What to do when you get Audited by the IRS

October, 07 2021 by Samantha Lamb

The first thing to do when you get audited by the IRS is to not panic! It may seem scary or overwhelming at first but, with the right tools and resources, you will be able to work through it.

There are several ways an audit may be conducted: by correspondence, at an IRS office, or “in the field” at the taxpayer’s home or place of business.

A correspondence audit is where the taxpayer and the IRS conduct the audit by mail and maybe a phone call or two. Any documents required to prove your deductions would be sent to the IRS, and then an examiner would respond. Generally, an office or field audit is done when the IRS deems it necessary to meet with the taxpayer in person. Office or field audits can be very intense and intimidating, and a taxpayer (in most cases) should be represented by a tax professional with experience in those types of audits.

After you get over the shock of receiving an audit letter, you will want to read the letter carefully. There is typically a lot of information in these types of letters, and you’ll want to make sure you take the time to understand what year or years are being audited and what items on the return are being looked at. It is very rare that an audit will examine everything on your return. Typically, they only ask to review specific items. These items will be found in the cover letter or in an attached document request. In the cover letter will also be the information on how the IRS wants you to provide any documents that they have requested. As previously mentioned, many audits will take place via correspondence, and while that may sound preferable – correspondence audits can take several months. This is especially true now as the country is still dealing with the COVID-19 pandemic. Correspondence audits also require a high level of organization on your part. You will not be able to explain to the examiner where to find information in your documents, which requires you to make notes and highlight information that supports the information on your tax return.

After you get over the shock of receiving an audit letter, you will want to read the letter carefully. There is typically a lot of information in these types of letters, and you’ll want to make sure you take the time to understand what year or years are being audited and what items on the return are being looked at. It is very rare that an audit will examine everything on your return. Typically, they only ask to review specific items. These items will be found in the cover letter or in an attached document request. In the cover letter will also be the information on how the IRS wants you to provide any documents that they have requested. As previously mentioned, many audits will take place via correspondence, and while that may sound preferable – correspondence audits can take several months. This is especially true now as the country is still dealing with the COVID-19 pandemic. Correspondence audits also require a high level of organization on your part. You will not be able to explain to the examiner where to find information in your documents, which requires you to make notes and highlight information that supports the information on your tax return.

I’ve read the letter; what’s next?

Now it’s time to get organized. Did you self-prepare, or did you have someone prepare your taxes for you? If you are a self-preparer, you will need to find your copy of the return(s) being audited. If you used an online service or computer program, such as TurboTax, you should be able to access your return through that same program. If you had a tax professional prepare your taxes for you, you will want to reach out to them regarding the audit letter.

If you purchased Audit Defense for the year in question, now is the time to contact us here at TaxAudit. You can start your TaxAudit case by going to our website or by giving us a call. Our team will help you every step of the way.

After you decide if you are going to represent yourself or seek out professional assistance, you’ll want to start gathering the supporting documents for the audited items on the return. For example, suppose the audit is looking at your itemized deductions. In that case, you’ll want to get copies of things like your mortgage interest Form 1098, copies of Forms W-2 or 1099 to verify state income tax withholdings (if you made state estimated tax payments, you will want to get copies of bank statements that confirm the payments were made), verification of charitable contributions made, etc. Occasionally, the IRS may be reviewing just one itemized deduction, like medical expenses. If that is the case, you will only need to gather and organize documents related to that deduction.

So many documents – what do I do with them all?

Now that you’ve gathered your documents, it’s time to put them in order so that they make sense to the examiner. Medical expenses, charitable deductions, and items purchased for Schedule C businesses all have receipts. A good practice is to keep all receipts throughout the year but, as we all know, sometimes receipts get lost. In a lot of cases, you can get receipts reprinted - but it might take some time, so make sure you request them as soon as possible to allow them to get to you so you can respond to your audit letter in a timely fashion. If you are being audited on more than one issue, you will want to put the receipts together by type. For example, if your auditor is looking at both medical expenses and charitable contributions, you will want to separate the receipts into those two categories.

Bank statements and credit card statements are helpful but typically are not considered sufficient proof of tax deductions by themselves, so making sure that you have your receipts or invoice statements is very important. Copies of canceled checks for things like medical expenses and charitable contributions can also help prove your deductions on your return.

We’re organized! Where do we go from here?

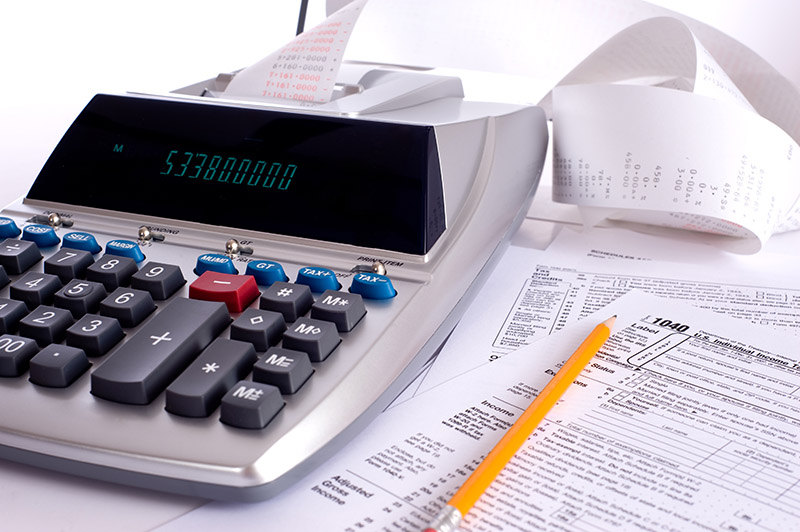

It’s time to add everything up! Add your receipts and compare the total with the amounts you claimed on your return. It might be a good idea to use an adding machine with tape to verify the numbers and attach the tape or a spreadsheet listing receipt details and amounts. This saves the examiner time and frustration.

Do the amounts match? If so, then you should be ready to assemble your response.

It looks like my numbers don’t match. What do I do?

If your numbers don’t match your tax return, it’s time to do some investigating. You may have missed receipts. If you know which receipts are missing, you can always contact the company or organization and request replacement copies. If the search comes up fruitless but you have the proof of payment from your bank or credit card records, you can still submit that to the auditor. There’s always a chance that the examiner may disallow a deduction if the substantiation is not complete. Even if you choose to respond to the IRS on your own, hopefully, you have a better understanding of what the IRS is reviewing and the information you will need to gather to respond to the IRS.

What if I don’t want to face the IRS alone?

We understand the stress of an IRS audit, and sometimes having professional assistance and representation on the items being audited is preferable to going through it by yourself. There are multiple options, such as finding a qualified CPA or Enrolled Agent (EA) in your area, to help represent you through your audit. It is recommended that you do some research before picking a tax professional.

Audits can be time-consuming and expensive. For tax returns that are still within the statute of limitations to be audited, you can check out our prepaid audit defense services. Our world-class, experienced tax professionals will be there for you every step of the way.