I sold my house but can’t find my original closing cost statement

April, 02 2020 by David E. Du Val, EA

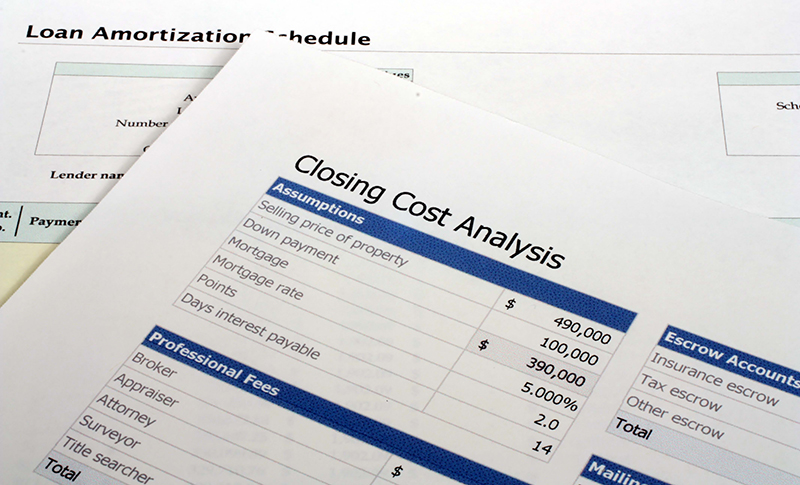

I bought the house in 1998. I just sold it in June, 2019. Long story made short, I cannot find my original closing cost statement dated November 1998. How do I find it? I also don't remember the original lender and I have refinanced twice. The info is needed for my tax returns 2019. Please stay safe and healthy. The most important aspect of living. My thoughts are with you.

Kathleen

Kathleen,

You are smart to try to obtain a copy of your closing statement of your home purchase in prior years. Many people try to guess the amount and use that for their taxes. If they are ever audited, this would not likely work out well for them.

In your case, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your settlement documents. Other parties that may have copies of the settlement documents include your real estate agent, the seller's real estate agent, the mortgage broker, the financial institution that holds/held the loan for the property, or the seller himself.

If you are unable to obtain the settlement papers from any of the parties listed above, you will need to reconstruct the transaction and estimate the amounts from whatever evidence you can gather. Examples of where you can obtain a number are from bank records, emails/correspondence, old property tax bills, or any other documentation involving the purchase or value of your home.

Thank you for your concerns. And, you too should stay safe.

Deductibly Yours,

Dave