Understanding IRS Notice CP15 | Notice of Penalty Charge

October 10, 2025 by Charla Suaste

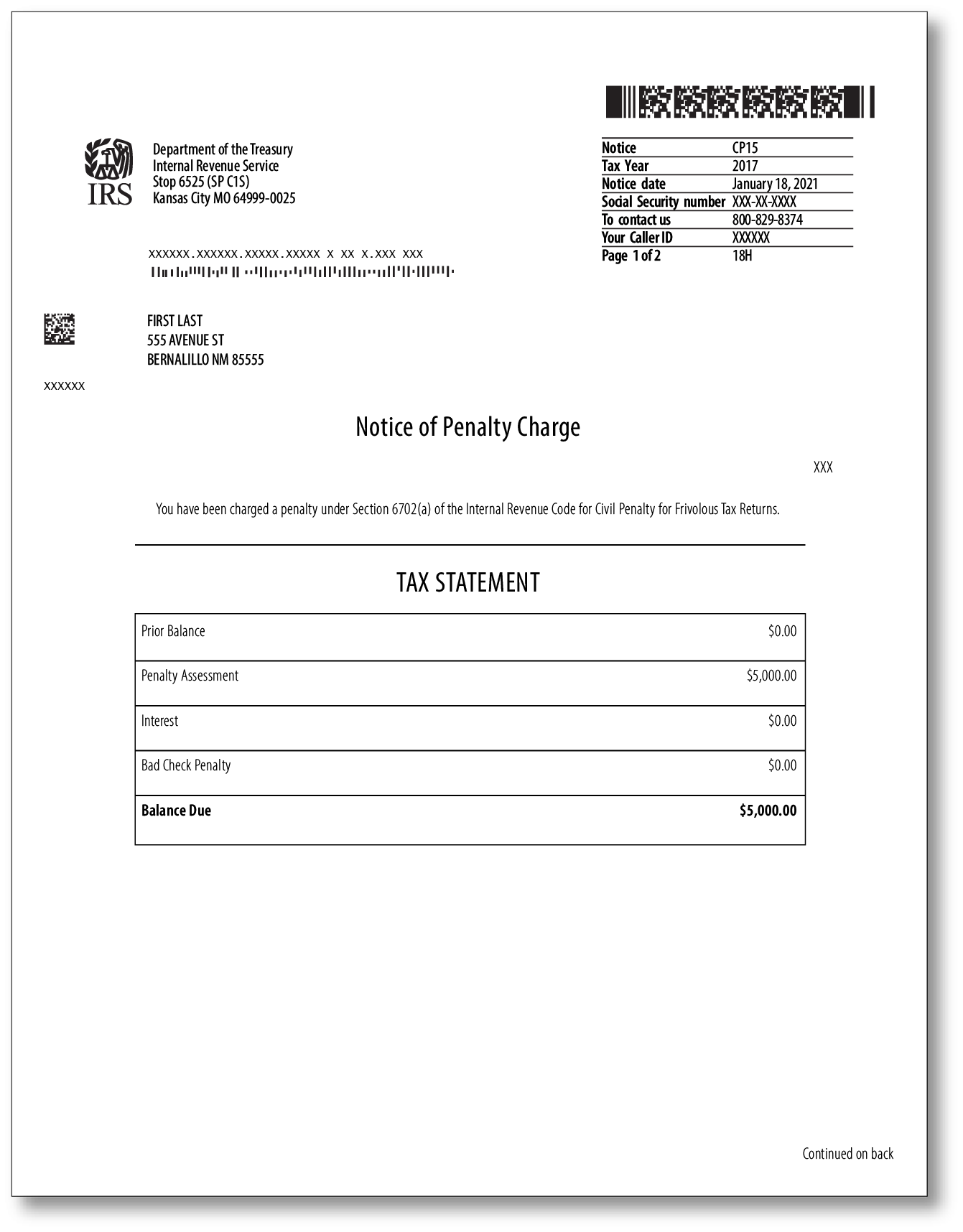

Receiving any letter from the IRS can be a source of immediate anxiety, but it doesn't have to be. Understanding what the notice is for is the first and most important step toward resolving the issue. If you've received an IRS CP15 notice, it's a formal communication from the IRS stating that a penalty has been assessed against you. Unlike an audit letter, which requests a detailed review of your entire return, a CP15 notice is very specific and can often be resolved with a clear, targeted response.

