IRS Notice CP91 | Seize up to 15% of your Social Security

November, 21 2023 by Autumn Sapor

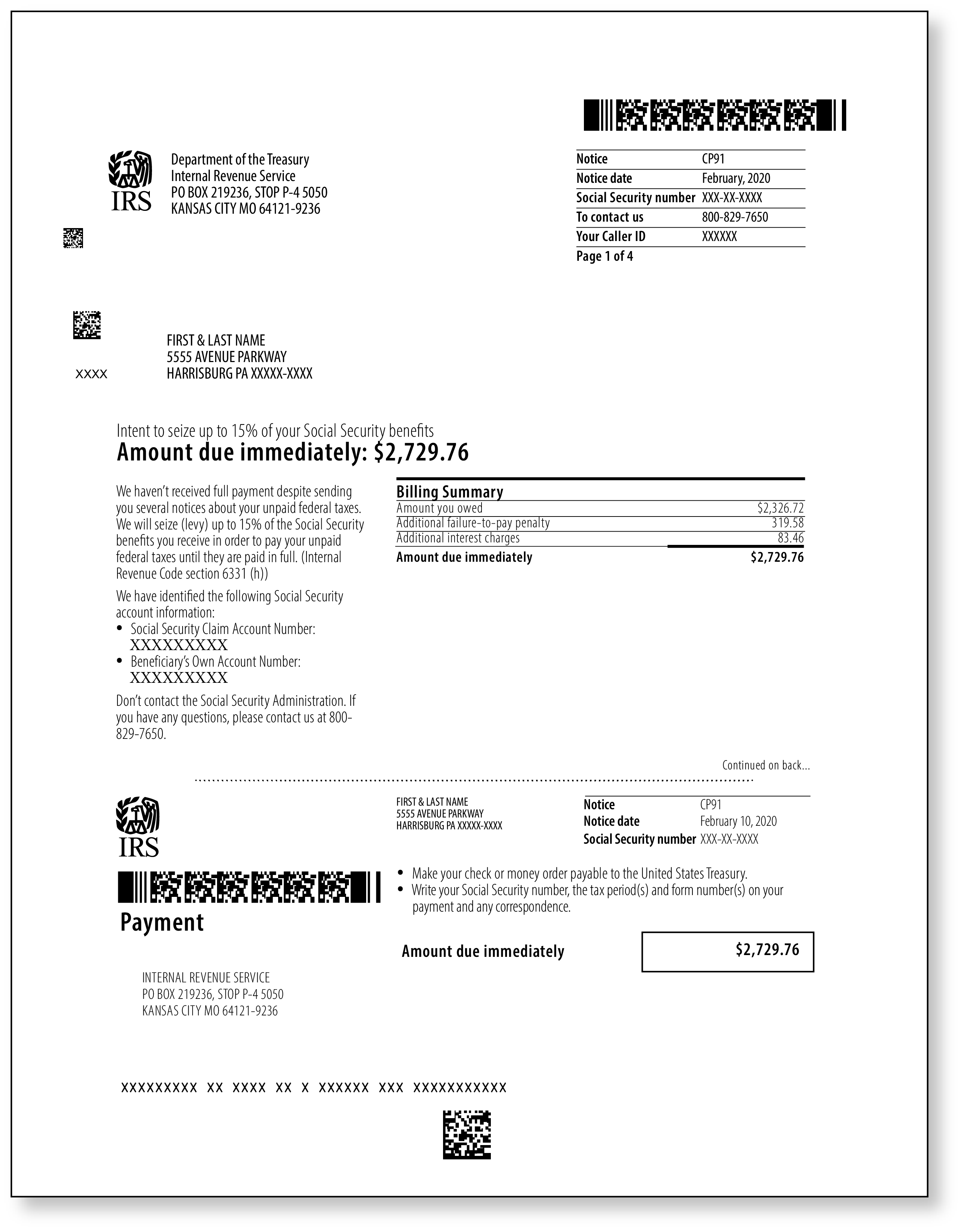

You’ve received a CP91.

Now, what do you do? This IRS letter states that they may seize up to 15% of your Social Security because you have an unpaid balance due. If you received this letter, you may be thinking, “I’ve worked my whole life, and now they are taking my Social Security money? Can they do that? Surely this is a scam! This is a phishing letter, right?”

Unfortunately, the short answer is no, this particular letter is not a scam or a phishing letter. And yes, the IRS can take a portion of your social security. (Please note: If you really suspect that a letter is a scam, please check out the IRS website at Tax Scams.)

Okay now, let’s take a deep breath and walk through this step-by-step.

Before we get into the particulars of the CP91 notice, let’s talk briefly about how outstanding balances can have an impact on your social security account. Social Security can be taken to pay for:

- Child support and alimony

- Court-ordered restitution

- Back Taxes

- Non-tax debt owed to a Federal Agency

- Other assorted items!

If you would like more information on how Social Security can be used to satisfy debts, the Social Security handbook is a great resource. If you’re not sure what you owe or why your SSA is being garnished, the Consumer Financial Protection Bureau is another great place to start for a better understanding of what other debts may or may not be collected against your federal benefits like Social Security.

So, what do the IRS and US Treasury have to do with Social Security?

The Treasury and IRS are often thought of interchangeably, but they do have different functions. Congress determines the tax code. The IRS enforces the tax code. The Treasury collects taxes owed by taxpayers.

While the largest volume of the US Treasury collections is probably for the IRS, the Treasury does collect for other agencies as well. Think about anything that could be owed to any governmental agency; the agency can refer that amount to the US Treasury for collection.

