IRS CP16 Letter | What to Know About the IRS CP16 Notice

December, 05 2023 by Charla Suaste

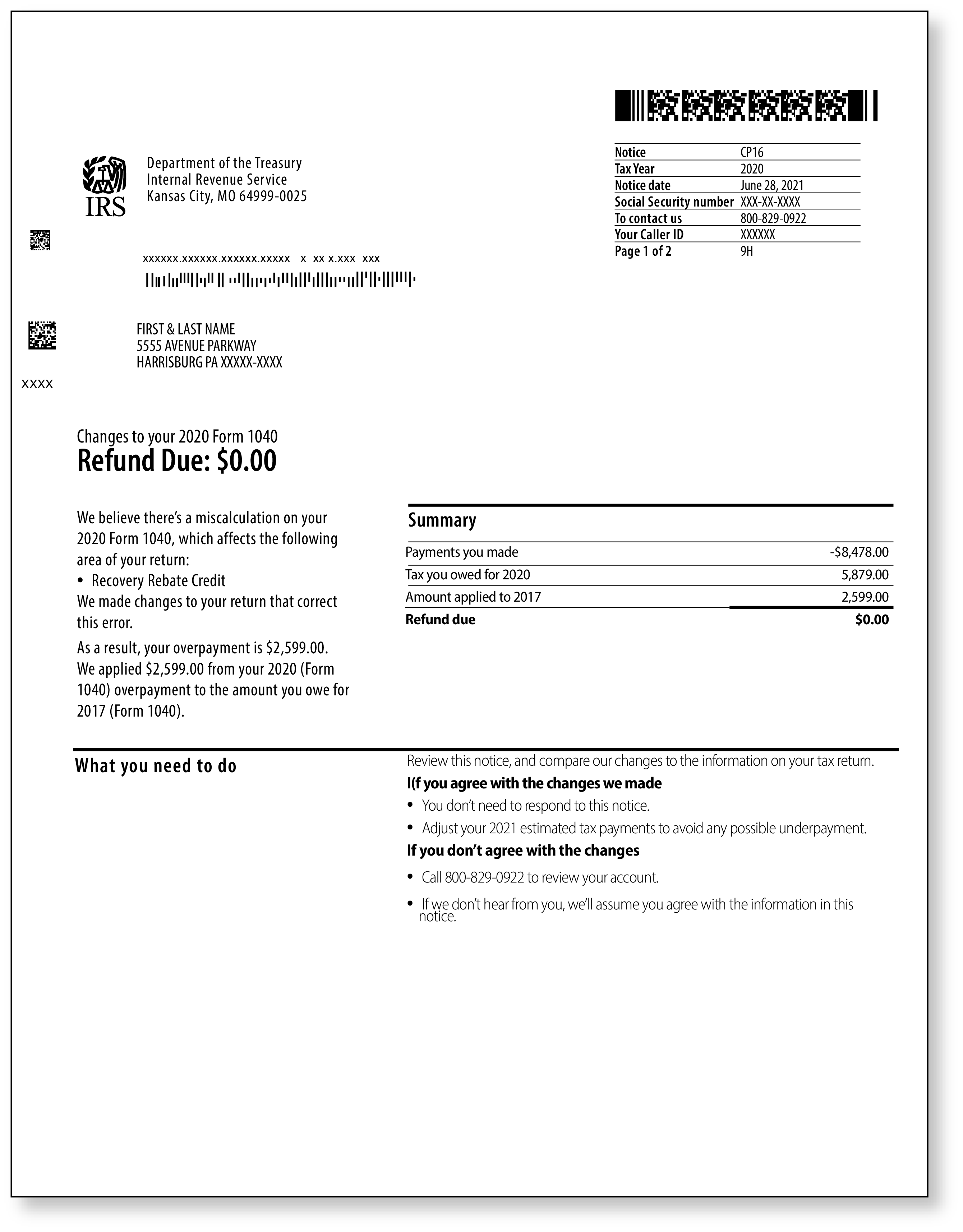

If you’re looking at this article, you’ve probably received an IRS CP16 notice - or something similar! Please see a sample of this notice below to confirm whether the notice you’ve received is the one discussed in this article.

