IRS Notice CP10 | Miscalculation on Tax Return

December, 13 2023 by Kate Ferreira

Well, it finally happened. What some might consider to be scarier than any haunted house or horror movie has happened to you. You received a letter from the IRS. Upon opening the notice and dodging the metaphorical bats that flew out of the envelope, you scan the pages to see that you received an IRS Notice CP10 which indicates that there was a miscalculation on your tax return. If you have received one of these notices from the IRS, read on to learn more about this notice and the options available to you.

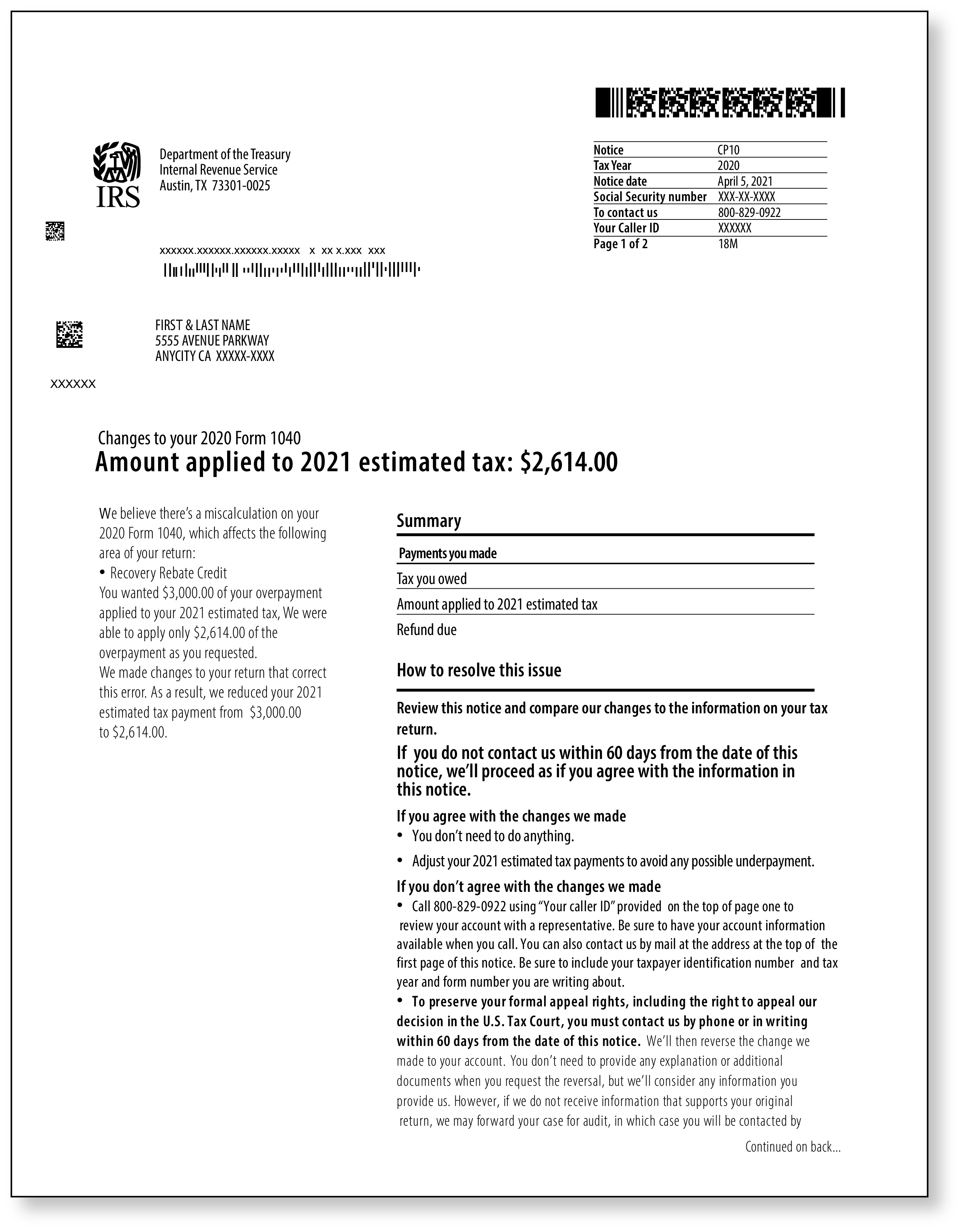

How do I know if I received an IRS Notice CP10?

