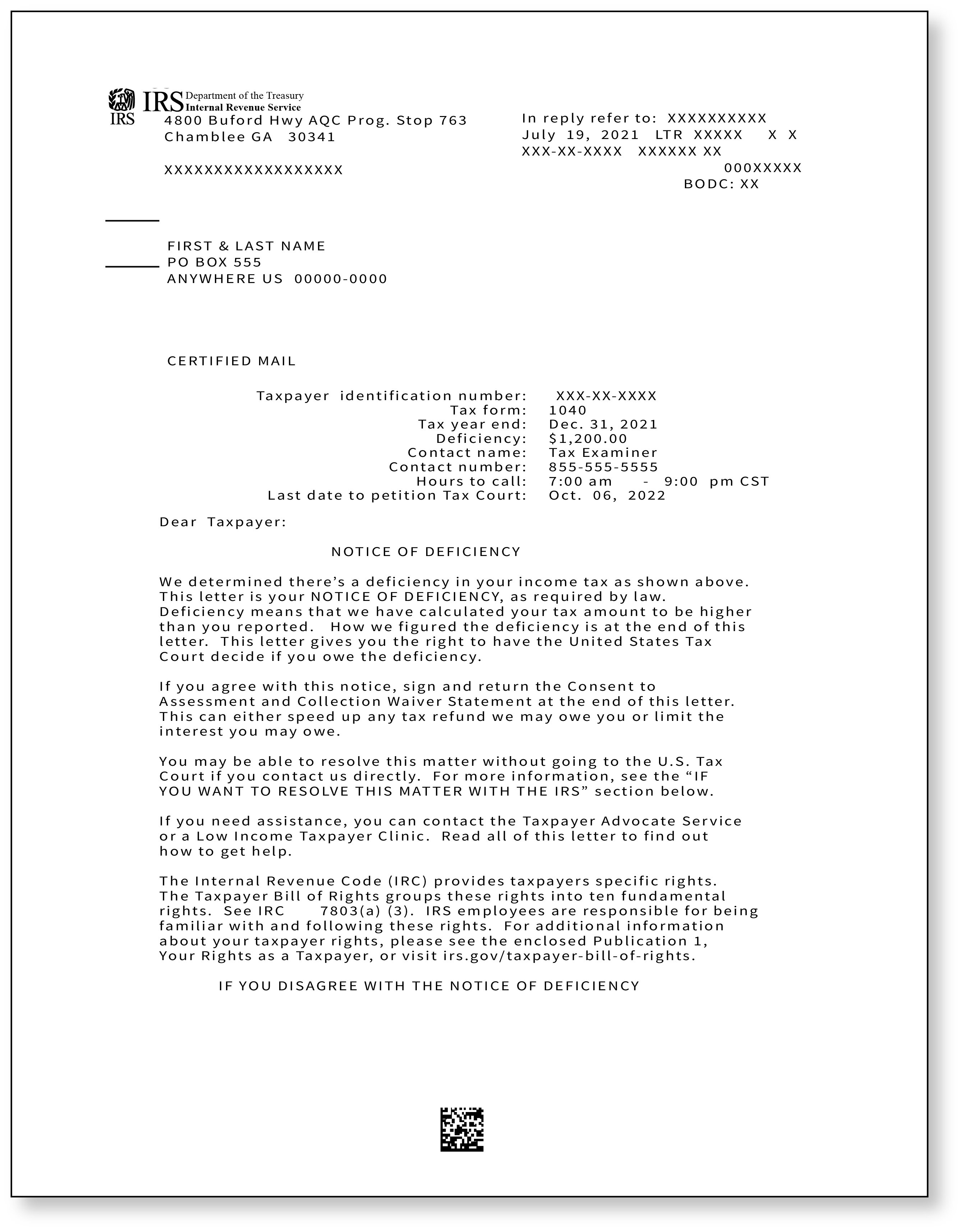

One of the most common notices we see at TaxAudit is the IRS Letter 3219C – also called a Notice of Deficiency. So, what is this notice? Why did you receive it? And how should you respond? Let’s discuss below.

