IRS Letter 4364C Amended Return | What You Should Know

August 27, 2025 by Charla Suaste

Nothing is more anxiety-inducing than opening your mailbox to discover an envelope with the letters “I-R-S" stamped on the top left-hand side. Receiving an IRS Letter 4364C is no different.

If you’ve received this letter and are unsure why or what you should do next, read on.

An IRS Letter 4364C is issued after a taxpayer has filed an amended return. This notice is sent to notify the taxpayer that:

- The IRS received the amended return;

- The IRS disagreed with the amended return that was filed, and they made adjustments to it.

In turn, this may have resulted in an amount due or an adjusted refund.

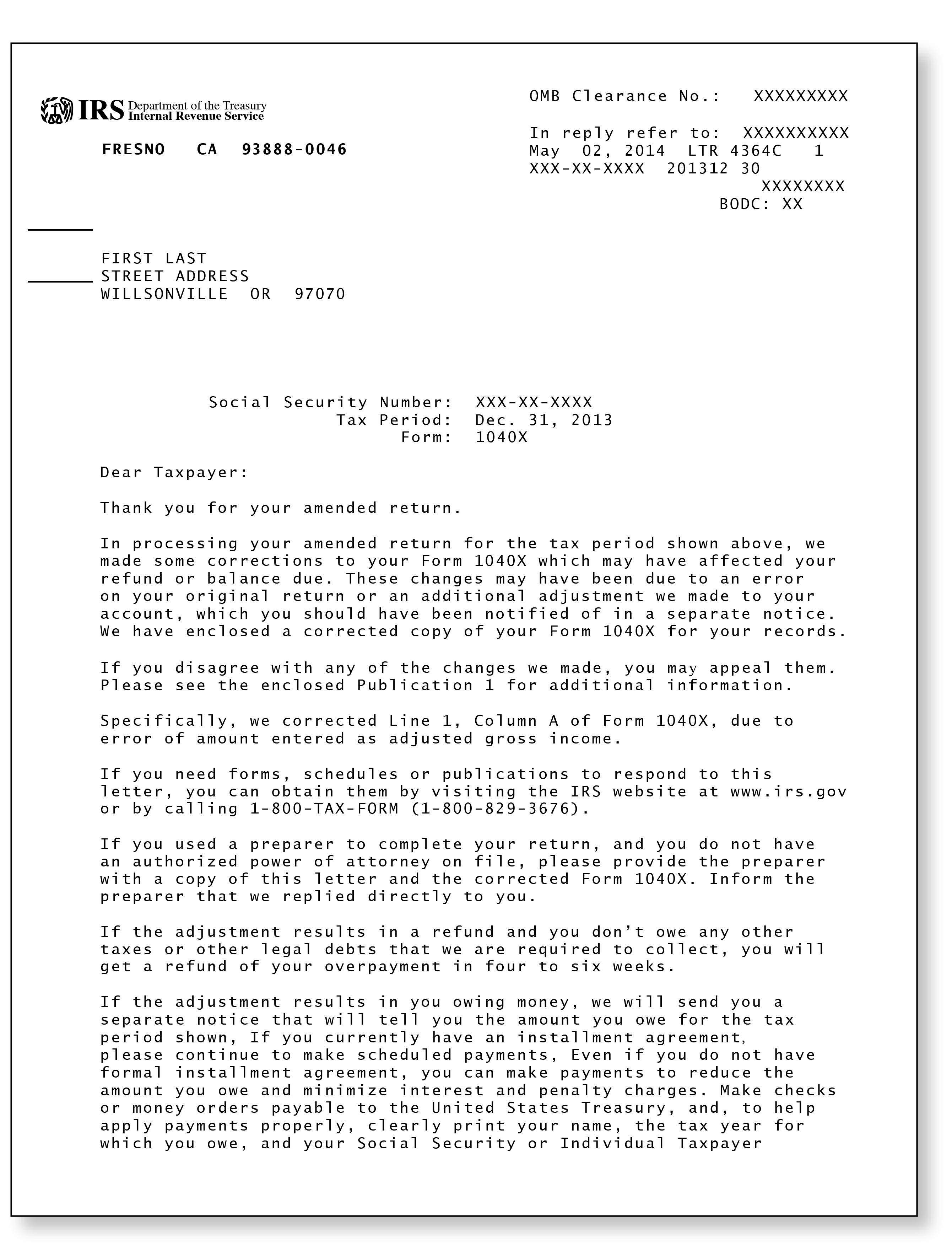

Unfortunately for the taxpayer, this specific letter is vague and may not list why the amended return was adjusted or what specific adjustments were made. Our sample letter above is an example of this. It notes an “error of amount entered as adjusted gross income,” but it does not list what amount they believe was incorrect, why they believe it was incorrect, or how it was adjusted. The taxpayer will need to wait for a follow-up letter (if they have not already received one) that lists the specifics of the adjustments made to the tax return.

If I have received this notice, what should I do next?

- Read the letter in its entirety.

This notice will outline expectations, next steps, deadlines, and taxpayer options (such as the right to appeal) so you can take action if necessary.

- Be on the lookout for an additional notice that lists the specifics of what the IRS changed on your amended return. (It is possible you have already received it.)

Once you receive that notice, make sure to review this notice in its entirety as well. This letter will provide additional details about what the IRS changed, why they changed it, and will note if you are due a refund or owe additional tax.

- Call TaxAudit!

Call us immediately if you have an Audit Defense membership for the tax year in question. We will request a copy of any notices you received, the corresponding tax return, then assign your case to one of our world-class tax professionals. This individual will review your documentation and advise on the next steps. If you expected to receive a refund from the IRS, they can verify that you are not receiving less than what you are due. Or, if the IRS is claiming you owe additional tax, our tax professional can verify that this is true and if the amount is correct. If they do not believe it is correct, they will respond to the IRS on your behalf to ensure that you pay no more tax than what you rightfully owe.

At the end of the day, we never recommend facing the IRS alone. Even if you do not have a TaxAudit membership, we would advise that, in the event of receiving any IRS letter, you contact an Enrolled Agent or CPA who can properly advise you on the best course of action.