IRS Letter 2645C | The IRS Needs More Time

July 22, 2025 by Charla Suaste

According to the Treasury Department, over the course of a single year, the IRS sends out close to 170 million notices to individual taxpayers.1 That’s a lot of notices! One of the most common notices they send out is IRS Letter 2645C, also known as a “stall letter.”

What is an IRS Letter 2645C?

This letter is issued to 1) confirm that the IRS received the documentation you or your tax representative sent, and 2) that they need additional time to review the information and issue a response. This notice does not typically require further action and is simply informational. The good news is this letter is not an audit notice – hooray!

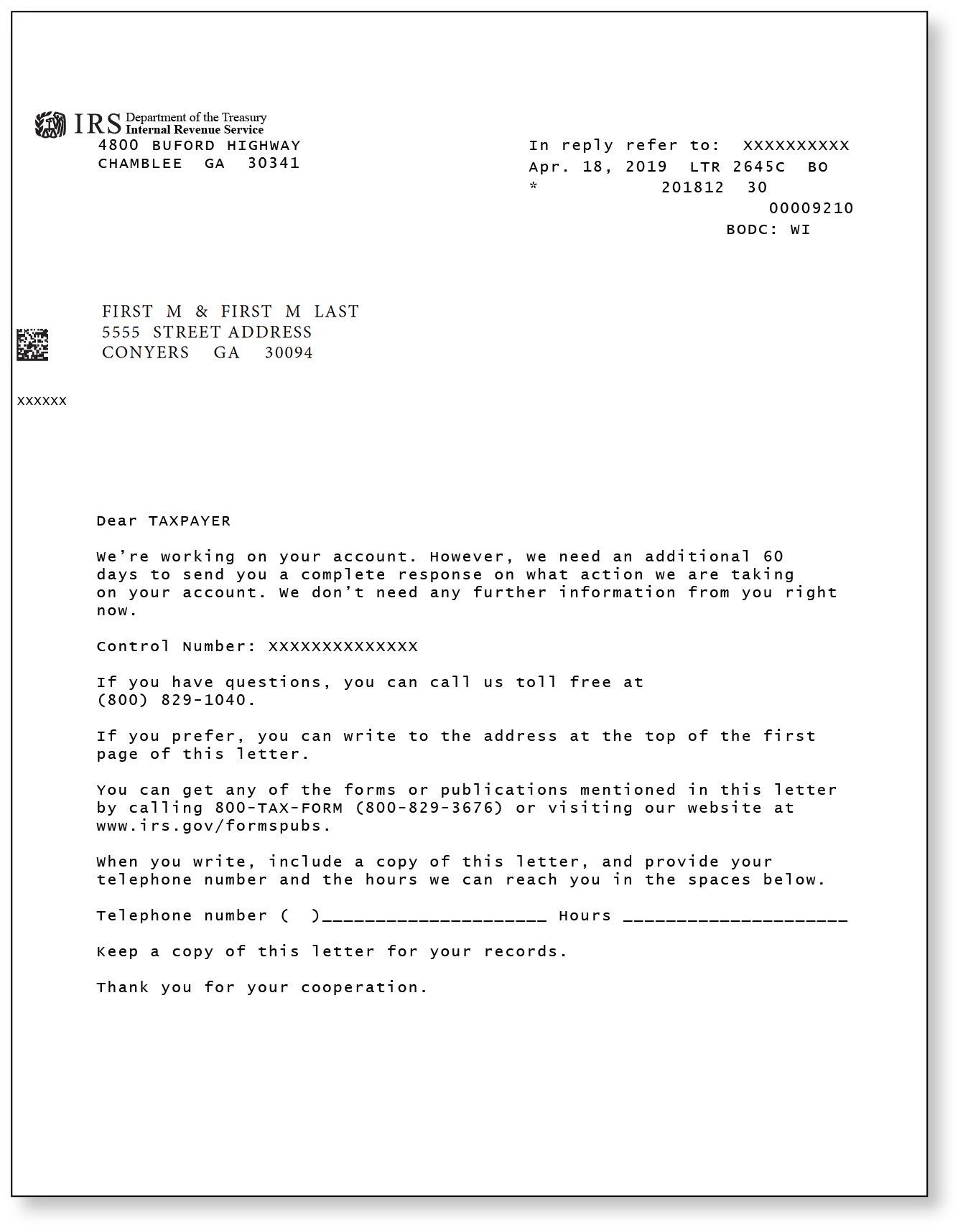

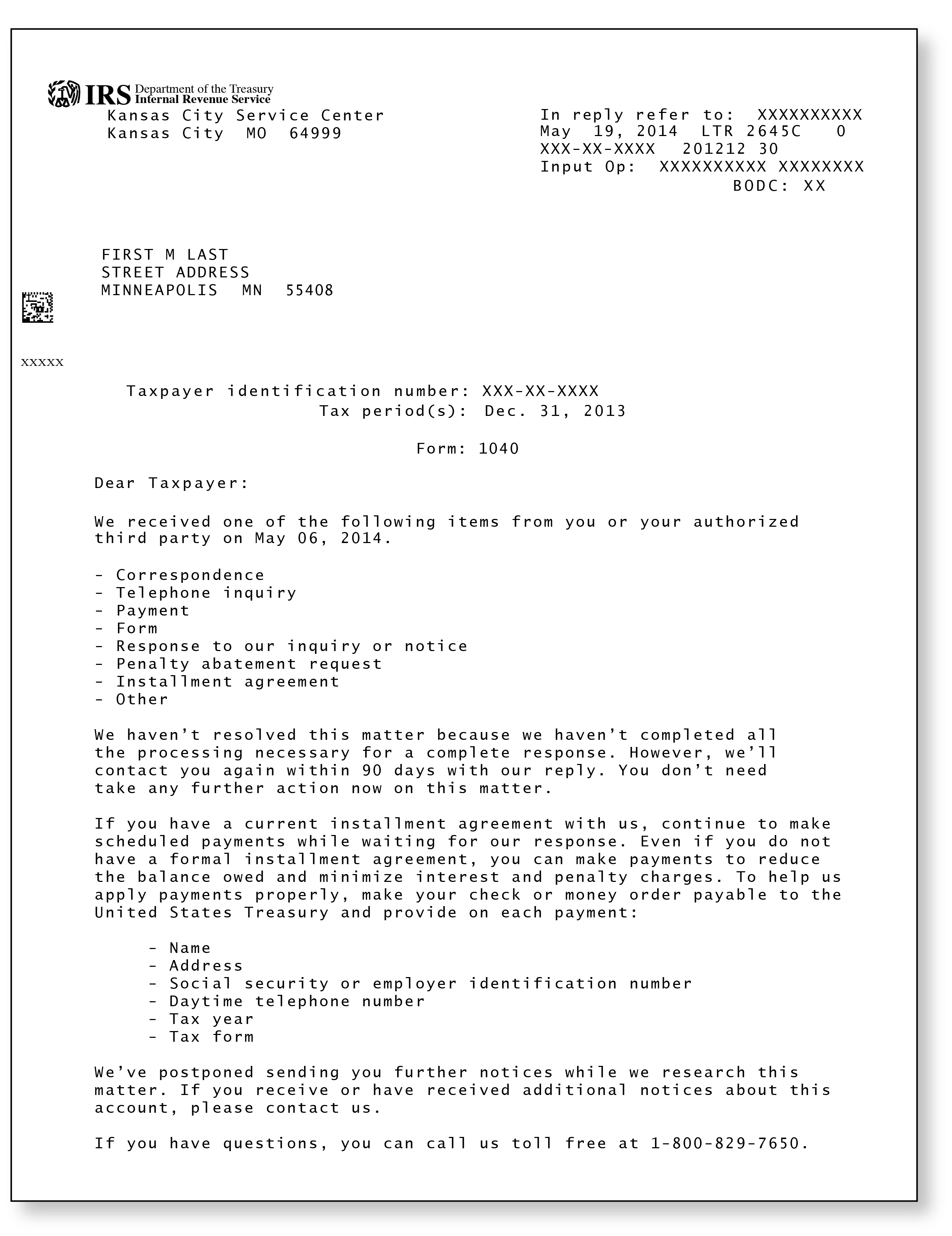

As you can see, there are two different types of IRS Letters 2645C. One will let you know that the IRS needs an additional 60 days to issue you a response, and the other letter requests an additional 90 days to respond.

You might also notice that both of these letters are vague. One reason for the vagueness is that many departments within the IRS issue this notice. They do not list what documentation they received or provide a date by which they will respond. That is because most of these letters are computer-generated, meaning that an IRS representative logged your response in their system, and the system issued this notice to let you know it was received.

What should I do if I have received an IRS Letter 2645C?

If you previously submitted documentation to the IRS, read the letter carefully to see if there are any important dates or instructions you should note. For example, if you are currently in an installment agreement, the notice may remind you to continue making your payments. You should follow this direction to avoid any further delays and possible reinstatement fees if you stop making payments. If there is a reason you can no longer make the agreed-upon payments, it is important to contact the IRS immediately to discuss other alternatives. Hopefully, this will prevent the IRS from nullifying the agreement and taking further action, such as issuing a Notice of Intent to Levy.

