IRS Letter 12C | What It Is and How to Respond

July 17, 2025 by Charla Suaste

Receiving a letter from the IRS is rarely a pleasant experience. You’ve gone through the process of gathering, organizing, and submitting your documentation, and you’re ready for the process to be over. Then, shortly after filing, you receive a letter from the IRS. You anxiously tear into the envelope to discover an IRS Letter 12C inside.

So, what does this letter mean? What next steps should you take?

- Read the letter from top to bottom.

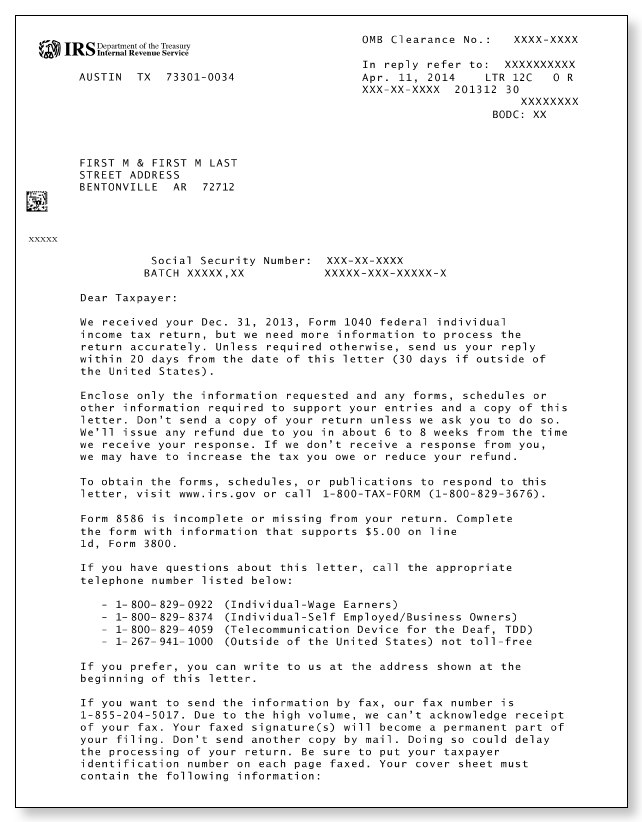

Every IRS letter contains crucial information that taxpayers should note. In this case, an IRS Letter 12C is requesting additional information to verify the claims made on your tax return. This could include anything from verification of income and wages to requesting additional forms the IRS believe were missing from your original return. The information they are requesting is typically included in the fourth paragraph down and can be easy to miss, which is why it’s so important to read the notice in its entirety. It’s also important to note any deadlines or timeframes by which the IRS expects to receive a response.

- Compile and send the necessary documentation.

The IRS Letter 12C will include instructions on the best way to send the requested information, whether that is via fax or mail. Again, it is important to note any details the IRS has listed, such as addresses, fax numbers, as well as instructions for what should be included in the response, such as page numbers, Social Security numbers, the number of pages being mailed or faxed, etc.- If you decide to mail your response, make sure to send it certified mail so that you can track when the documentation was sent and when the IRS receives it. Additionally, make sure to keep a copy of everything that was sent, so you have it for your own record.

- If you decide to mail your response, make sure to send it certified mail so that you can track when the documentation was sent and when the IRS receives it. Additionally, make sure to keep a copy of everything that was sent, so you have it for your own record.

- Do not file an amended tax return.

Some taxpayers assume they simply need to file an amended return to resolve the IRS letter, but this will only delay the process. The documentation the IRS is requesting will be added to your originally filed return, so make sure to follow the steps the IRS has laid out for you in order to expedite the process.

- Follow up with the IRS if you do not receive a response.

If you do not hear back from the IRS within 6-8 weeks after sending your response, make sure to follow up on the status of your case via phone call. The IRS is a large governmental agency and sometimes, things can fall through the cracks - so never hesitate to follow up to confirm that the IRS received your documentation and that any refund you may be expecting is forthcoming.

- If you have an Audit Defense membership with TaxAudit, give us a call!

We will assign you a tax professional who will review your IRS notice and tax return, submit any requested documentation on your behalf, and follow up as needed. Our goal is to make sure you never have to face the IRS alone and that you pay no more tax than what you rightfully owe. If you’d like more information about exactly what an Audit Defense membership is or if you’d like to start a case with us, click here. We are standing by and ready to help!