How to Handle IRS Notice CP45 | Payment to Estimated Tax

January 08, 2024 by Kate Ferreira

It is a warm summer day, and you are laying out by the pool, catching some rays, and getting ready to fire up the grill to cook some burgers. You do not have a care in the world as you watch your kids run through the sprinklers and pelt each other with water balloons. Your husband walks up to you, a look of fear in his eyes, and clutching a white envelope in his hand. As he draws near, you catch the top-left corner of the envelope and see that it is from the IRS. Instinctively, you want to throw the letter on the grill and watch it go up in flames – but realizing that would not be the smart thing to do, you brace yourself as your husband rips open the envelope.

You have received an IRS Notice CP45. Scanning through the letter, you are left with a lot of questions. If any of this sounds like your situation (although maybe with a little less imagery), then please read on to learn how to handle an IRS Notice CP45.

What is an IRS Notice CP45?

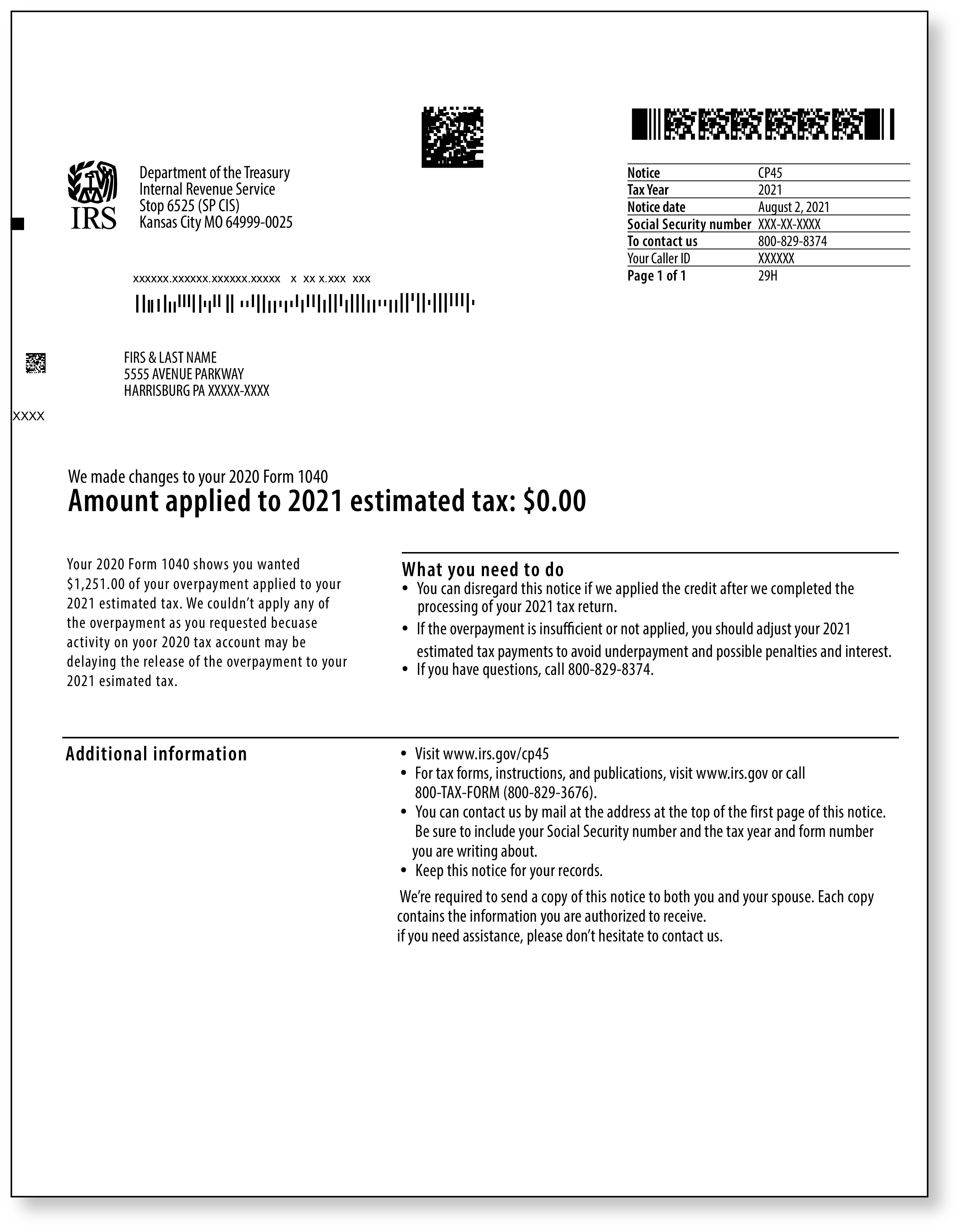

An IRS Notice CP45 is a letter the IRS sends to notify you that your request to apply your overpayment to your next year’s estimated taxes cannot be granted. Below is an example of this type of letter.

I’m confused. Is an overpayment the same thing as a refund?

The short answer is no, they are not the same thing. An overpayment happens when, throughout the year, you paid more taxes than you needed to. This can be done through withholding wages or by making estimated payments that were more than the tax you owed. The IRS can either refund the overpayment to you or you can opt to have the overpayment applied to your taxes for the following year.

How do I avoid this happening again?

The first thing the IRS advises is to file future tax returns electronically. This may help prevent mistakes from happening and you may find additional credits you can claim. You can also complete Form 1040-ES, Estimated Taxes for Individuals, to adjust your estimated tax payments to make them more accurate.

What is the first thing I should do?

As with any correspondence received from the IRS or other taxing agency, you will want to read the letter carefully and in its entirety. The letter will touch on why the IRS was not able to apply the amount you requested to next year’s taxes and provide additional steps that you may need to take.

What should I do if I agree with the notice?

In order to keep your records as accurate as possible, we recommend updating your copy of your tax return to reflect the changes made by the IRS. Additionally, be sure to adjust your estimated payments for the following year to avoid any possible underpayment.

If you have an outstanding balance, you will want to make arrangements with the IRS to get that paid. Click here to learn more about IRS payment options.

What if I don’t agree with the letter or want to know why this happened to my tax return?

If you have specific questions relating to your tax return, you will want to call the IRS using the phone number listed on the top right-hand corner of your notice.

If you have Audit Defense through TaxAudit, this is exactly the type of letter that one of our seasoned Tax Professionals can assist you with! To speak to a representative, simply click here to start a case online, or call our Customer Services Department at 800-922-8348. If you do not have an Audit Defense membership and would like to know more about it, click here.