I got an IRS Notice CP90 - What are my options?

July 17, 2023 by TaxAudit

Oh no! A letter from the IRS! The sky is falling; the sky is falling!

Actually...not really. While it might feel like it, remember that we are going to get through this together.

First, congratulations that you are not ignoring this notice. That is the first step.

Getting honest about the situation at hand is the second step. There were other letters and notices from the IRS, weren’t there? It could be that you have moved, and you didn’t get the other notices that were previously sent. Perhaps you are going through a divorce and the notice was sent to the other party.

Whatever situation you are in, it is time for you to act. It is not in your best interest to do ostrich imitations and bury your head in the sand to avoid this. That is because the next step the IRS is going to take is what is called a “levy.” This is a fancy term for saying the IRS has the legal right to start taking your stuff. To read more about levies, click here.

Thirty days from the date of the notice, the IRS has the right to begin taking assets. This can include:

- Bank accounts

- Wages

- Retirement accounts

- State Tax Refunds

- Your favorite rock collection

- Other assets

So, what can you do?

- Pay the Amount Owed

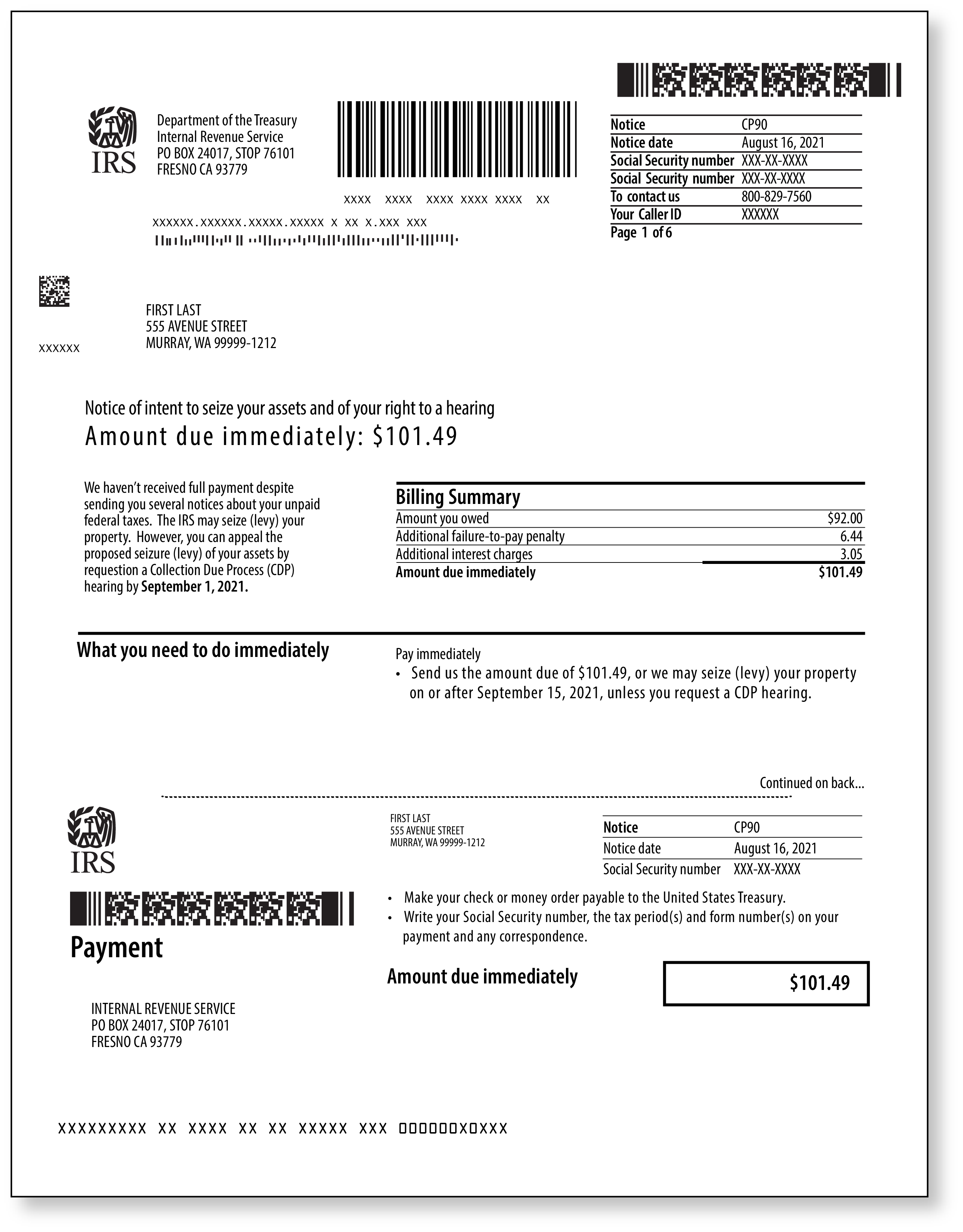

You will need to know the amount due, which will be listed on the notice. It will be in large print about a third of the way down the first page.

The easiest way to pay is to go to the IRS website. While you can mail a check, processing times and mail theft are issues you don’t want to deal with right now. Go to the website irs.gov. Locate the link that says, “Make a Payment.” You can choose “Pay Now with Direct Pay,” and this will come directly out of your bank account with no fees. Other options are available, but there will be fees associated with those transactions.

- What if I owe the money but can’t pay?

It is recommended you always pay what you can, even if it seems like a small amount. This shows good faith on your part to the IRS. For the remaining balance, you can request a payment plan. Generally, if you filed your tax returns with the IRS and then request a plan for less than 5 years, the IRS will accept the plan. The easiest way to set up a plan is to go to irs.gov, then click on “Make a Payment.” Scroll down toward the bottom of the page to find “Apply for Payment Plan.” All the details about who qualifies, how to apply, and what the fees are can be found there.

- What if I owe the money but can’t pay?

- Request a Hearing

Hearings are not automatic. Hearings must be requested. And, as with all IRS dealings, there is a form for that!

Look on the left side of your notice; there is an important appeal date. This is the date by which you need to request a Collection Due Process hearing. Complete Form 12153 on the IRS website. The instructions and links that come with the online form are easy to understand. To learn more about Collection Due Process hearings, click here.

- Request an Offer in Compromise

If paying your full debt would create a financial hardship, an Offer in Compromise may be an option. This is when the IRS settles with you for less than you owe.

Many factors are considered by the IRS when making a settlement offer. Each case is unique. Items they look at are your ability to pay, income, expenses, and equity in assets. If an installment agreement could remedy the situation instead, the IRS will reject the offer. If there is equity in assets, the IRS considers these available to pay the debt since they will levy the item if need be.

The questions and documentation required for this are complex. Some people have been known to give up on the process, saying it was just too much and they would figure out how to pay the tax, instead. Be prepared when you start the process for an Offer in Compromise as it can take quite a bit of time.

Please remember, the IRS is a collection agency. If you contact them, they are willing to work with you. If you still have questions about a CP90 Notice and how to avoid a levy on your assets, you can reach out to TaxAudit for additional guidance and assistance. Our Tax Debt Relief team may be able to work with the IRS on your behalf! They will provide you with a free, no-obligation consultation where they look at your specific financial situation and advise you on your next steps. Just be sure to reach out quickly since time is of the essence when it comes to IRS notices. You can also check out the video below from our Director of Tax Services about how to release and prevent an IRS Levy.