IRS CP80 Notice | Please File Your Tax Return

June, 26 2023 by TaxAudit

You’ve just received a letter from the IRS. Knowing that you haven’t filed your taxes yet, you’re anxiously wondering what the letter could say. Receiving mail from the IRS can be daunting and could possibly mean bad news. Fully aware of this, you tear open the envelope with a pit in your stomach, wondering how much money you might owe them.

Then, as you read the notice, you realize that they’re not asking you for money. The notice happens to be a CP80 notice explaining that you have a credit on your account for the tax year in question but have not filed a return. This credit may be in the form of withheld taxes reported to the IRS, estimated taxes you have paid, or a prior year’s refund that has been applied to the tax year in question. The credited amount will be applied to any amount due and, if any money remains, you may receive that amount as a refund.

So, what exactly is the IRS CP80 Notice?

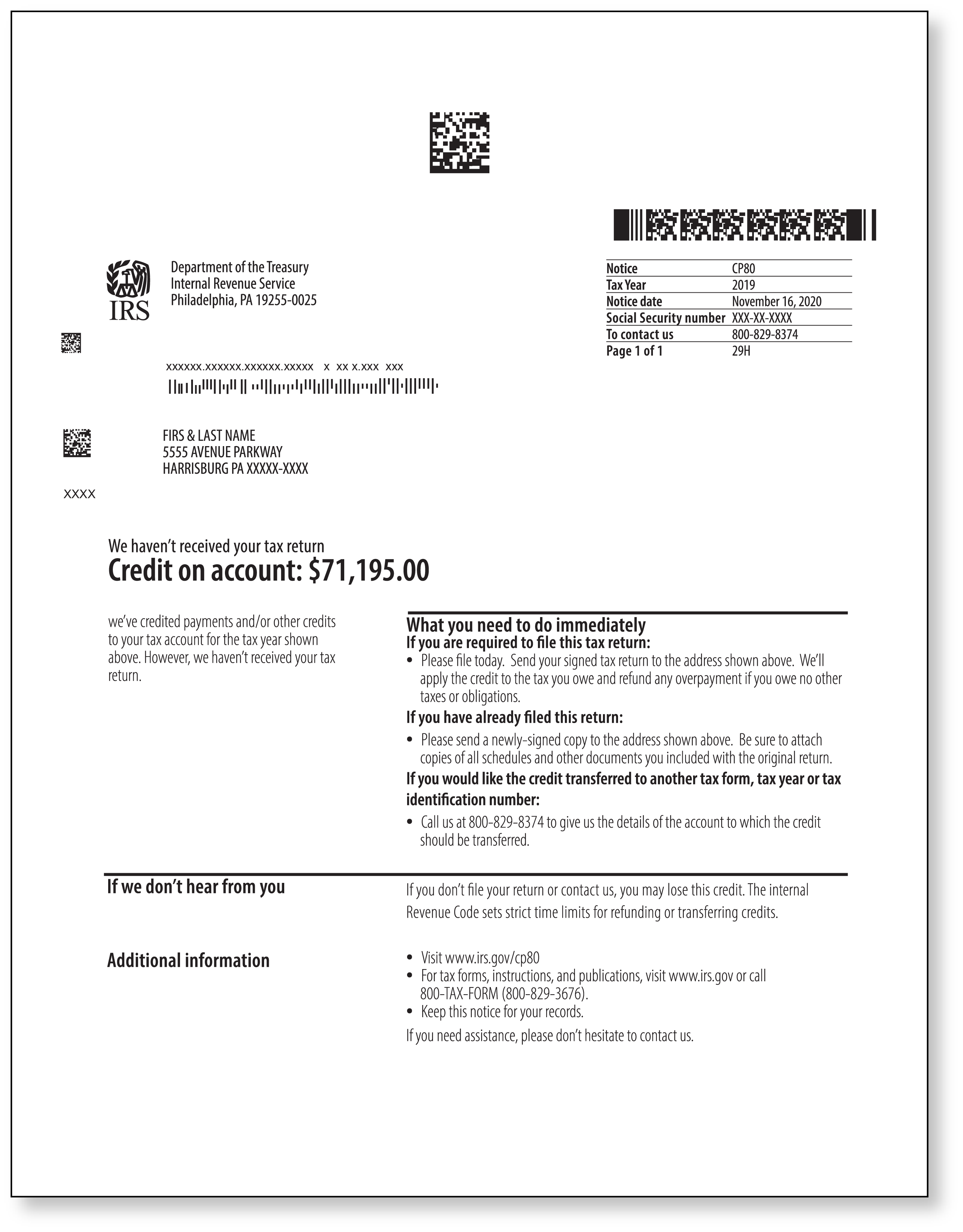

According to the IRS website, you will receive an IRS CP80 if the IRS has credited payments and/or other credits to your tax account for the tax period shown, but they still have not received your tax return for that year. It indicates that the credit will be applied to any tax that is owed for the tax year. If you have no other outstanding tax liabilities, any of the credit that still remains may be refunded. However, if you don’t file within three years of the return’s original due date, you will lose any credits to your tax account. An example of the IRS CP80 is shown below.

What should you do if you receive an IRS CP80?

Read the notice carefully and make sure that you completely understand the information and the situation.

If you haven’t filed taxes for the year listed on the notice, complete your tax return and file as soon as possible. You can send your signed tax return to the address shown on the top of the notice that you received from the agency. You’ll have three years from the date the original return was due. For most years, that is April 15. When April 15 falls on a weekend or holiday, the original due date is generally the next weekday. If you don’t file within this window, you will lose your refund – so try to file as soon as possible! If you have already filed a return for the tax year in question, sign a copy of the initial return and mail it to the address at the top of the CP80.

What if I want to transfer the tax credit?

If you would like the credited amount transferred to another tax form, tax period, or tax ID number, you can call the IRS at 800-829-8374 and give them the details of the account to which you would like the credits transferred.

Because of the COVID-19 pandemic, the IRS had an unprecedented number of returns (several million) that were not timely processed. It is important to note that due to the COVID-19 pandemic, the IRS experienced massive delays in processing 2019 and 2020 tax returns. To save taxpayers from receiving a CP80 notice when they may have already filed their return, the IRS has temporarily suspended this and other notices, beginning in February 2022. So, if you’ve received a CP80 for your 2019 tax return and you filed it in a timely manner, you should refile the return. If you received a CP80 for your 2020 return, the IRS recommended on January 25, 2023, to not refile the return at this time. However, it is important to check back with the IRS often to make sure this is still the case. If you are unsure if you should resubmit your 2020 return to the IRS, it is best to contact the IRS using the number provided on the notice.

If you have received a CP80 in the mail - or any other notice from a taxing agency - and you are confused about how to handle it, TaxAudit can help! We strive to ease the burden of tax complications for members across the nation. As the largest tax representation provider in the country, our team of tax professionals, CPAs, and enrolled agents handles more audits than any other firm. For more information, click here or call our Customer Service team at (800) 922-8348.