When receiving a letter from the IRS, the notice type will be indicated in the top right-hand corner of the letter. Below is an example of an IRS CP10 to reference.

Why did I receive this notice from the IRS?

An IRS Notice CP10 is issued by the IRS when they believe that there was a miscalculation on your tax return. Because of this miscalculation, they have made changes to your tax return. These changes affected the estimated tax payments applied to your taxes for the following tax year, so it is important to take note of the changes.

What do I need to do?

There are three things that you should do when you receive an IRS CP10.

- Read the notice carefully and in its entirety. The letter will explain why the IRS cannot accept the amount that you requested to be applied to next year’s estimated tax payments. The letter will also give additional information on steps to take if your situation merits additional action.

- If the notice looks correct, make the changes indicated by the IRS to the copy of your tax return you have at home. This way, your past records will be up to date for reference for future years.

- When making your estimated tax payments for next year’s taxes, be sure to make the proper adjustments to your payments to avoid underpaying on your return.

What if I don’t know how to adjust my estimated payments?

Estimated tax payments can be adjusted by using Form 1040-ES, Estimated Tax for Individuals. Additionally, you can find more information online by reviewing Publication 505, Tax Withholding and Estimated Tax. For those who prefer to go the paperless route, the IRS allows taxpayers to make estimated tax payments through their IRS online account. For more information about what actions can be taken with an IRS online account and how to sign up for one, please click here.

What caused my tax return to change?

If, after reading your notice, you do not understand why the changes were made to your tax return, call the number in the top right-hand corner of your notice to speak to an IRS representative about the specific information relating to your tax return.

I do not agree with the changes that the IRS made, what can I do?

If you do not agree with the changes made by the IRS, you can either call the number in the top right-hand corner of the notice or respond by mail to the IRS office listed on your notice. If you do decide to respond by mail, be sure to make a copy of the notice and include it with any documentation you send as a response. Keep the original for your records. Generally, once you contact the IRS, the IRS will reverse most of the changes they made, provided the changes had originally reduced your refund. Keep in mind that the response, whether it is by phone or mail, must be made within sixty days from the date on the notice. They are not required to reverse changes but will consider any information you provide. If the supporting documentation you send to the IRS does not provide a valid enough explanation for the claims made on your return, there is a possibility that your case could be forwarded for audit. If this occurs, an audit representative from the IRS will reach out to you within six weeks to discuss the audit process and your rights as a taxpayer.

If you opt to not contact the IRS within the sixty-day timeframe, the changes that the IRS made will no longer be eligible for reversal and you lose your right to appeal the decision to the U.S. Tax Court. So, if you are planning on contesting the changes the IRS made, be sure to respond before the sixty days are up!

Are there any options available if I missed the sixty-day deadline?

Even if you missed the sixty-day window to contact the IRS, there is one more opportunity to dispute the changes. Taxpayers may file a claim for a refund the later of three years from the date you filed your return or within two years of the date of your last payment for this tax year. In this situation, a taxpayer may file a claim for a refund by filing Form 1040-X, Amended U.S. Individual Tax Return.

I purchased an Audit Defense membership with TaxAudit, is there anything you can do?

Yes! If you purchased an Audit Defense membership for the year listed on your IRS CP10 notice, simply click here to start a case online, or call our Customer Service Department at 800-922-8348. If you haven’t purchased Audit Defense and want the peace of mind knowing that a team of tax professionals is on your side in the event of an audit, click here to learn more about our membership!