Audit Support vs. Audit Defense. What’s the difference?

August 13, 2021 by Robin Scott-Hutchens, EA

The terms ‘audit support’ and ‘audit defense’ may sound like the same thing for the average taxpayer. But in the world of taxes, they can be very different. It’s important to understand the differences so you are aware of what level of service you will receive if you are ever audited. Here’s some food for thought on what you receive (or not) with each.

Audit Support

Generally, if you are using a DIY tax preparation program, either from an online platform or from boxed software sold at your local retailer, you receive some level of audit support included at no extra charge. If you prefer to have someone else prepare your taxes and visit a well-known retail chain, generally, those establishments will offer a complimentary audit support service as well. But what can you expect if you receive a letter from a tax agency?

You, the taxpayer, are the person who gets to do most of the legwork with audit support. Most audit support services rely on you to timely notify the tax preparation company that you received a letter from a tax agency. Receiving a letter is enough to cause anyone some serious indigestion, so don’t wait to set things in motion. Once you’ve reported your letter, generally, you can expect a customer service associate to review your letter and further explain what information the tax agency is looking for. You may also be provided with suggestions about what documents to gather so you can respond. And finally, you may receive advice on how to respond to the tax agency - an address to mail a written letter or a phone number to use to speak to an examiner directly.

You, the taxpayer, are the person who gets to do most of the legwork with audit support. Most audit support services rely on you to timely notify the tax preparation company that you received a letter from a tax agency. Receiving a letter is enough to cause anyone some serious indigestion, so don’t wait to set things in motion. Once you’ve reported your letter, generally, you can expect a customer service associate to review your letter and further explain what information the tax agency is looking for. You may also be provided with suggestions about what documents to gather so you can respond. And finally, you may receive advice on how to respond to the tax agency - an address to mail a written letter or a phone number to use to speak to an examiner directly.

Think of it like watching your favorite celebrity chef’s show and then trying to replicate that meal yourself at home. If you are super organized and have a penchant for tackling seemingly tedious or difficult tasks, this may be a goal worth setting. However, if the recipe calls for ingredients you’ve never heard of or uses a kitchen tool you don’t have, it may seem like an insurmountable chore. Using Audit Support is much the same. If you are a great recordkeeper and can locate the documents you used months or even years ago to prepare the tax return in question, the free audit support service might be just the guidance you need to get things cooking.

Audit Defense

In sticking with our celebrity chef comparison, though, what if you could pay a nominal charge and have that chef prepare the meal for you? Of course, some participation would be required on your part, like providing the details of what you would like prepared. You might also need to bring your own utensils. But with a little bit of input and effort on your part, your chef is now ready to pick up the pieces and do all the work on your behalf. You just need to wait for the finished product. This is very similar to having an Audit Defense service ready if you should receive a tax agency letter. You will still need to report the letter promptly, and that will set the wheels in motion of having your very own celebrity chef, er, I mean, audit representative, communicate with the tax agency on your behalf. Once your audit representative gets some key details from you, they can take over all communications, written correspondence, and follow-up with the agency until your audit has reached its conclusion.

It really comes down to the difference between watching your favorite dessert chef make a birthday cake, and then you try the same – or having said celebrity chef bake the cake just for you.

As mentioned earlier, this advanced level of service does cost a little extra. But where do you get it? Some chain tax preparation sites will offer you their in-house service and add it to your preparation fees as you get ready to pay. If you utilize the DIY programs, there is usually an offer as you finish up your own return to add on the in-depth service. But let’s say you decline that offering at the moment only to worry about this decision later. Or what if you have your cousin do your taxes? Are you out of luck? Certainly not! You can still visit TaxAudit and purchase Audit Defense straight from the source. TaxAudit has been providing this service for over 30 years with a team of licensed audit representatives who have thousands of hours of combined experience.

With Audit Defense, you will be paired with your own audit representative who will take the time to explain the tax agency letter as well as what to expect. After gathering some details from you, they will move forward with defending your tax return to ensure you pay no more than your proper amount of income tax. This defense ranges from writing letters and sending responses to going to in-person interviews with examiners on your behalf. Their ultimate goal is to make the whole process as stress-free as possible while providing you with the best representation possible. For you, it’s easy as pie.

So, make sure you understand what level of service you have and what services you can expect. It could make all the difference between feeling like you are competing in Gordon Ramsey’s kitchen or having Gordon Ramsey in the kitchen cooking for you. One can seem like a tedious and stressful time, while the other has you feeling like you are being taken care of by an expert in their field.

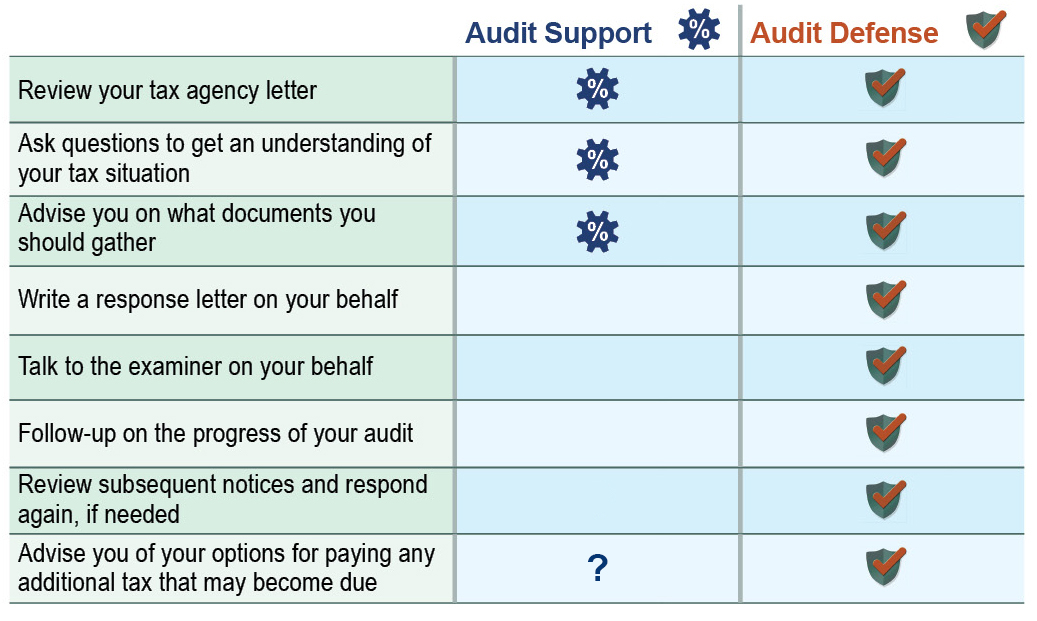

Here’s a quick review of the two services: