IRS Letter 4870 Electronic Funds Withdrawal | How to Respond

October 15, 2025 by Charla Suaste

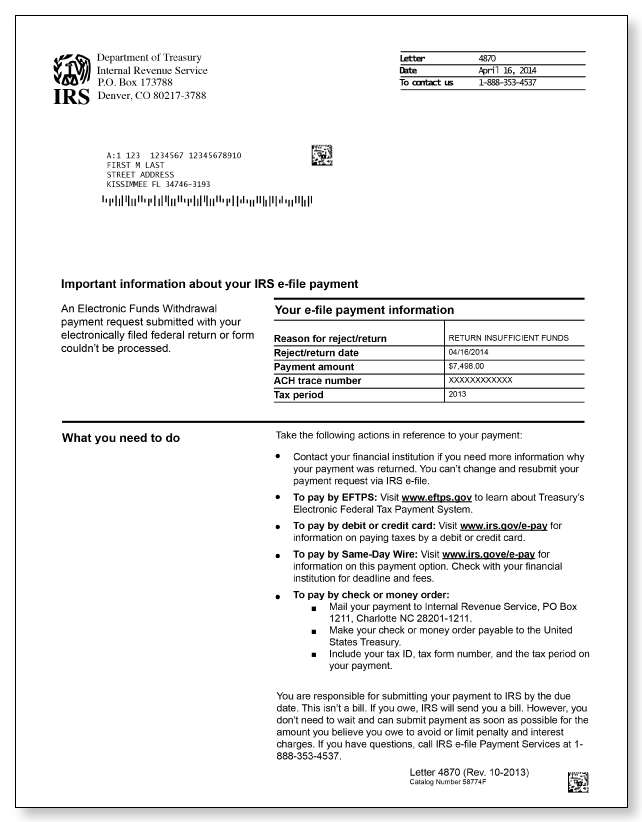

Getting a letter from the IRS is never a welcome sight, especially when it's about a payment. However, if you've received an IRS Letter 4870, don't panic. This is not a traditional balance-due notice or an audit letter. The purpose is simply to inform you that your scheduled e-file payment was rejected. The IRS sends this letter to inform you of the issue and provide alternative ways to pay. While this letter is not something to panic about, it's still time sensitive and requires your immediate attention to avoid accruing further penalties and interest.

What The Letter 4870 Entails

Letter 4870 will clearly state the reason your payment was rejected. Common reasons include:

- Insufficient funds: You didn't have enough money in your bank account to cover the payment.

- Incorrect account information: There was a typo in the bank account or routing number you provided.

- Closed account: The bank account you designated for the withdrawal is no longer active.

Your Next Steps

- Read the Notice Carefully: Take a moment to read the entire letter. The notice will specify the tax period and the payment amount that was rejected. It will also provide a list of payment options and will often include a contact number for the IRS e-file Payment Services if you need assistance resolving the issue.

- Verify Your Account Information: The first thing you should do is review the bank account information provided on your tax return. Look for any typos in the routing or account numbers. You may need to review the worksheets from your tax preparation software to see the full numbers you entered, as sometimes they are redacted on the final return. You may also need to contact your bank if the reason your payment was rejected is not apparent.

- Make a New Payment Immediately: Since the original payment was rejected, your tax liability for that period is still outstanding. While Letter 4870 is not a bill, the IRS will eventually send one if the balance remains unpaid, and it will include penalties and interest from the original due date. To stop these from accumulating, make a new payment as soon as possible. The letter will give you several payment options, including:

- IRS Direct Pay: A secure service that allows you to pay directly from your checking or savings account.

- EFTPS (Electronic Federal Tax Payment System): An online service for paying all types of federal taxes.

- Check or Money Order: You can mail a check or money order to the address provided on the notice.

- Debit or Credit Card: You can use a third-party processor to make a card payment.

- Dispute a Penalty (If Applicable): If you believe the rejection was an error on the part of your financial institution, you can try to dispute the dishonored check penalty. The IRS may remove the penalty if you can prove that you had sufficient funds and that the bank made an error. You would need to provide a written statement and supporting documents, such as a bank statement or a letter from your bank, to the address on the notice.

What if I have Audit Defense with TaxAudit?

If you have Audit Defense with TaxAudit, we can help you address this issue. Call us as soon as you receive the notice! While Letter 4870 isn't an audit, it is a notice from the IRS that requires a response to prevent further penalties. Our tax professionals can help you understand the notice, verify the correct payment information, and guide you through the process of making a new payment to the IRS. We're here to provide you with the assistance and peace of mind you need to resolve this issue quickly and correctly.