IRS Notice CP134B | All About this IRS Discrepancy Notice

November 25, 2025 by Charla Suaste

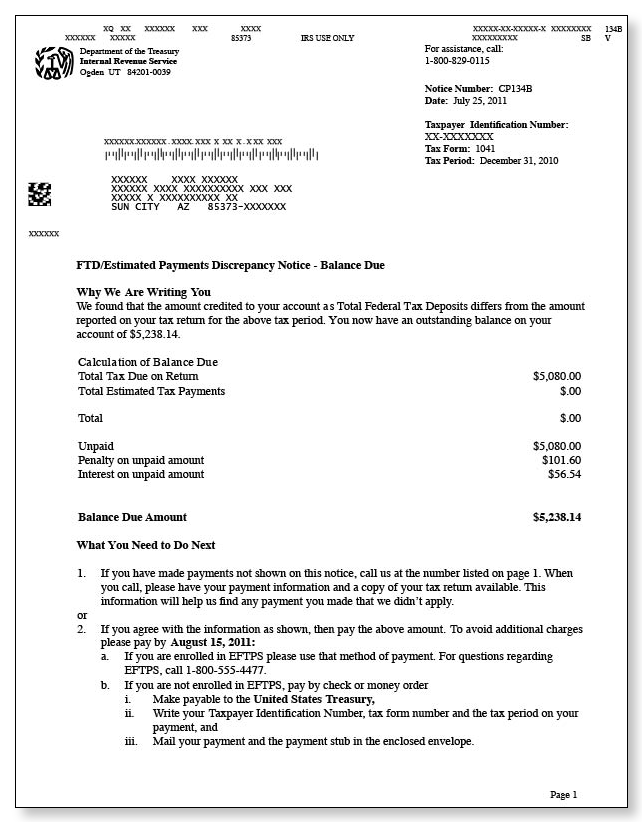

Getting a letter from the IRS is rarely a cause for celebration, and a Notice CP134B can be particularly concerning for business owners. This notice is a balance-due letter related to your business’s payroll tax obligations. It's a formal way of telling you that the IRS has found a discrepancy between the amount of federal tax deposits they have on record for your business and the amount you reported on your Form 941, Employer's Quarterly Federal Tax Return.

The IRS's records may not align with yours for a number of reasons. This could be due to a simple math error on your part, a misapplied payment, or a timing issue with your tax deposits. The notice itself will show a new balance, including penalties and interest, and provide a due date for payment. This is not an audit notice, but it's a serious matter that requires your immediate attention.

What The CP134B Notice Entails

When you open the envelope, you'll see a breakdown of the issue. The notice will clearly state the tax period in question, the original tax reported on your Form 941, the deposits the IRS has credited to your account, and the resulting balance due. This balance is a combination of the unpaid tax, plus penalties and interest that have accumulated since the due date. The penalties can be significant, so prompt action is essential to prevent them from growing even larger.

The notice will also include a "tear-off" payment stub and instructions on how to pay. If you agree with the IRS's findings, the easiest way to resolve the matter is to pay the amount in full by the due date.

Your Next Steps: A Guide to Resolution

- Read the Notice Carefully: This seems obvious, but it's easy to get flustered and skim the document. Read every word. Pay close attention to the tax period, the dollar amounts, and any deadlines.

- Gather Your Records: Pull out your business's financial records for the tax period mentioned in the notice. This includes your copy of Form 941, proof of your federal tax deposits (like bank statements or EFTPS confirmations), and any related payroll records.

- Compare Your Records with the Notice: This is the most critical step. Reconcile the deposits shown on your records with the credits the IRS has applied to your account.

- Is there a payment missing? You may have made a payment that the IRS hasn't yet processed or has incorrectly applied to a different tax period or business account.

- Is there a calculation error? Double-check the math on your Form 941. A simple typo or calculation mistake could be the source of the discrepancy.

- Did you underpay? Be honest with yourself. If your records show that you genuinely underpaid your tax liability, the IRS's notice is likely correct.

- Order an Account Transcript: To get a clear picture of what the IRS sees, you can request an Account Transcript for the specific tax period from the IRS. This document will show all the activity on your account, including all payments and penalties. It's an excellent tool for identifying where the discrepancy lies.

- If You Agree with the Notice: If you determine the notice is correct, your best course of action is to pay the balance due immediately to stop additional penalties and interest from accruing. The notice provides several payment options, including online payment, EFTPS, or by mail with the tear-off stub.

- If You Disagree with the Notice: If you believe the IRS has made a mistake, you must respond in writing. Send a letter to the address provided on the notice, explaining your position and including copies of all supporting documentation (e.g., proof of payment). Do not send original documents. It's also a good idea to call the number on the notice to try and resolve the issue by phone, but always follow up with a written response for your records.

What if I have Audit Defense with TaxAudit?

If you have Audit Defense with TaxAudit, a CP134B notice is something we can help you with. Call us as soon as you receive the notice! Our tax professionals are experienced in dealing with the IRS on a wide range of issues, including payroll tax notices. We can review your notice and records, help you determine the source of the discrepancy, and correspond with the IRS on your behalf. Don't go it alone—let us help you navigate this process and work towards a resolution.

IRS Notice CP134B is a serious matter that can lead to significant financial penalties if ignored. By acting promptly and methodically, you can resolve the issue and put it behind you.