Understanding IRS Notice CP215 | Notice of Penalty Charge

October 03, 2025 by Charla Suaste

Receiving a notice from the IRS can be a stressful experience. The official-looking envelope, the government letterhead, and the formal language are enough to make anyone nervous. But before you start to worry, it’s important to understand what the letter is and what you need to do next. If you’ve received an IRS CP215 Notice, you're not alone, and with the right steps, you can resolve the issue.

What is an IRS CP215 Notice?

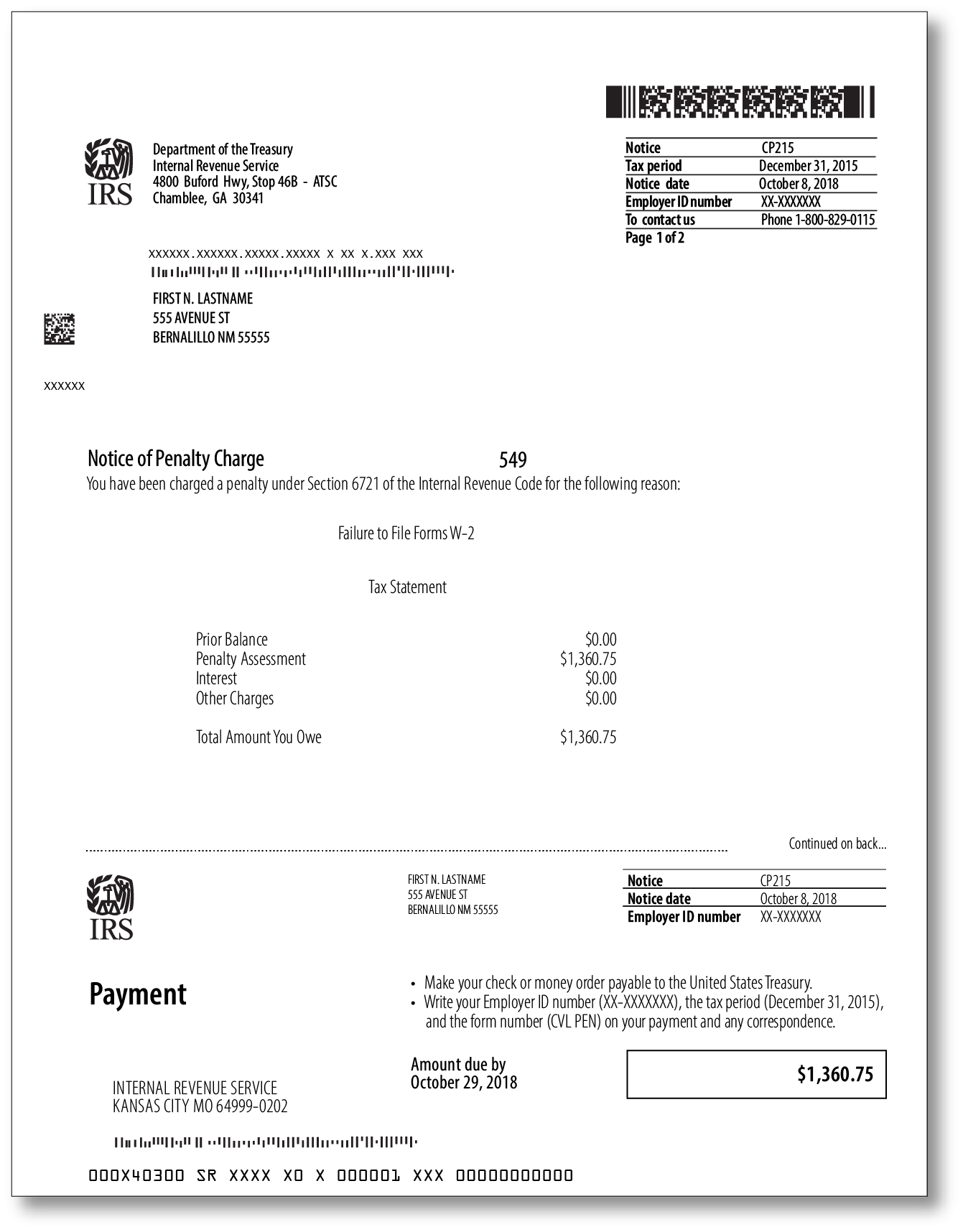

An IRS CP215 notice is a Notice of Penalty Charge. This letter is sent by the IRS to inform you that a civil penalty has been assessed against your business or, in some cases, your individual tax account. It’s not an audit notice, but it is a formal communication from the IRS indicating that they've found a compliance issue with your tax filings.

