Mortgage Insurance Premiums Deduction | What You Should Know

January 20, 2026 by Neal D. Volker

Homeowners have a familiar deduction returning beginning with tax year 2026. The mortgage insurance premium deduction has been reinstated with the One Big Beautiful Bill Act (OBBBA), effective for tax year 2026 for mortgage insurance contracts issued after 2006. The deduction is available to homeowners who itemize their tax deductions on their 2026 tax returns. These returns are filed by the due date in 2027. The mortgage insurance premium deduction was available starting with tax year 2007 but expired at the end of tax year 2021. The deduction isn’t available for tax years 2022 through 2025 but is coming back for 2026.

What is mortgage insurance?

Home purchasers who offer a down payment of 20% or less of a home's purchase price are typically asked by the lender to get mortgage insurance. This insurance protects the lender in the event the borrower defaults on the mortgage payments. The insurance premium amount can be paid as part of the purchase closing, as a monthly installment, or both. The monthly amount would typically be included in the monthly payment, which also covers principal and interest for the loan, taxes, and insurance. Mortgage insurance can be known by several names and abbreviations, depending on who provides it. Below are some common names and the entities that provide the insurance. They will be found in closing documents or monthly statements.

- Conventional lender - Private Mortgage Insurance (PMI)

- Federal Housing Administration (FHA - Mortgage Insurance Premiums (MIP)

- U.S. Department of Veterans Affairs (VA) – mortgage funding fees

- U.S. Department of Agriculture (USDA) - guarantee fees

Mortgage Insurance vs Mortgage Protection Insurance

You may have heard the phrase 'mortgage protection insurance,' which is different from mortgage insurance. Mortgage insurance specifically protects the lender, whereas mortgage protection insurance protects the borrower. It's easy to confuse the two because they sound similar. The lender will tell the borrower if mortgage insurance is required. It will be a condition imposed by the lender in order to get the loan, so it will not be an option the borrower chooses. Mortgage protection insurance (sometimes referred to as mortgage life insurance) is an optional life or disability policy that pays off the mortgage in the event of a specific occurrence, such as death or disability. A borrower chooses to obtain mortgage protection insurance, so it is not a requirement from the lender to obtain funding for the loan. Mortgage protection insurance is not a tax-deductible expense.

Here’s a quick side-by-side comparison between mortgage insurance and mortgage protection insurance.

| Mortgage Insurance | Mortgage Protection Insurance |

| Protects the lender | Protects the borrower |

| Required by the lender | Chosen by the borrower |

| Premiums can be tax-deductible | Premiums are not tax-deductible |

Which properties qualify for the mortgage insurance deduction?

The mortgage insurance must be on debt incurred to acquire, build, or substantially improve your principal residence or a second home.

How will I know how much I paid in mortgage insurance premiums?

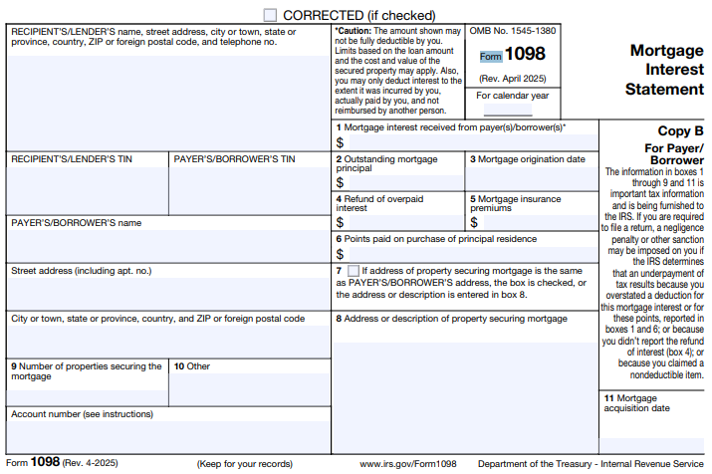

If you paid $600 or more in mortgage insurance premiums during the year, you should receive a Form 1098, Mortgage Interest Statement, at the end of the year from your lender, which will report how many mortgage insurance premiums you paid. You may already be familiar with Form 1098, as it also reports how much mortgage interest was paid. Sometimes, the mortgage insurance premium amount reported on Form 1098 doesn’t include the amount paid during the closing of the home purchase. It's always a good idea to verify how much you paid by checking your closing documents and monthly statements for the year and comparing them to what was reported on Form 1098. Report the total amount you actually paid in mortgage insurance premiums on your tax return. Remember, you may have to add the amount reported on your closing statement to the amount reported on Form 1098.

Below is an example of Form 1098 (Rev. April 2025). Please note that the Form 1098 available for tax year 2026 may differ from this example. Notice in this example that Box 5 is where the amount of mortgage insurance premiums paid is listed.

Where do I enter the deduction on Form 1040, U.S. Individual Income Tax Return?

The deduction is entered on Form 1040, Schedule A, Itemized Deductions, if you itemize deductions. If you don’t itemize, you won’t be able to take advantage of the mortgage insurance premium deduction. During the years the deduction was available, the line item was located in the section labeled ”Interest You Paid.” If you are using tax preparation software, you will likely be asked how much you paid in mortgage insurance premiums, and the software will automatically place the amount in the correct section on the tax return.

Is there a limit to the amount I can deduct?

Yes, there are two limits that can affect how much you may be able to deduct.

Income limit – The deduction begins to phase out for married couples with a modified adjusted gross income over $100,000 ($50,000 for those whose filing status is married filing separately). Modified adjusted gross income, or MAGI, is your income after certain adjustments. The deduction is reduced by 10% for every $1,000 ($500 for married filing separately) over $100,000 ($50,000 for married filing separately). The deduction is completely eliminated once the modified adjusted gross income is $109,000 or higher ($54,500 for married filing separately).

Here is an example of how the income limit reduces the mortgage insurance premium deduction for a married couple with $104,000 of modified adjusted gross income:

- Assume total mortgage insurance premiums paid for the year are $1,500.

- Their income is $4,000 over the $100,000 threshold, so their deduction is reduced by 40%.

- $1,500 x 40% = $600, which will be the amount to subtract from the total premiums paid.

- $1,500 - $600 = $900, which will be the amount of the deduction allowed based on the income limit.

If you are using tax software to prepare your tax return, it will take care of this calculation for you.

Mortgage debt limit – Mortgage insurance premiums will be considered deductible mortgage interest, subject to the debt cap that also limits the deductibility of mortgage interest. The details for the mortgage limit calculation and the rules that apply for mortgage interest limitation are beyond the scope of this article, but can be found in IRS Publication 936. If you have any questions about whether the mortgage debt limit applies to your situation, it’s best to consult a tax professional who can review your specific circumstances and advise you on how the debt limit may affect your tax return.

Is the mortgage insurance premium deductible for business or rental property?

The change made by the OBBBA reinstates the mortgage insurance premium deduction for homeowners on their principal residence or a second home that expired in 2021. The deduction for mortgage insurance premiums on rental, investment, or business property had no expiration date and continues to be deductible. If the expense is ordinary and necessary, then it is deductible on the appropriate form for the rental or business activity.

The return of the mortgage insurance premium deduction for tax year 2026 is a welcome benefit for homeowners who are paying for mortgage insurance and itemizing on their tax return. Remember that limits on how much income you have and how much debt is outstanding do affect the final amount that can be deducted. If you have any questions about the mortgage insurance premium deduction and how it applies to your specific tax situation, you should reach out to a tax professional for assistance.