IRS CP14 Notice | What it is About and How to Make a Payment

March 20, 2023 by Courtney Visser

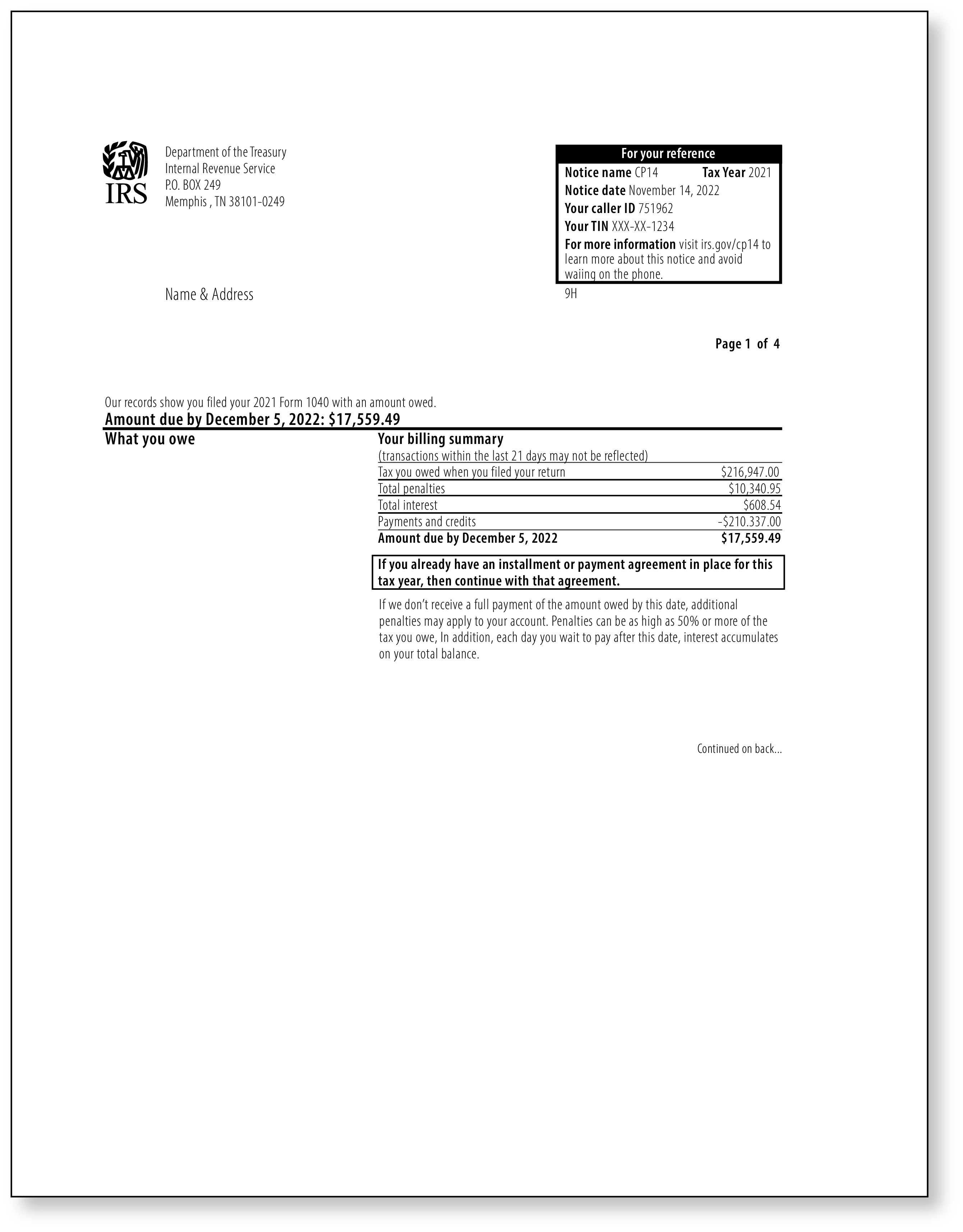

So, you’ve received an IRS CP14 notice in the mail, and you are left wondering what it all means, and more importantly, what to do next!

What it is

The IRS sends out a CP14 notice to notify a taxpayer when they have unpaid taxes and/or penalties and interest.

What should you do?

- First, read the notice carefully. It will explain how much you owe and how to pay it.

- If you agree with the information, be sure to pay the amount owed by the due date on the notice. You can do this online at IRS.gov/payments, or by mail using the information on the notice.

- Contact the IRS if you disagree with the notice, or if you believe there has been a mistake. The best way to contact them is by calling the phone number provided on your notice. Remember to collect any relevant paperwork like amended returns or cancelled checks before calling to help the process go smoothly.

It is also important to keep in mind that the IRS has been bombarded with a tremendous backlog of work over the past couple of years, amplified in part by the coronavirus pandemic. Delayed IRS responses have become a regular occurrence, so if you think you might have already paid the amount listed on your CP14 notice, you could be correct! You may want to double-check your bank statements to see if a payment has been deducted from your account, or create an IRS account online to see if your payment has been posted.

What if you owe, but are unable to pay the full amount immediately?

If you are unable to pay the amount in full, you can apply online for a payment plan. The IRS offers a few different repayment options. For more information on these, you can visit the payment plan page on the IRS website.

You may also submit an offer in compromise. The offer in compromise allows you to settle your tax debt for less than you owe. It may be an option if you are unable to pay the full amount, or if doing so creates a financial hardship. With an offer in compromise, the IRS will consider your unique situation and circumstances such as your ability to pay, income, expenses, and asset equity. If they accept the offer, you can pay with either a lump sum cash payment, or by using a payment plan.

However, if you have received a letter similar to this one – or any other notice from a taxing agency, TaxAudit can help! We believe that no one should have to deal with the stress and uncertainty of facing the IRS alone. As the largest tax representation provider in the country, our team of attorneys, CPAs, and enrolled agents handles more audits than any other firm. We offer Tax Debt Relief Assistance to those who owe the IRS or state government, and consultations at no cost to you. For more information about an Audit Defense membership, you can visit our website or call our Customer Service team at 800-922-8348.