IRS CP14I Notice | Exceeded the Maximun Contribution to IRA

May 30, 2025 by Charla Suaste

In this blog, we’ll be discussing IRS Notice CP14I: what it is, why you received it, and what steps you should take to address it effectively.

So, what is an IRS Notice CP14I?

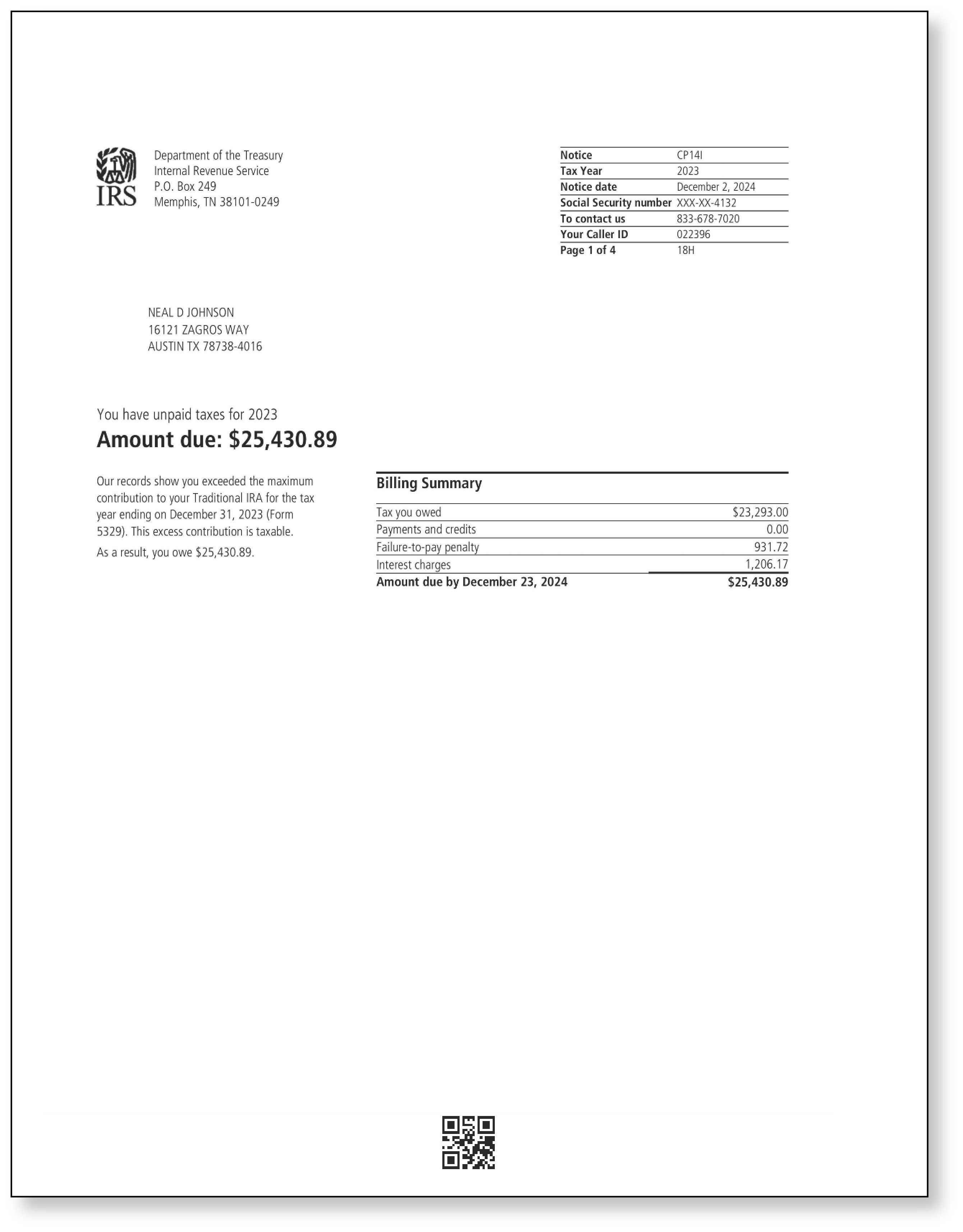

A CP14I is issued when the IRS believes you did not withdraw the required minimum distribution (RMD) from your IRA or made excess contributions to an IRA or another tax-sheltered account.

Why did I receive an IRS Notice CP14I?

There are two primary reasons why you might receive an IRS Notice CP14I:

- Failure to Take Required Minimum Distributions (RMDs): If you have a traditional IRA, you must start taking minimum distributions from the account once you reach a certain age. The IRS enforces this rule to prevent individuals from indefinitely deferring taxation on retirement savings. If you fail to take out the required minimum distribution, the IRS will calculate the tax and penalties based on the information provided in your tax return.

- Excess Contributions to Tax-Deferred Accounts: Another reason for receiving this notice could be that you contributed more to a tax-deferred account (such as an IRA, Roth IRA, Medical/Health Savings Account, or Education Savings Account) than is allowed by IRS regulations. The IRS has strict contribution limits for these accounts to prevent excessive tax deferral. The IRS will assess additional taxes and penalties if you exceed these limits.

What should I do next?

If you’ve received an IRS Notice CP14I, it is crucial to act promptly and follow these steps:

- If you are a TaxAudit member, contact us immediately. If you have an Audit Defense membership with us for the year in question, contact us as soon as you receive the notice. Instead of having to parse through documentation to determine whether the notice is correct, respond to the IRS, or decide if you should set up a payment plan, let us do that for you! Our team of tax professionals are experts at dealing with the IRS, responding to them on your behalf, and making sure you pay no more tax than what you rightfully owe. If you do not have a TaxAudit membership, follow the steps below.

- Carefully review the notice. Examine the details of the notice, including the amount owed, the deadline by which to respond, and why the IRS sent the notice.

- Review the documentation you used to prepare your return. Double-check your tax return to confirm whether the IRS's findings are accurate. Do not assume that the IRS has the correct information.

- If you disagree with the IRS, prepare and submit an IRS response. If you believe you reported your information correctly the first time, gather the appropriate documentation to dispute the IRS’ findings and make sure to submit the documentation prior to the deadline listed on the notice – usually 30 days from the date listed on the notice. This might seem like a lot of time, but this window will go by quickly, and you may need time to gather and prepare the appropriate documentation, so we recommend responding as quickly as possible. If you need more time to gather information or seek professional advice, contact the IRS to request an extension. If you do not respond by the deadline, the IRS will assume you agree with the notice and issue additional notices requesting payment.

- If you agree with the IRS, withdraw the excess IRA amount and pay the amount due as soon as possible. First and most importantly, if the notice you received was due to contributing too much to your IRA, you should withdraw the excess amount as soon as possible. Penalties will continue to apply if the excess remains in the account, and these can quickly add up.

Once you have withdrawn the excess funds, pay the amount due to the IRS. The notice you receive will list the options available to you. You can typically pay via the IRS website or by check. If you can pay the entire amount due immediately, we recommend doing so as penalties and interest will accrue the longer the amount goes unpaid. If you cannot pay the entire amount immediately, you can set up a payment plan with the IRS on their website.

Receiving any type of IRS notice can be stressful; however, taking prompt action is crucial to resolving the issue as swiftly and painlessly as possible. Whether you want to dispute the notice, set up an installment agreement, or contact a tax professional for assistance, addressing the issue head-on will help set you up for success.

Lastly, if you are a member of TaxAudit or would like to learn more about our Audit Defense membership, click here to visit our website or call 800.922.8348 to speak with someone on our customer service team. We are standing by and ready to help!