Some important details to look for right away are:

- The notice type

- The tax year

- The notice date

This information can all be found in the top right-hand corner of the notice. If your notice says it’s a CP16, please read on, as we will discuss the steps you need to take in more detail.

First and foremost, you are probably wondering why you received this notice in the first place. An IRS CP16 typically informs you that the IRS believes a miscalculation or other error was made on your return, and they have adjusted your refund for the tax year in question or applied your potential refund to an amount they believe you owe for a previous tax year.

So, what should you do in response to this notice?

- Read the document from top to bottom.

- Every IRS notice contains important information specific to your tax return. The first and second pages will typically state which area(s) of your tax return they’ve adjusted and why these adjustments were made. They will also provide a breakdown of the changes by comparing the numbers on your tax return versus the changes they’ve made. These changes could be made to anything from income to withholding, from credits to payments – or all of the above – so make sure to read these numbers carefully.

- Pull out your tax documents, including your tax return and supporting documentation, to see if the numbers align with what the IRS states.

- If it seems that the IRS’ changes are correct, there is nothing you need to do at this time except to note the changes on your tax return for future reference.

- If you don’t agree with the notice, you must contact the IRS by the deadline listed on the notice. You can do this by calling the IRS or by mailing in the appropriate documentation to dispute the IRS’ claims.

Usually, taxpayers must submit their dispute within 60 from the date on the notice. If the IRS is contacted within 60 days, the IRS will reverse any changes made. However, be aware that if you do not have documentation or some other information that supports your claim, the IRS may forward your return for audit. If it turns out the IRS was correct in their initial assessment, you will still owe the tax and may incur interest and possibly a penalty.

It is important to timely respond to the notice if you believe it is in error. By not submitting a timely response, taxpayers lose their right to appeal the IRS’s determination. Once a taxpayer loses their right to appeal, their only other recourse is to pay the tax due and then file a claim for a refund within the statute period. The statute period (formally known as the Statute of Limitations period) is the time the IRS or taxpayer has to complete a certain action. These actions can include the IRS auditing a taxpayer’s tax return or a taxpayer amending their return to include information that was missing or inaccurate on their originally filed return. Normally, the amount of time you have to file a claim for refund is the later of 3 years from when you filed your return or within 2 years of the date of the last payment made for the tax year in question. Here’s an example.

Tony and Lola filed a joint return for 2018 on April 18, 2019. The return showed a balance due of $10,000. They paid the balance due when they filed the return. Tony and Lola have until April 18, 2022 (three years from the date they filed their original 2018 return), to amend their return and claim a refund if they determine later that they had missed some deductions or overstated their income.

But let’s assume they could not pay the balance due when the return was filed and instead made $50 monthly payments on an installment plan from May 2019 to January 2023. On February 14, 2023, they paid the remaining balance due, which was $8,500 (due to penalties and interest being added). Tony and Lola have until February 14, 2025, to file a claim for a refund if they determine later that they overpaid their 2018 taxes. The amount they could claim would depend on their total payments in the two years leading up to the date they filed the claim.

However, if you have Audit Defense with TaxAudit, the first step you should take is to contact us! Whether you believe the notice is correct or not, it is best to have one of our world-class professionals review your case to determine your best course of action. The process is easy and straightforward and is covered under your membership!

To get started, you must contact us to report that you’ve received a notice – either through our website or by contacting our Customer Service Team. Once they have opened a file for you, you can easily submit your documentation through our secure portal. When we have received a copy of your documents, your case will be assigned to one of our tax professionals, who will review your case and advise you on any next steps that may need to be taken. If the IRS notice turns out to be incorrect, they will work with the IRS on your behalf until the case is properly resolved. Our goal is to make sure you never have to face the IRS alone and ensure that you pay no more tax than you rightfully owe!

If you have not received a notice from the IRS yet but want the peace of mind of knowing that you have a tax professional on your side, make sure to purchase an Audit Defense membership prior to receiving any type of notice from the IRS or state – either by visiting our website or by contacting our Customer Service team at 800.922.8348. They are standing by and ready to help!