All About IRS Notice CP504 | Intent to Levy

December, 30 2022 by Charla Suaste

One of the most nerve-wracking experiences a taxpayer can have is that of rifling through your mail, only to find a letter from the IRS or your state taxing agency tucked inside. But even more spine-chilling is opening up an IRS envelope to discover that you've received a notice CP504.

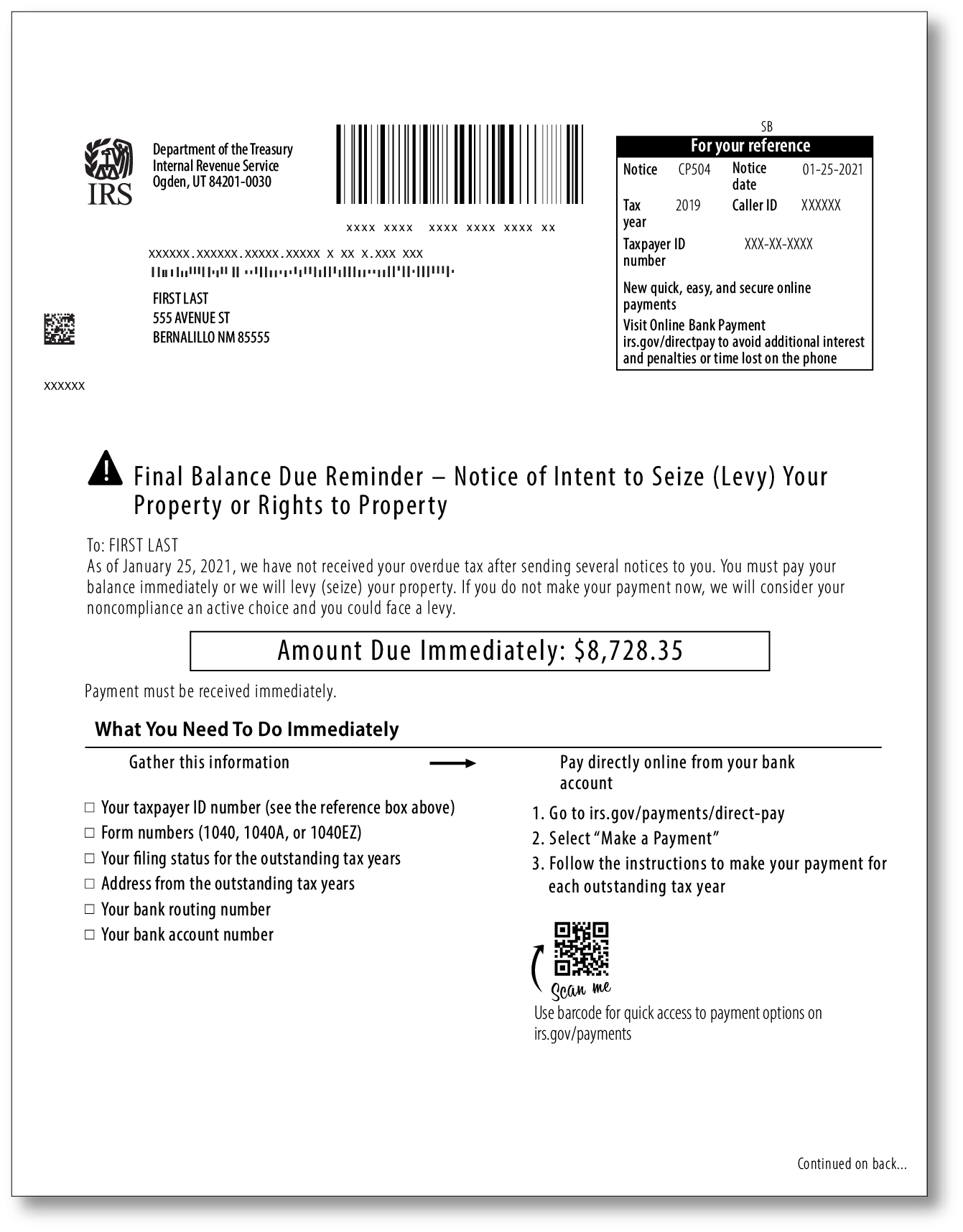

A CP504 is one of the scariest notices you can receive as it is considered a final notice, warning that the IRS is preparing to levy (or seize) a taxpayer’s property. “Property” can include everything from wages to bank accounts to physical personal property, such as a car or home.

Such a notice is issued after the IRS has previously sent multiple notices and they have not received (or believe they have not received) a response or payment from the taxpayer.

Before we continue, let’s talk about the contents of the notice, what they mean, and what your next steps should be. Please keep in mind that every part of this notice has critical information, so it is imperative that you read it carefully.

The top right-hand corner of the notice will list the tax year in question and the notice date. This date is important because it is when the clock starts ticking in terms of the time period by which the IRS is expecting you to pay the tax they are requesting. The time period is typically 30 days from the notice date. It also starts the time period for you to exercise your other collection rights.

In the middle of the notice, they will list the amount of overdue tax they believe you owe, along with instructions for what you need to do immediately. These instructions will typically let you know what information needs to be provided in order to properly make a payment.

The second page will list the consequences of continuing to ignore the IRS letter. Here, they will list all the property they are legally able to seize if the debt is not paid in a timely manner. As mentioned above, they can do everything from garnish your wages or Social Security benefits to seize your business or physical assets.

Below that, they will list alternative options for payment. For example, if a taxpayer is not able to pay the full amount all at once, the IRS will provide instructions for how the tax balance can be paid over time.

So, what steps should you take from here?

If you do not agree with the amount listed on the notice or do not believe that you owe the money they are asking for, the third page will provide instructions on how you can request an appeal. A request for an appeal has to be made within a certain time frame from the notice date.

No matter what you decide to do, it is imperative that you respond to the IRS right away. While notices like this can make taxpayers want to put their heads in the sand, prolonging the response will only cause you further hardship. Additionally, in the eyes of the IRS, a lack of response means that you agree with the notice, and this allows them to take action against you.

All that being said, if you are unsure of where or how to get started to resolve the issue, you can contact the Tax Debt Relief experts at TaxAudit. They will provide you with a free, no-obligation consultation where they look at your specific financial situation and advise you on your next steps. In some cases, we may be able to stop the levy from taking effect, prevent future levies, and come up with a plan to help you resolve your tax debt. We may also be able to correspond with the IRS on your behalf, so that you don’t have to.

If you’d like to take advantage of this process – or just get more information, please click here. We are ready to help!