What is a Notice of Deficiency?

A Notice of Deficiency (also known as an NOD or 90-day letter) is a letter sent to the taxpayer by certified mail, meaning that the taxpayer must sign for it, confirming they’ve received it.

The receipt of this letter tells us a few important things.

The first thing an NOD indicates is that the IRS has tried to contact the taxpayer multiple times by mail regarding an audit result or return correction that resulted in additional tax. The IRS has either not received a response from the taxpayer or they did receive a response from the taxpayer, but they disagree with the response and believe the taxpayer continues to owe additional taxes.

Why did I receive this notice?

Prior to sending a Notice of Deficiency, the IRS usually sends other letters, such as a CP2501, a CP2000, or an audit notice to let the taxpayer know that changes were made to the return. These letters will list what changes the IRS is proposing to make to the return, state why the changes were made, and claim the taxpayer either owes additional tax or is receiving a reduced refund. The taxpayer will have 30 days from the date on these notices to either call the IRS or send in documentation to dispute the claims and defend what was on their originally filed tax return. However, if the IRS does not hear from the taxpayer in a timely manner, does not hear from them at all, or disallows the submitted documentation, they will send this final notice, an IRS Letter 3219C.

While this letter might seem a little intimidating, it can actually be a good thing! An NOD is intended to put the taxpayer on notice and let them know that they have one final opportunity to state their case, and have 90 days to do so.

What should I do now?

After receiving a Notice of Deficiency, you should read the notice from top to bottom. This notice will include copies of the previous letters they sent you, which will state what changes they made to your tax return and why. You will want to review the corresponding tax return – as well as any documentation – and see if the changes the IRS made to your return are correct.

If they are correct, you should take steps to make a payment as soon as possible or enter into an installment agreement with the IRS. This allows you to pay any taxes due over a certain period of time. You can call the IRS to see what your payment options are or visit the IRS website at IRS.gov. Payment plan information can also be found at this link here: https://www.irs.gov/payments/payment-plans-installment-agreements

If you do not agree with the changes the IRS made, however, “you have the right to challenge the increase in tax by filing a petition with the U.S. Tax Court no later than the date listed on the notice.” You can do this either electronically or by mail; however, filing electronically is the recommended method to make sure your petition is filed on time. The IRS will not consider your petition if it is filed late.

If I file a tax court petition, what happens after I file?

According to the IRS website, “If you filed a paper petition, you will receive a notice of receipt of petition from the Tax Court by mail acknowledging the filing of the petition. That document will tell you the docket number of your case. If you eFiled your petition, the DAWSON system will provide the docket number. You should include the docket number assigned to you on all letters and documents you send to the Tax Court and to the IRS. Next, an Answer is filed by the IRS. After your petition has been filed, you should send a copy of everything you send to the Tax Court to the attorney representing the IRS. The name and address of the IRS attorney is on the last page of the Answer.”

How can TaxAudit help?

We’re so glad you asked. This can all be a bit confusing, can’t it? Well, never fear because our experts are here! Our team of tax professionals has been around for over 30 years, and we are truly the best in the business. And when it comes to a Notice of Deficiency, we have a special team of NOD experts who step in to handle your case for you. So, if you have a membership with TaxAudit, make sure to call us the minute you receive a copy of any notice from the IRS. Our Tax Professionals will review any notices you’ve received as well as the corresponding tax returns – and then advise you on whether the IRS notice is correct or incorrect. If it is not correct, we will step in immediately on your behalf. This includes making phone calls to the IRS, attending all meetings, submitting documentation, and working with the IRS to make sure you pay no more tax than you rightfully owe.

If you are not a member with TaxAudit, now is the time to sign up for a membership. It’s as easy as going to our website at TaxAudit.com or calling our Customer Service Representatives at 800.922.8348. They are waiting for your call and will be more than happy to get you all signed up and ready to rock ‘n’ roll.