IRS Notice CP75 – Verifying the Earned Income Tax Credit (EITC)

June, 18 2025 by Veselina Arangelova, EA

I sometimes wonder how many people remember their favorite teachers. To this day, I stay connected with my elementary school teacher. She is someone I remember as having a unique way of encouraging participation in class and making learning fun. My math teachers are another story; I remember some fondly. However, they all shared one thing—always asking me to show my work.

Think of the IRS and the CP75 letter as a teacher asking you to show your work on a math problem. It is not because you are wrong, but because they want to ensure everything adds up!

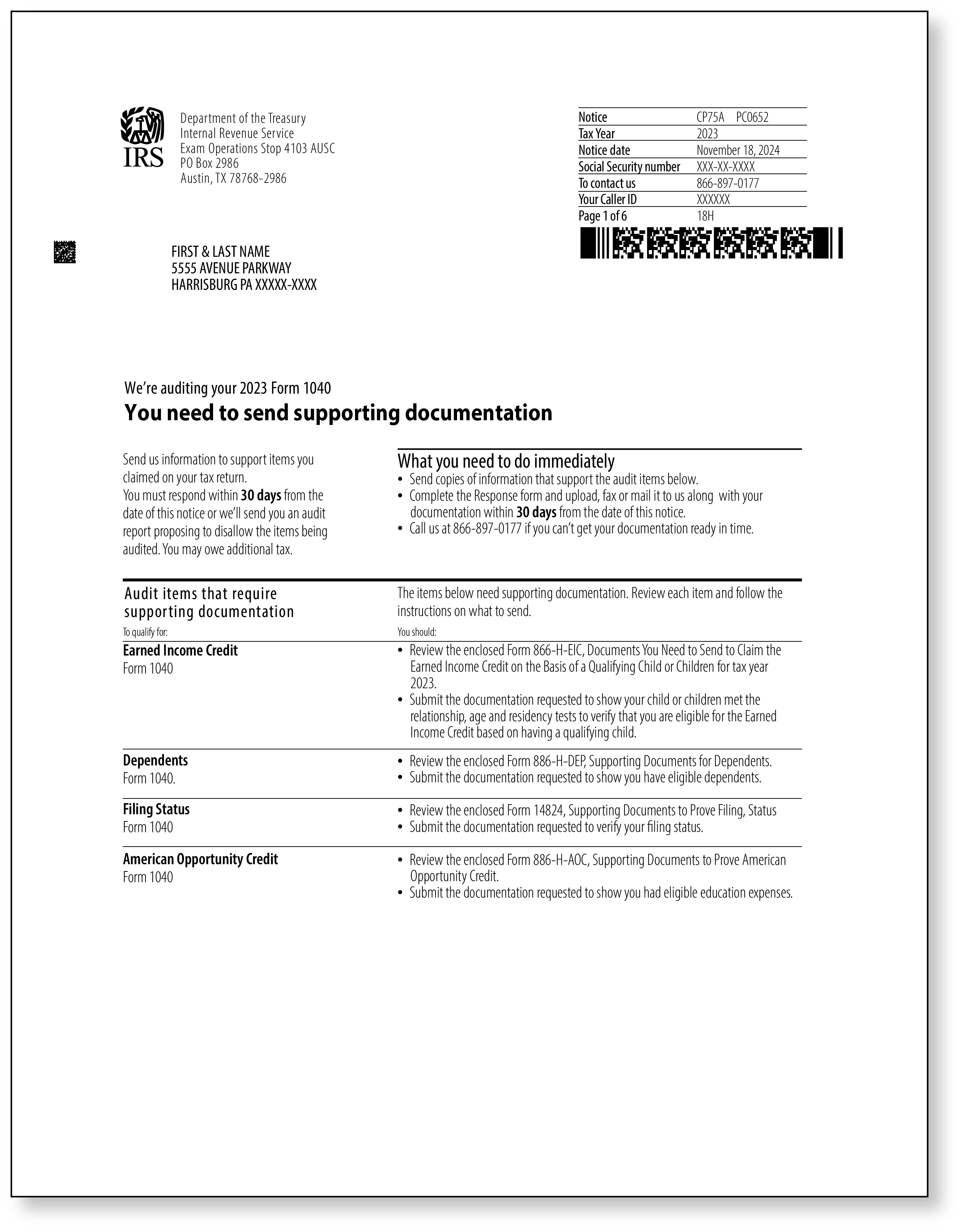

IRS Notice CP75 is common for returns having refundable credits, such as the Earned Income Tax Credit. Every year approximately 270,000 taxpayers receive it.

What does Notice CP75 seek to verify?

In the Earned Income Tax Credit context, a CP75 notice seeks to verify your eligibility for the credit before it gets paid as part of your refund. The IRS wants to ensure people do not accidentally – or on purpose – claim credits they do not qualify for, hence the CP75 letter.

Before we discuss the notice details, let us recall what the Earned Income Tax Credit, or EITC for short, is and why it is so important. The EITC is a refundable credit for taxpayers with low to moderate income and is calculated based on their earned income and household size. The EITC can be a significant boost to your year-end refund and, for that reason, the IRS wants to verify eligibility before paying it out.

What are the rules for claiming the Earned Income Tax Credit?

You can qualify for the EITC with dependent children on your return or without. Let us start with who can get the EITC even if they do not have qualifying children.

You can claim the EITC without a qualifying child if you meet the following rules. You (and your spouse, if filing jointly):

- Must meet the basic EITC qualifications

- Have a primary home in the United States for more than half the tax year

- You are not claimed as a qualifying child on anyone else’s tax return

- Be at least 25 years old but under age 65 (at least one spouse if filing jointly must meet this rule)

If you have qualifying children on your return, you:

- Must meet the basic EITC qualifications

- Your qualifying child must have a valid Social Security number

- Your qualifying child must meet all four tests for a qualifying child

- Not be claimed by someone else as a qualifying child

