All about: IRS Notice CP21B - Refund Status

April 21, 2022 by Samantha Lamb

Every year, the IRS sends out hundreds of different types of letters to taxpayers– and one such letter is the CP21B. If you have received this letter, you may be confused about what – if anything – you need to do!

That’s okay because I’m going to walk you through this type of letter step-by-step.

What should I be looking for?

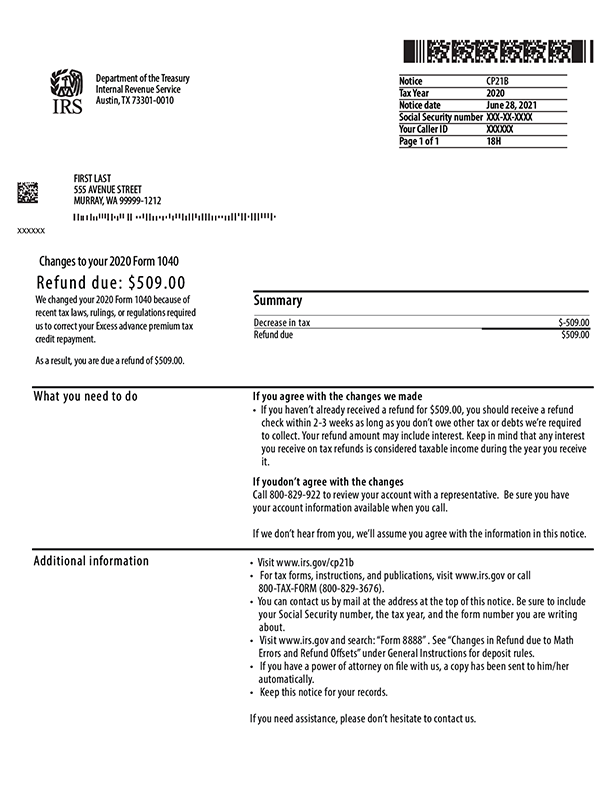

Starting at the top of the letter, in the upper right-hand corner, is a set of important information. The first thing listed will be the notice type which, in this case, will read CP21B. Beneath the notice type will be the tax year the notice is referring to. In the sample below, you’ll see that the notice has been issued regarding the tax return filed for 2020. The next important piece of information is the Notice Date; this is the date that the letter was issued. If you need to contact the IRS for any reason regarding the CP21B, you will need to do so in the amount of time specified on the notice. This amount of time is typically within 30 to 60 days of the notice date.

Why am I receiving a CP21B?

The IRS uses this letter to inform you of a change to your tax return that resulted in a refund. Information on what they changed and why will be located toward the left of the page. The amount that you will receive as a refund will be listed on the right side of the page.

Here is an example of the IRS Notice CP21B for reference:

Do I need to do anything if I agree with the notice?

On the letter CP21B, there will be instructions on what to do if you agree with the notice. If you do agree, you typically do not have to do anything. In the case of this letter, you should receive your refund within two to three weeks of the notice date. There are instructions on what to do if you do not receive the refund in the timeframe given.

What happens if I don’t agree with the CP21B?

If you do not agree with the refund, the notice will list a phone number to call the IRS so you can chat with a representative and get more information regarding the changes that were made.

Or, if you are a member here at TaxAudit, we can assist you in making sure that the notice is correct! To have one of our tax professionals review the notice, you just need to report your notice on our website or give our Customer Service team a call at 800.922.8348 and they will be happy to help you!

If you are not a member with us and are interested in purchasing the peace of mind that comes with an audit defense membership, look no further! Our tax professionals are the best in the business and are ready to represent you to the IRS or state taxing agencies in case of receiving an audit or notice. For more details about the cost of a membership and what is included, please click here!