IRS Notice CP05A | What It Is and How to Respond

May 15, 2024 by TaxAudit

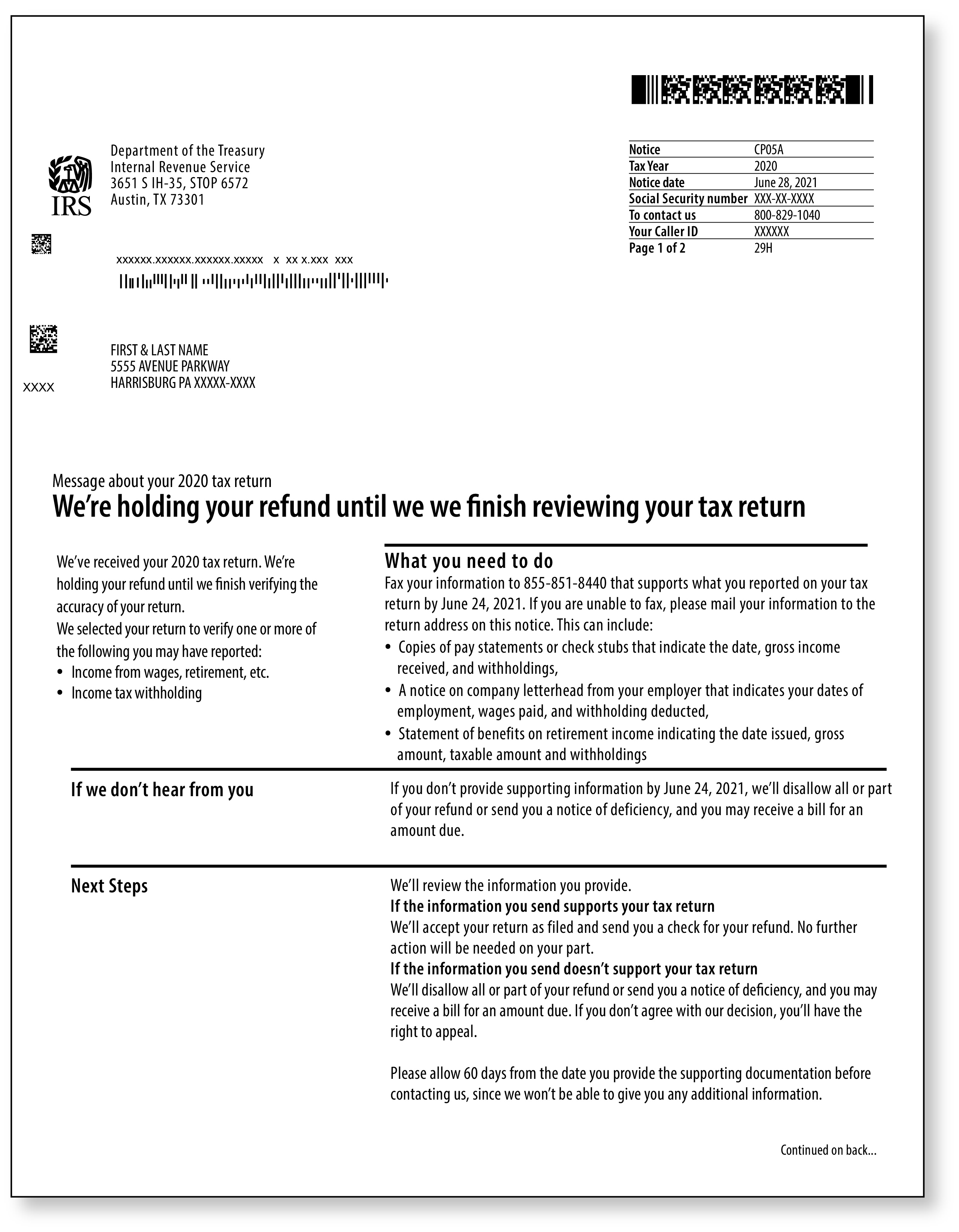

The IRS notice CP05A is sent by the IRS to inform taxpayers that they need more information about the submitted income tax return before they can issue a tax refund. Receiving this notice doesn’t mean that you are being audited. Rather, it is a request for clarification regarding a taxpayer’s tax return, and usually indicates the IRS has questions about certain items such as income, deductions, or credits. Although receiving a CP05A doesn’t necessarily mean that a mistake was made while filing your tax return, it can be a good indicator of one. The letter may request additional documents such as paystubs, receipts, bank statements, or other financial records in order to determine the accuracy of the return.

If you receive an IRS notice CP05A, it’s important to respond as soon as possible, and provide all the requested information to avoid having your refund further delayed or disallowed altogether. The notice will also include a deadline by which you should respond that is usually within 30 days from the date listed in the top right corner of the notice.

Make sure that you review the notice carefully to ensure that you understand which issues the IRS is questioning and what information they are requesting. Once you determine exactly what you need, you should gather all the necessary documents, make copies, and send the copies either by fax or by mailing them to the address listed on the notice. It is important to provide complete and accurate information in your response to the IRS. Failure to respond or provide the necessary documentation may result in the IRS disallowing your refund or issuing you a notice of deficiency. The notice of deficiency may show interest and penalties in addition to tax owed. You will also want to make copies of your entire response to the IRS and keep them for your records. This will help if you need to refer to the information later, or if there are any further issues with your return in the future.

After you’ve sent in your response, you should follow up with the IRS. According to their website, the IRS asks that you allow 60 days for them to complete their review before contacting them. Know that the wait times to speak to a representative can be lengthy so you may want to download a good book or movie onto your tablet before dialing. Be sure to be available and responsive during this period in case they reach out requesting more information or documentation.

If you’re unsure of how to respond to the notice, or you have questions about the information requested, it’s best to consider hiring a tax professional such as an enrolled agent, certified public accountant, or tax attorney. They will be able to help ensure that you are sending all the correct documents in your response.

What happens if I received this notice but didn’t file a tax return for that year?

Unfortunately, identity theft remains a global concern. If you received a CP05A and did not file a return for the year in question, please respond to the notice letting the IRS know you did not file a return. Next, you may want to submit to the IRS Form 14039, Identity Theft Affidavit. For more information on identity theft, please review the IRS’s Identity Theft Central webpage.

TaxAudit is equipped with a team of tax professionals who will happily assist all members who receive IRS notices just like this one. They are here to help you navigate your case and represent you to the IRS, so you can remain stress-free throughout the process. For more information, visit our website here or call our Customer Service team at 800-922-8348.