What is the Head of Household Filing Status?

June 26, 2025 by Veselina Arangelova, EA

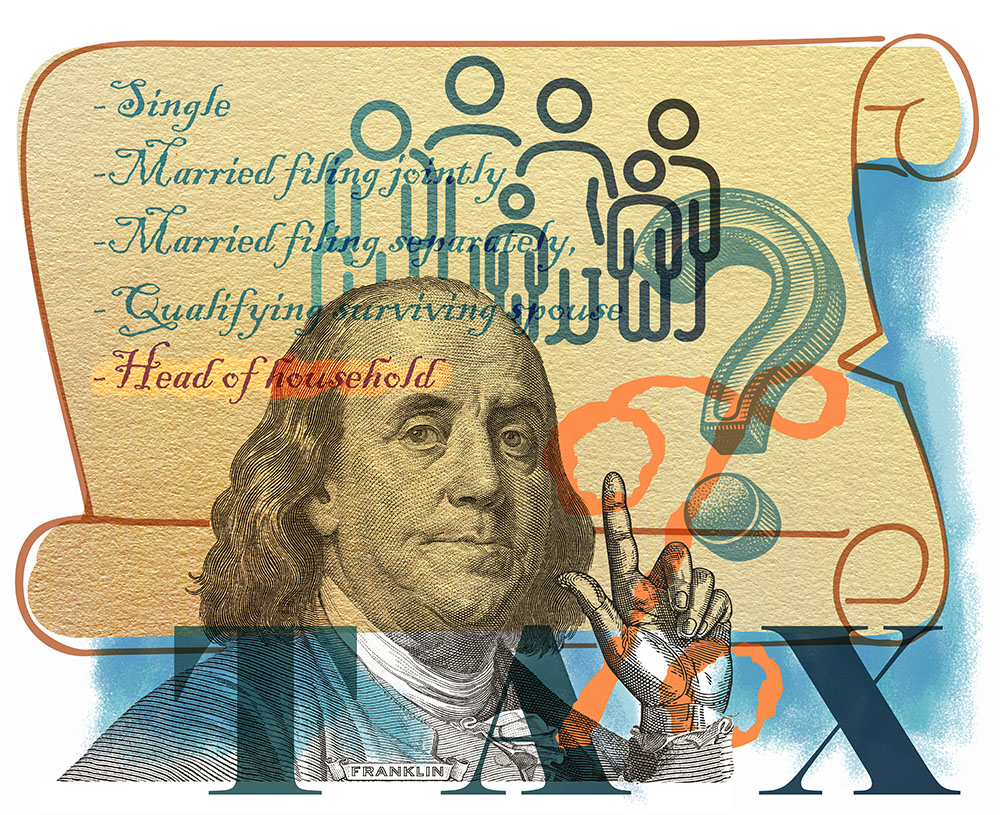

There are two things certain in life – death and taxes. This phrase commonly references a statement written in a letter to Jean-Baptiste Le Roy by the great American polymath Benjamin Franklin. It is arguably one of the most repeated phrases by people. Whether you agree or not, one thing is truly certain – your filing status changes as you go on your lifelong journey of filing tax returns every year.

As a taxpayer, you may wonder what prompts a change in filing status and why it is important to report it correctly. Dearest reader, I am writing this blog to answer just that question and then some – so, let’s get started.

What is a filing status?

A filing status is an important identifier that defines a taxpayer's personal situation and determines their filing requirement, tax bracket, standard deduction amount, eligibility for certain credits, and, most importantly, the correct amount of tax.

The IRS recognizes five filing statuses:

- Single,

- Married filing jointly,

- Married filing separately,

- Qualifying surviving spouse (also referred to as widowed) and

- Head of household.

As a single taxpayer, you are responsible for reporting only your income and deductions to arrive at the correct amount of tax for the year. As a married person who lives with their spouse, you are responsible for reporting all income to arrive at the correct amount of tax.

If you previously filed alongside another taxpayer, but no longer do so, you will likely use either the married filing separately status or the qualifying surviving spouse status.

A married filing separately status is used when married individuals choose to file separately from one another. Each spouse will report their income and deductions to arrive at the correct amount of tax. While there are a few advantages to using this tax filing status, there are even more disadvantages. Since this isn’t the topic of our current blog, we will not go into additional detail. However, it is important to remember that if you are considering using the married filing separately status, certain credits may be lost and income thresholds lowered for other tax deductions. You can review Pub. 501, Dependents, Standard Deduction, and Filing Information for more guidance.

The qualifying surviving spouse, often referred to as widowed status, is one that applies to married individuals who have lost their spouse. It can only be used in the two years immediately following the year of the spouse’s death before it no longer applies to the surviving spouse. A married filing joint return can be filed in the year of the death. This status also comes with its own rules and regulations, so make sure to check out Publication 501 for additional information.

