IRS Letter 474C | What It Is and How to Respond

October 30, 2025 by Kate Ferreira

Receiving a letter from the IRS can be a nerve-wracking experience, especially when it’s a notice you’ve never seen before—like IRS Letter 474C. If you’ve just opened your mailbox to find one of these letters, it’s natural to have questions and concerns. What does this letter mean? Why did you receive it? What are your next steps? As tax professionals who have helped thousands of people through situations just like yours, we’re here to demystify IRS Letter 474C and guide you through your response.

What Is IRS Letter 474C?

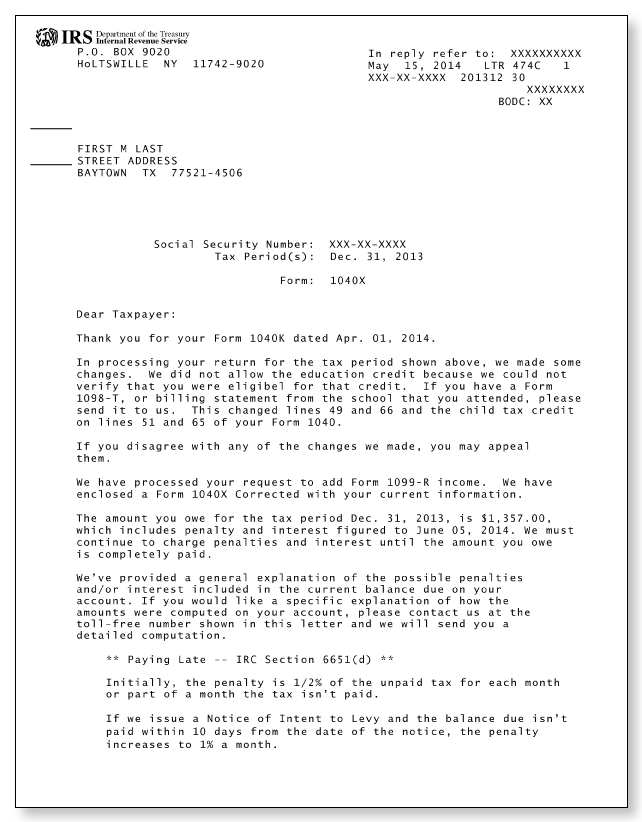

IRS Letter 474C is an official communication from the Internal Revenue Service. This letter is sent when the IRS needs additional information to verify certain items on your tax return; typically, from an amended tax return Form 1040X. Unlike an audit notice, this letter is a request for clarification or supporting documentation—often because something on your tax return appears to be unclear, incomplete, or inconsistent with information the IRS has on file.

In many cases, Letter 474C is issued when the IRS is considering an adjustment to your return but wants to give you the opportunity to provide more information before making any changes. The letter will specify exactly which items need clarification, such as income, credits, deductions, or other tax-related matters.

Why Did You Receive Letter 474C?

There are several reasons why you may have received this letter, including:

- A discrepancy between the income you reported, and information provided to the IRS by employers, banks, or other third parties.

- Missing or incomplete documentation for certain credits or deductions claimed.

- Questions about dependents, filing status, or other details that impact your tax return.

The letter should detail the specific issues the IRS is questioning. It will also provide instructions on how to respond and what documentation, if any, you need to submit.

What Should You Do Next?

First and foremost, it’s important not to ignore IRS Letter 474C. Failing to respond can lead to unwanted outcomes, such as the IRS adjusting your return in a way that may not be in your favor.

Here’s what you should do if you receive Letter 474C:

- Read the Letter Carefully: Take your time to read the entire letter. Pay close attention to the sections explaining what information the IRS needs and why.

- Gather Documentation: Collect any documents that support the information on your original return. This may include W-2s, 1099s, receipts, invoices, or other records.

- Respond by the Deadline: The letter will specify a deadline for your response, usually 30 days from the date of the letter. Make sure to reply promptly to avoid complications.

- Submit Your Response: Follow the instructions for sending your documentation. Depending on what is outlined in your letter, this could be by mail, fax, or through the IRS’s online system.

- Keep Copies: Always make and keep copies of any correspondence with the IRS and all documents you send.

How TaxAudit Can Help

If you’re a TaxAudit Audit Defense member, you don’t have to face the IRS alone. Call us as soon as you receive IRS Letter 474C. Our team of experienced tax professionals will review your letter, help you understand what’s being asked, and work with you to submit the necessary documentation. We’ll communicate directly with the IRS on your behalf and guide you every step of the way, so you can have peace of mind knowing you’re in good hands.

Final Thoughts

IRS Letter 474C is not an accusation of wrongdoing; it’s a request for clarification. By responding promptly and thoroughly, you can resolve the issue efficiently. And remember: with Audit Defense from TaxAudit, expert help is just a phone call away.