Why Was My Tax Return Rejected for Efiling?

February 13, 2026 by Jean Lee Scherkey, EA

Federal return rejected due to “REJOOI.” What is this rejection?

-John, Pennsylvania

Dear John,

Thank you for contacting TaxAudit with your question. In your message, you said that your return was rejected for efiling, showing a rejection code of “REJOOI,” and you are wondering what this rejection code means.

What does IRS efile rejection code “REJOOI” mean?

While the IRS publishes a bounty of guidance in the form of publications and webpages on its website, it unfortunately does not issue an annual publication on efile rejection codes, what they mean, and how to correct the error. The good news is that your tax software provider should provide not only the efile rejection code(s) but also a brief explanation of what they mean and how to correct the issue when a return is rejected for efiling. However, even when an explanation is provided, it can seem as if it were written in Wingdings rather than English. While I could not find any definitive information from the IRS to confirm what the efile rejection code “REJOOI” means, I have a possible theory.

Your return may have been rejected due to a timing issue.

You included that the state you file your taxes in is Pennsylvania. Form PA-40, Pennsylvania Income Tax Return, is closely linked to the Federal Form 1040, Individual Income Tax Return. Several amounts listed on IRS Form 1040 are reported on Form PA-40 and ultimately used to calculate a taxpayer’s individual Pennsylvania state income tax. Because of this connection, the Commonwealth of Pennsylvania requires federal return data to be efiled along with the Pennsylvania state return.

When the state return is linked to the taxpayer’s federal return, the federal return needs to be accepted first. If the federal return is not accepted first, an efile error code of “REJOOI” or “REJ001” can occur. You wrote that you believe your federal return was rejected. However, is it possible that your state return was rejected because your federal return was not accepted yet? If this is your situation, then you can try to efile your federal return first, and once it has been accepted, efile your state return.

It is worth noting that major 2025 tax changes have delayed the finalization of various federal and state income tax forms. It is possible that your federal or state income tax returns include a form that was not finalized when you efiled. Also, keep in mind that there have been changes to popular tax credits, such as the Child Tax Credit, American Opportunity Tax Credit, and Lifetime Learning Credit. For instance, to claim the Child Tax Credit, the child must have a valid Social Security number. Having an individual tax identification number (ITIN) for the child will not be sufficient. Additionally, either the taxpayer or their spouse (if filing married filing jointly) must have a valid Social Security number.

Since we don’t have any of the other information you might have received, we can only guess why you received this efile rejection code. If it does not seem like your return was rejected because the federal return was not accepted first, then we recommend contacting your tax software provider by phone or chat.

Information that tax software providers should provide when a return is rejected for efiling.

Usually, when a taxpayer’s return is rejected for efiling, the tax software they are using to transmit the return, such as TurboTax, should provide the following:

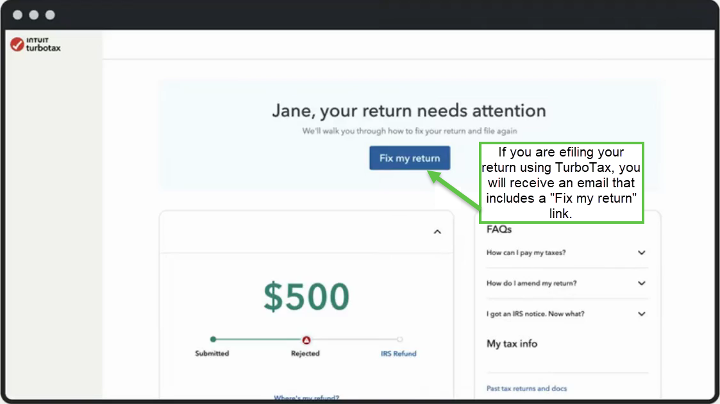

- An efile transmission report. You may receive the notification by email or via a notification pop-up within the software. For instance, TurboTax will send the taxpayer an “Action Needed” email. The email will notify the taxpayer that the return was rejected for efiling and includes a “Fix my return” link. Here is a snapshot of what an efile rejection notification email from TurboTax may look like.1