What is the Head of Household Status?

As the name suggests, this status applies to taxpayers who are responsible for the care of another who is their dependent. To determine if you qualify to use a head of household status, first, you must review the requirements for the following three tests: the marriage test, the qualifying person test, and the cost of keeping up a home test. To use the head of household filing status, you must meet all three tests first, or you cannot use this filing status. Let us review each one of these in detail.

As the name suggests, this status applies to taxpayers who are responsible for the care of another who is their dependent. To determine if you qualify to use a head of household status, first, you must review the requirements for the following three tests: the marriage test, the qualifying person test, and the cost of keeping up a home test. To use the head of household filing status, you must meet all three tests first, or you cannot use this filing status. Let us review each one of these in detail.

The marriage test aims to determine your legal marital status. As a head of household, you are either single, divorced, legally separated, or married but your spouse did not live with you during the last six months of the tax year. If you are married and your spouse lived with you at any time during the last six months of the year, then the most appropriate status will be married filing jointly or married filing separately, but you will not qualify as a head of household.

The qualifying person test determines three things: the relationship between the person and you, if they lived with you, and if you can claim them as a dependent. The dependent may be:

- A child – biological, adopted, or foster child

- A sibling – brother or sister, including half-siblings and stepsiblings

- A grandchild, niece, or nephew

- A parent (special rules may apply)

This isn’t an exhaustive list, so if your relationship with a child is not on it, please see Pub. 501, Dependents, Standard Deduction and Filing Information for further instructions.

Simply being related to a dependent is not sufficient. As we mentioned, you must be able to claim a dependency exemption for the child or parent, and they generally must have lived in your home for more than half of the tax year (parents have specific rules that may not require them to have lived with you. Consult Pub.501 for details on this topic. For your qualifying children, it is important to note that temporary absences from home, such as time spent at school, will count as time they lived at home.

Finally, if you pass both the marriage test and the qualifying person test, then you must pass the cost of keeping up a home test. To pass this test, you must have paid more than half of the costs of keeping up your home where you live with the qualifying person. In an audit, you will need to support that test by providing rent receipts, utility bills, grocery receipts, property tax statements, or a mortgage interest statement. Again, this isn’t an exhaustive list but rather a general guide.

If you pass all three tests, then you are the head of household and you can use that filing status when preparing your tax returns, as long as you qualify for it. In a year when you do not pass all three tests, your filing status will be different, based on your circumstances at that time. When it occurs, you will need to reevaluate your correct filing status.

Why is head of household status so important?

As I mentioned before, the proper filing status impacts more than one area of your tax return. To demonstrate how important it is to get it right, I'll compare two filing statuses. I’ll use the single and head of household statuses using the standard deduction for tax year 2024.

Ben is single, he has never been married, and he lives on his own. However, in March of 2024, Ben’s niece, Jenny, moved in with him, and now he is her guardian. Jenny cannot be claimed by anyone else as a dependent. Until now, Ben has always filed his taxes as single. He earns $70,000 from his job, and when he files, he uses the standard deduction for a single person. Ben is wondering, now that he is responsible for Jenny, does it matter if he files as single or head of household?

Assume that the gentleman in our example compared the results of the two filing statuses, indicating he had earned the same amount of money in 2024 on both returns. As a single individual who earns $70,000 and takes the standard deduction of $14,600, he will have a taxable income of ($70,000 -$14,600) = $55,400. If no other deductions and credits apply, the total tax due on the return will be $7,600.

Now consider the same income of $70,000, but the standard deduction is $21,900, which is the exact amount that applies to someone who qualifies as head of household. Then, the taxable income is ($70,000 - $21,900) = $48,100. If no other deductions and credits apply, the total tax due on the return will be $5,438.

I won’t bore you further with additional math calculations, but that is an impressive 28% reduction in tax by simply reporting the correct filing status on the return.

As you know, most tax returns are never as simple as this example I’ve given because there is more to our lives than just going to work and reporting one income. Every year, your tax return is a reflection of what is going on in your life – who do you care for, if you have more than one job, whether you have investments or passive income, and if you go to school. The list goes on and on. My hope is, however, that this simple example demonstrates the power of proper reporting.

Returns are complex, and that may make you feel uneasy, but there is true joy in knowing you are paying the least amount of tax, and it is also the most accurate. The IRS keeps a directory of licensed professionals you can use to find a local expert for your tax preparation needs. But if you need some extra assurance that someone will be in your corner if you get your tax return questioned, check our membership page and learn more about our prepaid audit defense service.