What Exactly Is a CP15 Notice?

A CP15 notice is a Notice of Penalty Charge. The IRS sends this letter to inform you that a civil penalty has been charged to your account. The notice itself will be very direct, providing:

- The type of penalty that was assessed.

- The specific amount due for the penalty, including any interest that has accrued.

- The tax year to which the penalty applies.

- A brief explanation of the reason for the penalty.

It’s crucial to understand that this letter is not merely a suggestion; it's a demand for payment. The IRS uses the CP15 notice for a variety of civil penalties, but some of the most common reasons include:

- Failure to file an information return, such as Form 3520 (for transactions with foreign trusts and receipt of certain foreign gifts), or other international reporting forms. These penalties can be substantial.

- A "frivolous return" penalty. This is a serious classification where the IRS believes a tax return was filed based on a frivolous position or a desire to impede the collection of taxes. This is a rare but very serious reason for receiving this notice.

- Trust Fund Recovery Penalty (TFRP). This applies to business owners or officers who fail to collect or pay over employment or excise taxes. This is often communicated through a CP15B, a variation of the CP15 notice.

- Penalties for other compliance issues, such as a substantial understatement of tax due to an unrealistic position.

The language in this notice can feel cold and unyielding, but don't let that deter you. The letter also contains information about your rights and how to dispute the penalty if you disagree.

Your Action Plan: What to Do Next

A prompt and strategic response to a CP15 notice is essential. Ignoring the notice will not make it go away; in fact, it will only result in further interest charges and more aggressive collection actions by the IRS.

Step 1: Read and Understand the Notice

First, read every detail of the notice. Find the notice number at the top right, the due date, and the reason for the penalty. It's important to match the information in the letter with your own records to identify the specific issue the IRS has flagged.

Step 2: Pay or Dispute the Penalty

Once you understand the reason for the penalty, you have to make a choice: pay it or dispute it.

- If You Agree with the Penalty: The most straightforward option is to pay the amount in full by the due date. The notice will provide payment instructions. Even if you agree with the penalty, you may still be able to request an abatement if you have a valid reason, such as the First-Time Penalty Abatement for taxpayers with a clean compliance history. You may also qualify for a reasonable cause abatement, which we will discuss below.

- If You Disagree with the Penalty: If you believe the penalty was assessed in error, you must take action to dispute it. The process can be complex. In many cases, to formally challenge a penalty like the one on a CP15, you may be required to first pay the penalty and then file a claim for a refund using Form 843, Claim for Refund and Request for Abatement. The notice itself will outline the specific requirements for your situation. It's critical to gather all supporting documentation that proves the IRS's assessment is incorrect. This could include copies of your original returns, proof of timely filing, or other records that show you were compliant.

Step 3: Request a Penalty Abatement

The IRS may be willing to reduce or remove your penalty if you can demonstrate a reasonable cause for your non-compliance. This is a formal process that requires you to prove that you exercised ordinary business care and prudence but were still unable to comply.

Acceptable reasons for reasonable cause can include:

- An unforeseen illness or death in your immediate family.

- A natural disaster or other civil disturbance.

- The inability to obtain necessary records.

- Reliance on a qualified tax professional's advice, if you provided them with all the correct information.

To request an abatement, you must submit a written statement explaining your situation to the IRS, supported by documentation such as a doctor’s letter, police report, or other official records.

Penalty Relief with TaxAudit

Navigating a penalty notice like the CP15 can be confusing and frustrating, especially given the high-stakes nature of some of the penalties it addresses, such as those for international filings.

TaxAudit offers help for penatly abatements and disputes. Get started with a free consultation. During your consultation, a licensed tax professional will answer your initial questions and determine if we can help based on your financial situation.

With our expertise on your side, you can be confident that your case is being handled correctly and efficiently, allowing you to get back to your life with peace of mind.