The notice will clearly state:

- The specific penalty that has been assessed.

- The amount due, including any accrued interest.

- The tax year the penalty applies to.

- A brief explanation of why the penalty was charged.

A CP215 notice is usually triggered by one of the following issues:

- Failure to file a required return. This is a common reason for a CP215, especially for business returns or information returns like Form 1099, Form 1095-C (for the Affordable Care Act), or Form 941 (Employer’s Quarterly Federal Tax Return).

- Late filing or late payment. Even if you filed the return, failing to do so by the deadline can lead to a penalty. Similarly, if a required payment was made late, the notice may be for that specific penalty.

- Underreporting income. Discrepancies between what you reported and what the IRS has on file from third parties (such as banks or employers) can lead to a penalty.

- Filing a return incorrectly. The IRS may assess a penalty if you failed to file in the proper format, such as not using electronic filing when it was required.

The key takeaway is that the IRS believes you owe a penalty for a specific reason, and the CP215 notice is their way of notifying you and demanding payment.

Your Next Steps

Receiving a CP215 notice can be intimidating, but a thoughtful and prompt response is the best way to handle it. Here’s what you should do:

Step 1: Read the Notice Carefully

First, do not ignore the notice. The due date for your response is crucial, and ignoring the letter will only lead to more penalties and interest. Read the notice in its entirety to understand the specific penalty and the tax year it applies to. Compare this information with your own records to see if you can identify the discrepancy.

Step 2: Determine if You Agree or Disagree

Once you understand the reason for the penalty, you need to decide whether you agree with the IRS or not.

- If You Agree:

- The simplest solution is to pay the penalty in full by the due date. The notice will provide instructions on how to pay.

- Alternatively, you may be eligible to request a penalty abatement, even if you agree with the penalty. The IRS may grant penalty relief under certain circumstances, such as the First-Time Penalty Abatement, or if you can demonstrate a reasonable cause for the non-compliance.

- If You Disagree:

- Gather your supporting documents. Collect copies of the original tax return in question, proof of timely filing, proof of payment, or any other relevant records that support your position.

- File the missing returns. If the notice is for failure to file a return, the most important step is to file that return immediately.

- Write a formal response. Draft a clear and concise letter explaining why you believe the penalty is incorrect. Be sure to reference the notice number and the tax year in question. Include copies of all your supporting documents with your letter and mail it to the address provided on the notice.

Step 3: Request a Penalty Abatement

Even if the penalty is valid, you may still be able to get it reduced or removed. The IRS may grant penalty relief for reasonable cause, which includes events beyond your control, like:

- A natural disaster or other civil disturbance.

- A serious illness, injury, or death in your immediate family.

- Unavoidable absence.

- The inability to obtain necessary records.

If you believe you have a reasonable cause, you should draft a letter to the IRS explaining the situation and include supporting documents like a doctor’s note or police report. You may also be eligible for the First-Time Penalty Abatement if you have a clean compliance history and no penalties in the three preceding tax years.

How TaxAudit Can Help

Dealing with IRS notices and penalties can be complex and stressful. If you have Audit Defense with TaxAudit, you don't have to face this alone. Call us as soon as possible after receiving your IRS CP215 Notice. Our experienced tax professionals will:

- Review your notice and explain exactly what it means for your specific situation.

- Help you understand your options, whether it's paying the penalty, disputing it, or requesting an abatement.

- Assist you in gathering the necessary documentation.

- Communicate directly with the IRS on your behalf.

- Guide you through the entire process, from preparing your response to representing you if an appeal is necessary.

Don't let an IRS penalty notice overwhelm you. With TaxAudit by your side, you can confidently navigate this challenge and work towards a resolution. Click here to contact us today!