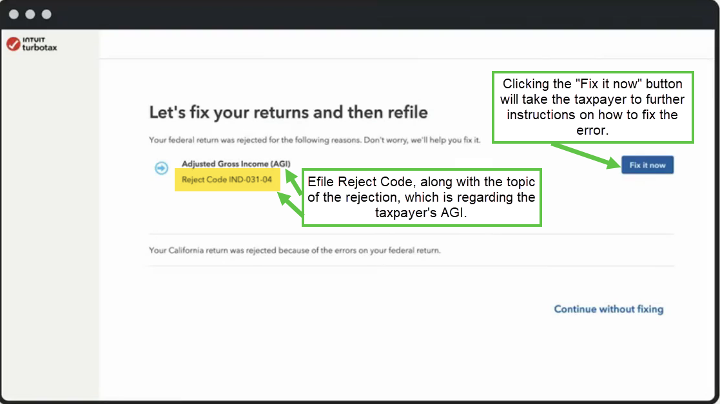

- Efile rejection code(s). Your tax preparation software provider should provide you with the efile rejection code(s). If you are using TurboTax, you will see which efile rejection codes apply to your tax return once you click on the “Fix my return” link and sign into your account. If you are using TurboTax, the snapshot below shows what you will see when you sign in to your account to review why your return was rejected for efiling.

- Explanation of the rejection code and instructions on how to fix it. Efile transmitters, such as TurboTax, will provide a brief explanation of each rejection code and instructions on how to correct the return so it qualifies for efiling. Keep in mind that some returns cannot be efiled. For example, if a return was previously filed that included you, your spouse’s, or one of your dependents’ Social Security numbers, you may not be able to efile your return.

Preparing and submitting your return through IRS Free Fillable Forms.

Taxpayers with any income level can prepare and efile their federal income tax return through the IRS Free File Fillable Forms. Unlike many tax preparation software programs that offer guided assistance when entering your tax information, taxpayers using IRS Free File Fillable Forms should at least have a basic understanding of the tax rules and be comfortable reading and following IRS form instructions. Those who use IRS Free File Fillable Forms to prepare and efile their federal return have a webpage where they can send inquiries to the IRS if their return is rejected for efiling.

The most common reasons why individual income tax returns are rejected.

Given the limited information we have about your return, pinpointing the reason why it was rejected is akin to finding a Cheddar Goldfish Cracker in a barrel of Cheez-Its. However, there are several common reasons why many individual income tax returns are rejected for efiling. These reasons include:

- Incorrect taxpayer, spouse, or dependent Social Security number or name: It is easy to overlook the spelling of your, your spouse's, or your dependents' names. Maybe your spouse goes by the name of “Judy,” and you enter it on your return, but the name on her Social Security card reads “Mary Judith.” The mismatch between the name on your spouse’s Social Security card and what is input on the return can cause an efiled return to be rejected. All it takes is to transcribe one number, and a relatively straightforward return can turn into a filing nightmare.

- The Social Security number listed on the return was already used on another submitted tax return. It is common for teens and young adults still in high school or college who work part-time to file their own income tax returns. When they do, they often claim their own exemption even though they are still considered dependent. Often, parents can be in for a surprise when they efile their tax return, only to have it rejected because their child has already filed and did not indicate they are considered a dependent.

- Employer Identification Number (EIN) does not match the name of the business, university, or other institution. Ensure that all employer identification numbers are entered correctly. Spending an extra minute or two confirming your data input can save you hours of hassle down the road.

- There is an electronic signature mismatch. When a taxpayer self-prepares and electronically files their return, the return is “signed” by entering a personal identification number (PIN) and including their original prior-year adjusted gross income (AGI) amount. If the wrong AGI is entered, the efiled return will be rejected. It is important to include the AGI from your originally filed prior year return. Even if you amended your prior-year return, you would still enter the AGI from your originally filed return. For those filing their first income tax return, they would enter their prior-year AGI as $0, provided they are over age 16. If you are 16 or under, then you cannot self-prepare and efile your own return. You can have your return efiled by a paid tax practitioner.

- ITIN Expiration. If you use an Individual Taxpayer Identification Number, ensure that it has not expired. If you haven’t needed to file a return or were not included on another return as a spouse or dependent at least once in the last three years, it may have expired. Additionally, if your ITIN was assigned before 2013 and has never been renewed, it more than likely has expired. For more information, please review IRS Topic No. 857, Individual Taxpayer Identification Number (ITIN).

We hope this information proves fruitful and that you are able to successfully efile your 2025 tax return. Kudos for jumping right into the tax return filing season. You are the epitome of the saying “The early bird gets the worm.” While there is always a sense of relief when you know your tax return is completed and efiled, it is important to take those extra few minutes to ensure all your information, facts, and figures are correct.

Wishing you many happy returns,

Jean

[1] “What does my rejected return code mean and how do I fix it?” TurboTax, January 21, 2026, Accessed February 9, 2026, https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-return/fix-rejected-return/L5Kn9Ijk5_US_en_US