It’s important to note how much additional time the IRS is requesting to issue a response. For example, if the IRS requests 60 days to issue a response, you should note this date on your calendar. If you do not hear back from the IRS by the end of the 60-day timeframe, you should follow up with them by calling the contact number listed on the notice.

What if I did not submit documentation to the IRS?

It is possible that the IRS reached out to third parties, such as your employer, who submitted documentation to the IRS to verify claims made on your tax return, which is why you might be receiving this letter. The letter could have also been sent in error. If you did not recently submit information to the IRS, it is a good idea to do a little digging to ensure everything is fine. One of the things you can do is sign in to your IRS online account, where you can view a record of your account, including digital copies of notices the IRS has sent. If your account shows the IRS has not contacted you, then it may be time to reach out to the IRS by phone, using the telephone number listed on the letter. Chances are, there is a reasonable explanation why the letter was issued. However, it is still good to confirm the reason for the letter. Unfortunately, there are many culprits out there trying to steal people’s identities, so it is important to stay vigilant.

If I have an Audit Defense membership, can you assist me?

Yes! If you have an Audit Defense membership with us for the year in question, please contact us immediately. We can assign your case to a tax professional who will review your case and determine the best next steps.

If you do not have a membership with us but would like to have Audit Defense for any future audit or notice, you can sign up by visiting our website or by calling our customer service team at 800.922.8348.

(1) “Fact Sheet: IRS Launches Simple Notice Initiative,” U.S. Department of the Treasury, January 23, 2024, https://home.treasury.gov/news/press-releases/jy2042#:~:text=The%20IRS%20sends%20around%20170,filled%20with%20complex%20legal%20jargon.