Most of us believe that our Social Security is untouchable. “They have to LEAVE $750 of my Social Security! That is the law! Right? A guy has to live.” Unfortunately, it is complicated. There are many different laws, court cases, and rulings that exist to protect Social Security. Yes, there is one that even says a garnishment cannot reduce a Social Security check below $750. Unfortunately, it generally doesn’t apply to government agencies.

Moving on, we are going to look at how garnishments are triggered by that third bullet point mentioned earlier: Back Taxes. That is what the CP91 is addressing.

Why did I get a CP91?

Let’s look at why that CP91 ended up in your mailbox. Were there other notices you missed or ignored?

If you have those old notices that you were waiting for the right time to open, now is the right time. If you have a stack of them, line them up by date. Start with the first one and move through them. This may help you get a better picture of the timeline. Perhaps there are other reasons for missing notices: Does someone else pick up your mail? Have you moved? Have you gone through a divorce? All these situations can cause IRS notices to go astray. You may need to check with the other people who may potentially have received your mail.

You can also start by reviewing your Record of Account transcript. You can do this by visiting the IRS website here.

If the reason for the notice still eludes you, reach out to the IRS. Look at the notice under “What you need to do immediately,” and you will find “Or call us at 1-800-xxx-xxxx.” That is the phone number to call. They can answer questions about why you have received the notice, discuss the outstanding balance, as well as advise you of your payment options.

Let’s Take Care of the Immediate Pain

Let’s get started talking taxes. You have a past-due tax bill that has not been paid. How did that happen, and what is its status?

Did you mail a check?

Old-fashioned snail mail could be the problem.

Check with your bank. Did it clear your account? If your check cleared, it may have been directed to other balances owed or applied to an incorrect tax year. You want to make sure it was credited to you somewhere. Have copies of your canceled check ready when you call the number on the notice to discuss.

Did you pay online?

Do you think you already paid this bill online? First, make sure the transaction cleared your bank. We often assume electronic transactions are automatic; however, there are times when there are issues or errors with such payments.

If you discover there was an error, repeat the transaction and read further down the page to see what to do after a payment has been made.

If you determine the transaction did go through, why does it appear the payment was not applied?

Here are several possibilities:

- The funds were applied to other tax debt.

- The funds were applied to quarterly payments.

- There was a typo in the Social Security number.

- The notice was generated prior to the payment being received or registered on the IRS’ end.

If you discover you have yet to make payments against the balance in question, the most important thing to do is pay some, if not all, of the outstanding amount. Paying online through the IRS website is the most efficient and fastest way to have a payment applied to your account. You can also mail in a check but remember that you will need to account for mailing time with the post office, and then processing time once the check arrives at the IRS. If you cannot pay the entire balance at once, you can apply for an installment agreement. You can inquire about this option by calling the IRS or setting it up yourself online through the IRS website. Whatever your decision, it is important that you communicate it to the IRS as soon as possible to fend off the seizure of your social security funds.

Setting Up an IRS Account

If you do decide to apply for an installment agreement or make a payment to the IRS on their website, the best way to go about this is to set up an IRS account. There are many advantages to having an IRS account, such as being able to see your tax return information, letters the IRS has sent you, your refunds, and amounts owed. You may also be able to find answers to any questions you have here and use it as a tool to keep an eye out for potential identity theft. Lastly, you will be able to pay your tax bill from this account. The receipt for the payment will then be saved in the account. The IRS will be able to see the payment and receipt in the account without you having to provide it to them. Overall, an IRS account can be a great tool for you.

Something to note is that once you have your account set up, you may have to wait up to 24 hours for all your information to be populated.

Handling the Payment without an account

Don’t want to set up an IRS account? Here are a few options to make the payment without an IRS account:

- Pay the full amount online on the IRS website.

Yes, you can still pay online via IRS.gov without creating an account!

For instructions on how to do this, look at the CP91. Page 2 will have a section titled “What you need to do immediately.” In that section, it will list the amount owed – that is the amount you are going to pay online. You can either use your credit card to pay (there is an additional service charge for this option) or you can enter your bank account routing and account numbers and the funds will come directly out of your account. There isn’t a processing charge when you pay using the latter option.

Something important to note is to make sure you are on the .GOV site when paying, and not on a .org or .com or other pay site.

Once you have completed the payment, print the online receipt as an electronic copy or save it to your desktop. You want to be able to attach it electronically or upload it easily as proof of your payment in the event it is ever needed.

- Apply for an installment agreement with the IRS online or over the phone. If you can’t pay the full amount all at once, it is important to show the IRS that you are attempting to make payments and then make them on time each month. This will keep their hands off your Social Security as long as you hold up your end of the deal.

Okay, we have paid: Now what?

Remember that electronic copy of your payment receipt? Here is where it comes in handy so you can show the IRS that you did indeed pay the amount due (or are in the process of paying the amount via an installment agreement).

You have the option to either fax or mail your payment confirmation. On the first page of the notice will be the appropriate address and fax number to which you should send your information. If you fax, be sure to include a copy of the first page of the notice along with proof of payment. If you mail your response, make sure you keep a copy for yourself and send it with a Return Receipt and tracking.

What about penalties and interest?

That CP91 includes interest and, most likely, penalties for not paying the tax on time. However, you may be able to request relief in the form of abatement by filling out and submitting Form 843 to the IRS.

For more information about penalty relief and interest relief, click here.

Can TaxAudit help me?

If you need further help understanding your options with this levy or any other IRS bills or notices, TaxAudit’s Tax Debt Relief team is always here to help. With years of experience in both audit defense and tax debt resolution, the team of Tax Professionals at TaxAudit can review your situation and propose a course of action. As with any levy or lien, it is critical to act quickly so you know your options and put a plan in motion.

Until next time,

🍂 Autumn Sapor