IRS CP24 Notice | What It Is and How to Respond

August 05, 2025 by Kate Ferreira

Have you just received an IRS CP24 Notice and do not know what to do? No need to fear! In this blog post, we will go over what an IRS CP24 Notice is and how to respond.

What is an IRS CP24 Notice?

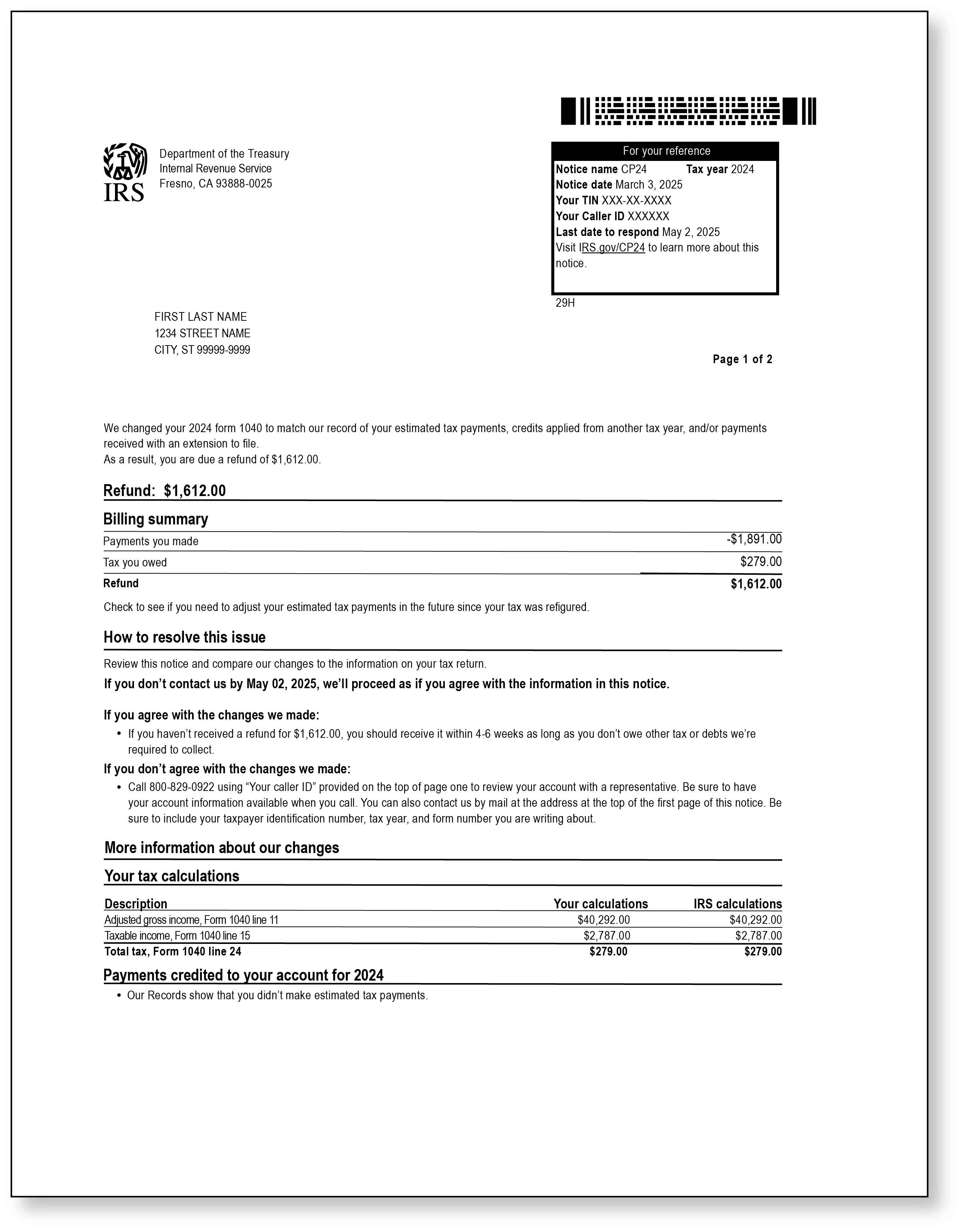

First, what is this notice you received from the IRS? An IRS CP24 Notice is issued when there is a difference between the amount of estimated tax payments listed on your submitted tax return and the amount that the IRS applied to your account. This discrepancy could be due to estimated tax payments made, credits applied from another tax year, and/or payments made when a taxpayer has requested an extension to file. Due to these changes, you may have a credit and be owed a refund. Additionally, if the IRS has made any other changes to your tax return, these will be listed on the CP24 as well.

What do you need to do?

The first thing you will need to do is read the notice carefully and, in its entirety, to make sure that the total amount of estimated tax payments, withholding, and other payments made during the tax year were accounted for. An example of an “other payment” might be if your refund from a previous year was applied to the tax year in question.

If you agree with the notice, no response is required from you. The IRS has already updated your account on its end. However, it is recommended that you correct your copy of your tax return, which you should keep for your records. You should receive your refund within 4-6 weeks, as long as you do not owe any other taxes or debts that the IRS is required to collect.

If you do not agree with the notice and changes made by the IRS, you will need to contact the IRS by the date listed on the top right corner of page one of the notice.

There are a few ways you can contact the IRS regarding your IRS CP24 Notice:

You can contact the IRS via telephone.

This is our recommended way to contact the IRS, as they may be able to correct your account immediately. A toll-free number is listed under the “What to do if you disagree with our changes” section of your notice. In some cases, the IRS might require you to provide additional information over the phone to ensure they are speaking with you and not someone who may be posing as you. The IRS may ask you to verify the Social Security numbers and birth dates for those who were named on your tax return. For example, the IRS may ask for the Social Security number and date of birth of your child or parent if they are listed as a dependent. Additionally, the IRS may confirm your identity by asking you to confirm your filing status and questions about your prior year’s tax return. Keeping this in mind, it is beneficial to have a copy of your prior year’s tax return and the tax return that is in question. For instance, if the IRS sent you a CP24 Notice regarding the estimated tax payments reported on your 2024 return, you will want to have a copy of your 2024 and 2023 returns handy when you call the IRS.

You can contact the IRS via mail.

Using the address provided at the top of page one, you can send a response to the IRS. In your response, you will want to include a copy of the IRS CP24 notice and a copy of any documentation that supports your claim. Examples of documentation may include copies of cancelled checks, bank statements, and prior year returns where a refund was applied to the tax year in question. Please be sure to retain a copy of the IRS CP24 you received for yourself, and do not include originals of any documentation you send. The IRS will need time to review your response, so please allow 90 days or more for a resolution or response.

You can contact TaxAudit for guidance.

If you have an audit defense membership with TaxAudit for the tax year of your IRS CP24 notice, you can contact us to have one of our seasoned tax professionals review the notice, answer any questions, and advise you on the best course of action.

If you have received an IRS CP24 notice or have questions regarding audit defense with TaxAudit, feel free to visit our website by clicking here or by calling our customer service department at 800-922-8348.