I got an IRS CP22E Notice. What Should I Do?

August, 15 2023 by Kate Ferreira

It is always a stressful situation to receive a letter from the IRS. However, one might find it even more stressful to receive a new letter from the IRS after completing a recent audit. You might be in this boat if you have received an IRS CP22E notice.

The first thing you might be wondering is, what is an IRS CP22E notice and why did I receive it?

An IRS CP22E notice is a letter that the IRS sends as the result of a recently completed audit. Because of the changes made to your tax return during the examination, you now have a balance due.

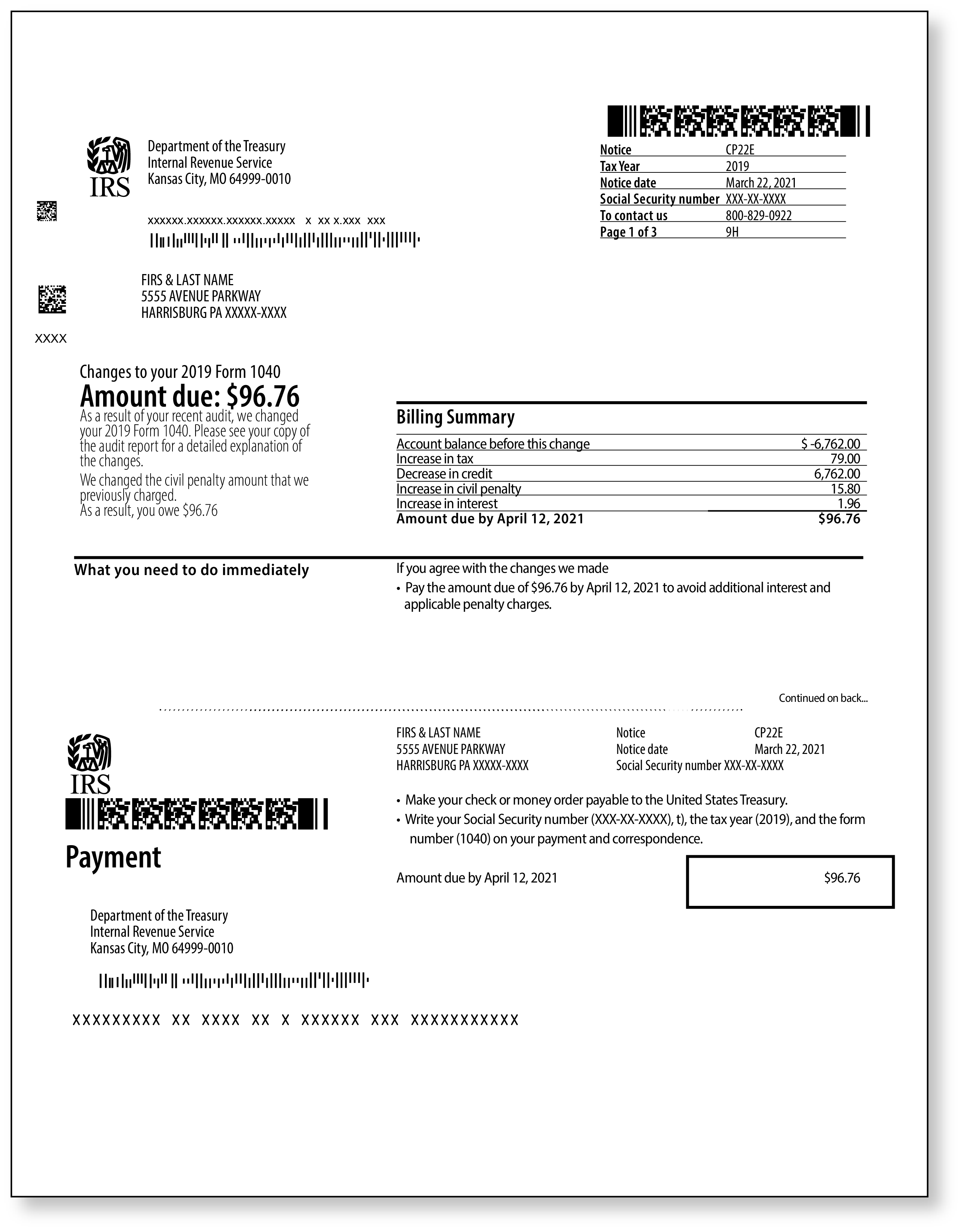

If you have received a CP22E notice from the IRS, this article will go over your options. Below is a copy of an IRS CP22E notice for reference.

Please be sure to read the notice in its entirety. The IRS will detail why you owe money for the tax year(s) in question. If you agree with the changes made to your return and the balance owed, make arrangements to pay the notice. There is a due date on the notice for when full payments need to be made, so please be sure to verify that date on the payment coupon. Additionally, it is important to note that if the payment is not paid in full by the date on the payment coupon, interest will accrue on any unpaid balance after the due date - not to mention you may owe additional penalties.

If you are unable to pay the full amount by the due date, you can arrange to make payments through a payment plan with the IRS. This can be done by calling the toll-free number listed on the top right corner of your notice. You can also request a payment plan by visiting the IRS website, or simply by clicking here.

So, what happens if you have received this letter and do not agree with the changes made or the balance owed? Or perhaps you are thinking, I never received a notice that my return was being examined and are tempted to ignore the letter altogether. While it may be momentarily fun to crumple the letter into a ball and try to make a two-point shot into your kitchen trash can, hold off. If you moved in the last year or two, the previous audit notice may have been delivered to your old address, so it will be important to follow the steps outlined below.

Whether you were previously aware of the examination or the CP22E notice took you by surprise, taking a proactive approach to resolving the matter is key. One way to gain a better understanding of your situation is by requesting IRS transcripts for the tax year in question. The IRS has several types of transcripts available, and the good news is they are free of charge. Transcripts can be requested online, ordered by mail, or obtained by phone. They provide useful information, such as the changes the IRS made to your account, the wages and other income reported to the IRS by third parties, and the basic data that was included in your return, if filed. Information about the different types of transcripts available and how they can be obtained can be found by clicking here.

If you have an audit defense membership with TaxAudit for the tax year in question, we can help you with this type of notice as part of your membership. Simply call our Customer Service Department at 877-829-9695 or click here to report an audit letter received. If you do not have a membership with TaxAudit and disagree with the notice, the IRS outlines a few next steps to take.

- If you have new information that the IRS did not review in your previous related audit, and you have not paid the amount due in full yet, you may request an audit reconsideration. For more information, please refer to Publication 3598, What Should You Know About the Audit Reconsideration Process. Keep in mind that an audit reconsideration is not a quick process and may take several months before there is a resolution.

- If you do not have any additional information to provide, but you still disagree with the changes proposed by the IRS as a result of your previous audit, you can appeal your case to the IRS Appeals Office. For more information on this, please refer to Publication 5, Your Appeal Rights and How To Prepare a Protest If You Don’t Agree.

If you are considering submitting an audit reconsideration with the IRS and do not have a TaxAudit membership, we may still be able to help! TaxAudit’s Tax Debt Relief department understands the complexities of the audit reconsideration process. For more information, please review our Audit Reconsideration webpage.

Finally, if you have over $10,000 in tax debt and are unsure of what your next steps should be, our Tax Debt Relief department also assists with getting taxpayers set up on payment plans or finding additional types of debt relief. If you are interested in a free consultation, please click here to get started.