IRS CP523 | Intent To Terminate Your Installment Agreement

March 08, 2024 by Kaylie Jonutz

Upon filing your 2021 tax return last year, you realized you could not fully pay your balance due. Because of this, you signed up for a payment plan. You then set reminders so you would remember to make your monthly payments on time; however, life happened, and you needed to catch up on your payments. The stress of everything else in your life made you completely forget about your payments – so when you receive an IRS letter CP523, everything floods back to you. You realize you don’t know or remember the last time you paid on your IRS installment agreement.

What is an IRS notice CP523, and why did I receive it?

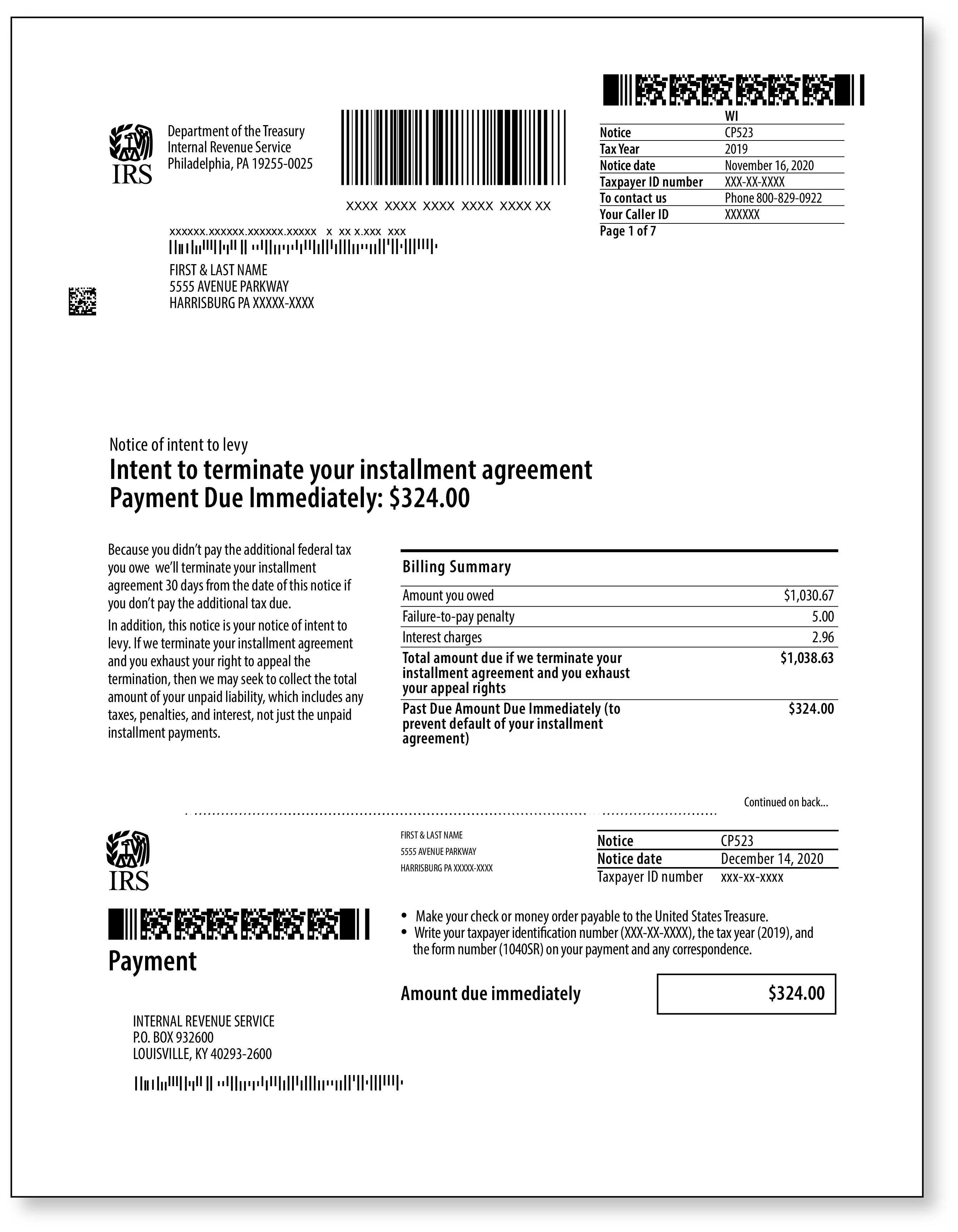

If you receive a CP523 notice, you must act fast. This notice informs you that the IRS intends to terminate your installment agreement or payment plan because they have yet to receive one or more monthly payments. Along with the intent to terminate your payment plan, the IRS notifies you that they may seize your state income tax refund (if you have one), levy your wages, take money from your bank accounts, etc. if you take no action.

Additionally, per the Fixing America’s Surface Transportation (FAST) Act, taxpayers considered to have seriously delinquent tax debt may have their passports denied or revoked by the State Department if they default on their federal installment agreement. (A taxpayer is considered to have seriously delinquent tax debt when they owe more than $52,000 – adjusted yearly for inflation – in federal taxes, including penalties and interest, and the IRS has filed a Notice of Federal Tax Lien. For 2023, a seriously delinquent tax debt is one where a taxpayer owes more than $59,000 in federal taxes, penalties, and interest. Taxpayers can learn more about passport revocation or denial due to seriously delinquent tax debt by clicking here).

What should I do now?

The first thing you should do when you receive this notice is reach out to the IRS as soon as possible, no later than within 30 days of the notice. In this call, you can discuss the steps needed to resolve the issue. Keep in mind that the IRS will terminate your current installment agreement if a payment is not made within 30 days from the date of the notice. If you can, submit the payment listed on the notice as soon as possible. You can do this by going to the IRS payments page. From that page, you can make your payment or see if there are additional payment options.

If the IRS already terminated your installment agreement, you may need to pay a fee to get it reinstated. If you are unable to make the current monthly payments and need to have a lower monthly payment or are unable to make any monthly payment, the IRS may request additional financial information.

The one thing you should NOT do is ignore the notice or fail to respond.

How much time do I have?

You have 30 days from the date posted on the notice to respond. If you do not act within the allotted timeframe, the IRS may terminate your installment agreement and levy your wages, take money from your bank accounts, etc.

What if I disagree with the notice?

If you have already caught up with your payments, it is important to contact the IRS by calling the number printed at the top of the notice and confirm your account is up to date. If you disagree with the notice, you also have the right to file an appeal and request a hearing with the IRS Independent Office of Appeals.

If you're in need of assistance with your tax debt, consider our Tax Debt Relief (TDR) service. You'll receive free, no-obligation answers to your tax debt-related questions. We will then provide you with a plan for achieving the best possible outcome for your tax debt settlement. Your tax professional will be by your side throughout the whole process and will represent you through all the negotiations with the IRS or state tax authorities. All you must do is go to this webpage and answer a few questions - and we will get back to you as soon as possible!