IRS Form 3531 Missing Signature | How to Respond

October 01, 2025 by Charla Suaste

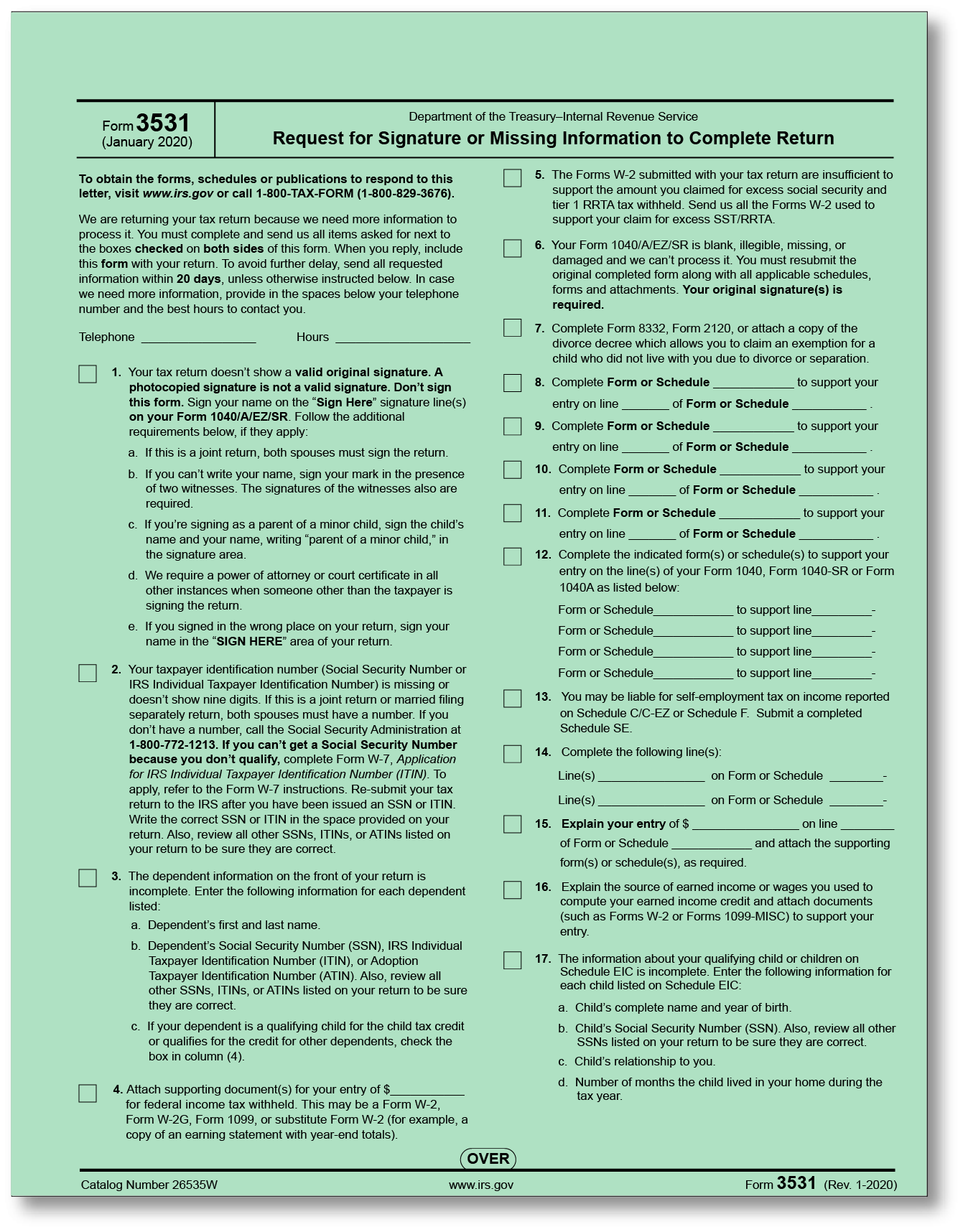

Receiving an unexpected letter from the IRS can be unsettling; however, if you've received IRS Letter 3531, you can rest easy. This notice, titled ”Request for Signature or Missing Information to Complete Return,” is not a tax audit. It's simply a notification that your tax return cannot be processed because it's missing a required signature or other vital information.

What is IRS Letter 3531?

This letter is a direct result of the IRS's automated system flagging your return as incomplete. While the most common reason is a missing signature, the letter may also indicate other issues, such as:

- A missing or incorrect Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Missing dependent information.

- Missing supporting documentation, such as W-2s or 1099s.

- Illegible, blank, or damaged forms.

The IRS is not questioning the information you reported; they are simply unable to move forward with processing your return until the missing piece is provided. The good news is that by responding promptly, you can prevent further delays in your return's processing and avoid any potential penalties or interest.

What Happens Next?

This letter should include a copy of the incomplete tax return and a checklist of the missing items. Your primary next step is to address the specific issue(s) the IRS has identified.

- Read the Letter Carefully: The notice will specify exactly what is needed. For a missing signature, you will be instructed to sign the provided copy of the return. If there are other issues, such as a missing SSN or W-2, the letter will specify what information is missing and what next steps you need to take.

- Gather the Requested Information: Make sure you have the correct and complete information. For a signature, you must provide a "wet" (original, non-photocopied) ink signature on the document. (Photocopies of signatures are not accepted by the IRS.)

- Return the Documents: The IRS notice will provide a specific return address, which is typically a Submission Processing Center. It is crucial to use the address provided on your letter and not the general IRS filing address. To ensure your documents are received, we highly recommend sending your response via certified mail with a return receipt. This provides proof that you sent the documents and that the IRS received them.

How TaxAudit Can Help

Dealing with the IRS can be a stressful experience, especially when navigating forms and procedures you're unfamiliar with. If you have Audit Defense with TaxAudit, you don’t have to go through this alone. As soon as you receive IRS Letter 3531, please contact us.

Our tax professionals are experts in handling these types of IRS notices. We will review your letter, determine the best course of action, and guide you through the process of correctly preparing and submitting the required documents. Our goal is to give you the peace of mind knowing your tax issue is being handled by a professional. For more information, you can visit our website here or call our customer service department at 800.922.8348 and they will be happy to assist you.