IRS Notice CP21C | What You Should Know

September 25, 2023 by Kate Ferreira

When it comes time to prepare your taxes, you know exactly what to do. You have a routine. Gather your documents – check. Run to Starbucks and get the biggest cold brew they will let you out of the store with – check. Clear out your Saturday schedule to get everything done in one go – check. Double check you have everything you need – check, check! You prepare your return, you get it mailed off and sent to the IRS, and you can rest easy because you got everything done. However, later, you realize that you might have made a mistake or needed something to be changed. Without panicking, you contact the IRS and let them know that there is a change needed to be made on your return. A few weeks later, you receive an IRS Notice CP21C in the mail. If this sounds like your situation, read on to see what you should know about an IRS Notice CP21C.

Why did you receive this notice?

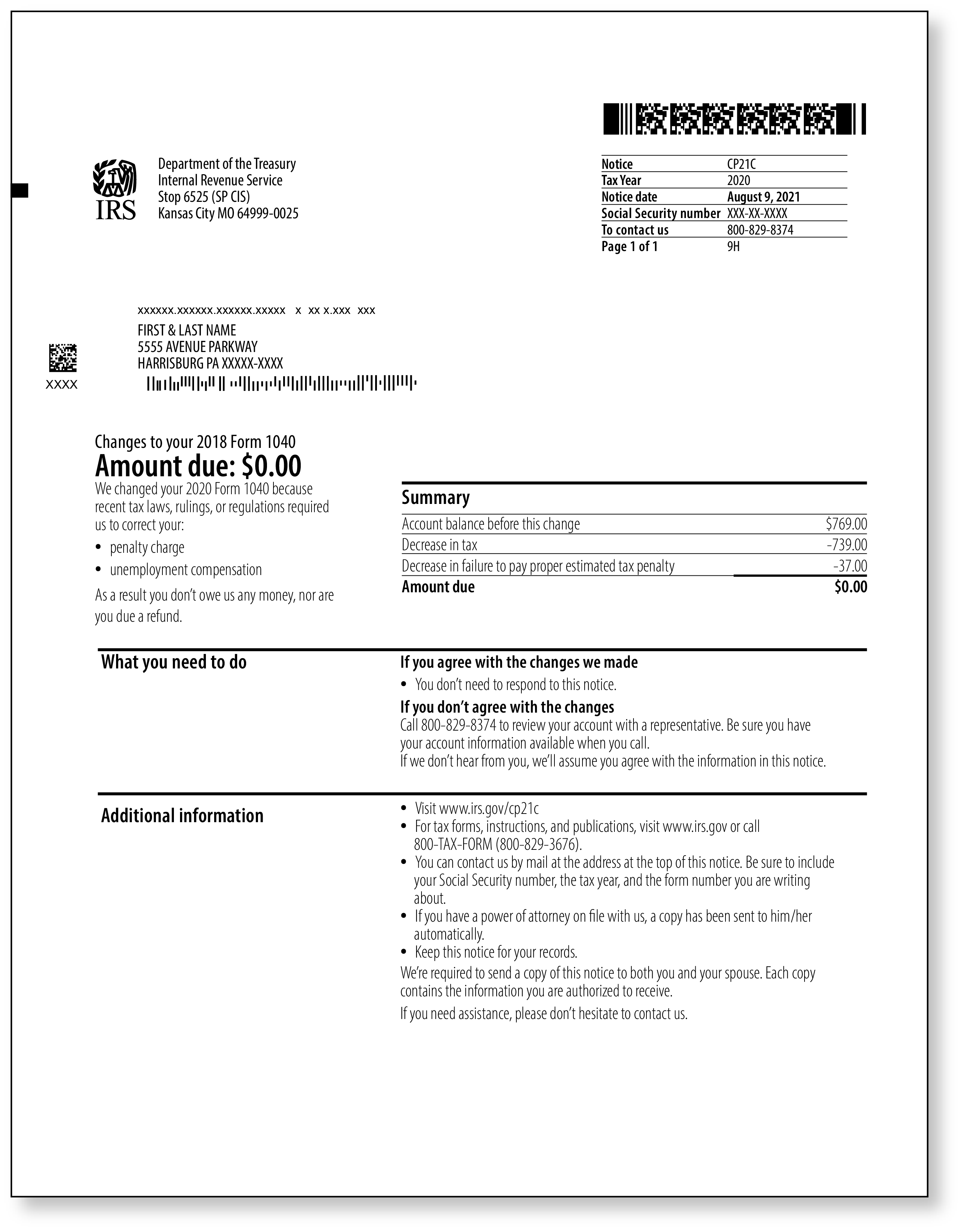

The IRS sends out an IRS Notice CP21C when a taxpayer requests to make a change to their tax return. (A couple of ways taxpayers can request a change are by filing an amended return, a Form 1040-X, or by mailing/faxing a letter to the IRS.) The tax return for the year in question will be listed on the top right corner of the notice. The notice will inform you that the change you requested has been completed. Additionally, the notice will state that you are not due a refund or you do not owe any additional amount to the IRS. Based on the changes, your balance due is zero or your refund is under $1.

What do you need to do?

You will want to review the notice in its entirety to be sure that the changes the IRS made are the ones you requested. If the changes are accurate, no real action is needed to be taken on your part. Be sure to correct the copy of the tax return you have at home in your records to indicate this change. This will help you in future years to ensure you do not make the same mistake again.

If you disagree with the changes, you will want to contact the IRS at the number listed on the top right corner of the notice. If you have a membership with TaxAudit for the tax year of the notice, this is something that one of our team members would be happy to help advise on. Simply click here to get a case started or call our Customer Service Department at 800-922-8348.

What if you don’t remember asking the IRS to make a change to your tax return?

If you do not remember asking the IRS to make changes to your tax return, you will want to call the IRS directly at the phone number listed on the top right corner of the notice. This will also allow you to find out what the IRS received to initiate a change to your tax return.

What if you need to make additional changes to your tax return?

If you need to make any additional corrections to your tax return, you will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return. For more information on amended returns, please click here.

What if you have contacted the IRS multiple times without any response?

If you have attempted to reach the IRS several times and have not received any answers or responses, you will want to contact a Taxpayer Advocate by calling 877-777-4778 or, for TTY/TDD, 800-829-4059.

What if you think you might be a victim of identity theft?

If you believe that you might be a victim of identity theft, you will want to contact the IRS at the number on the top right corner of the notice immediately. You will also want to refer to the IRS Identity Theft resources for additional information.

What are some helpful tips?

The IRS recommends filing your taxes electronically. By filing your tax return electronically, mistakes can be avoided and there may be additional credits and deductions you qualify for that you might have missed by filing by mail. If you would like to learn more about e-filing your tax return, click here.