Now, that is a lot to remember. Luckily, we have discussed the subject of qualifying children in another blog where unique family circumstances may allow you to claim an adult child.

How to respond to Notice CP75?

If you get this notice, here is a step-by-step guide to handle it smoothly:

- Read the Notice Carefully: It is essential to read the notice immediately and recognize what the IRS asks you to do and within what timeframe. Generally, you have 30 days from the date of the notice to respond with all relevant documentation.

- Gather the Documents Requested: This is where you want to pay attention—the documents you provide are the most critical component of your response. Gathering all necessary information should, hopefully, be easy because they are what you used to complete your tax return. In almost every case, the necessary documents should support the income you claimed on the return, your relationship with your dependents, and prove that you cared for them.

- Do not send anything unrelated: If you are asked to prove your income for the year, the gold standard is to send a copy of your W-2 or last pay stub. Do not send information for prior tax years even if you have worked for the same employer and made the same amount. It is important to send only what you are asked to and only for the relevant tax year.

- Send timely: Sometimes, documents can be mailed, faxed, or uploaded directly to the IRS. The notice will have the exact instructions; you should follow them to the T. If you are asked to mail your response, do not send any originals – birth certificates, for example – as they will not be returned to you; make a copy of the original document and include it in your response. It is also good practice, if you choose to mail your response, to keep a copy of the receipt of the date you responded.

- Keep a copy: Keep a copy of what you send for your records. If you have to follow up with the IRS over the phone and must discuss your documents, you will have a reference.

- Be patient: This is hard but possible. The IRS can take several weeks, sometimes longer, to review and respond to your documentation, but rest assured they will. If you are due a refund, it will not be paid until the documents are reviewed and accepted.

Getting a letter from the IRS can be scary, but it is not the end of the world. Responding in a timely and careful manner will help resolve the issue faster. It can be overwhelming, and if you feel like you cannot do it alone, we are here, ready to step in and help with your audit needs.