IRS Notice CP21E | Changes Tax Return Due to Recent Audit

September 11, 2023 by Charla Suaste

So, you’ve received an IRS Notice CP21E. What is it? Why did you get it? What steps should you take next?

What is an IRS Notice CP21E?

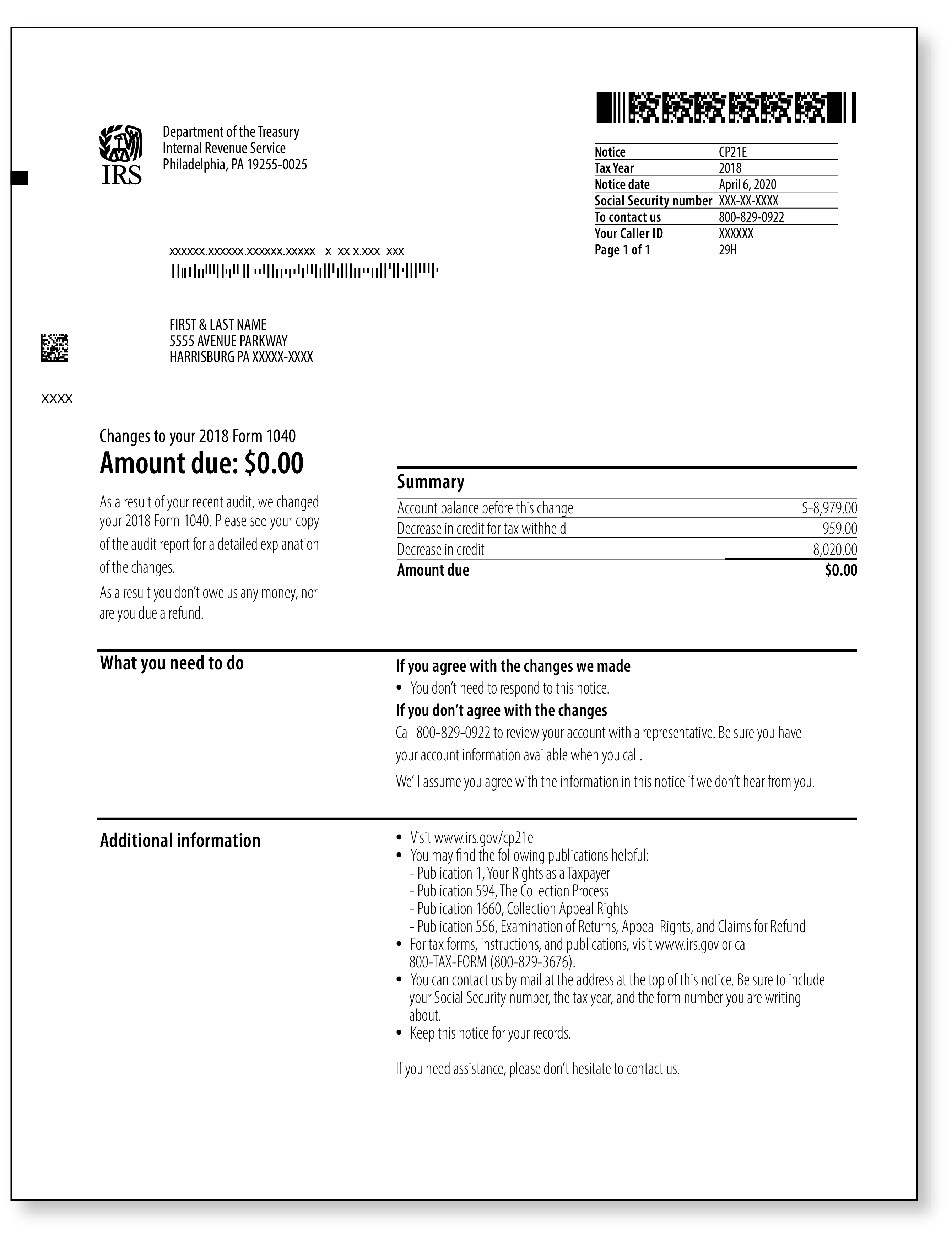

'This notice is sent from the IRS to inform taxpayers that an audit was recently done on their tax return, and, upon completion, the IRS determined that:

- Changes were made to the tax return and

- Those changes resulted in additional tax due.

Why did I get this notice?

As mentioned previously, the IRS is issuing you this notice to inform you they recently completed an audit on your tax return and determined that you owe additional tax. There are a couple scenarios that could’ve played out before you got to this point. The first is that you have been corresponding with the IRS regarding a recent audit and this notice is their most recent determination. The second scenario is that you were unaware your tax return was being audited, and this notice is a surprise to you. Regardless of which scenario is specific to you, please read on to see what steps you should take next.

What should I do in response to this notice?

The first step you should take is to read the notice in its entirety, top to bottom, front to back. There will be additional pages attached that outline the parts of your tax return that were being audited and the IRS’ determinations on each of those line items. You will also want to review the corresponding tax return – as well as any supporting documentation and records – and see if the changes the IRS made to your return are correct.

If, after reviewing the contents of the notice, you agree with the IRS, you will need to pay the tax due. There are several options to choose from:

- If you can pay the amount in full by the deadline, that is the recommended option as this will help you avoid accruing additional interest and penalties on the amount due. You can easily make a payment on the IRS’ website or by sending in a check, along with the payment coupon attached to the notice.

- If you are unable to pay the amount due all at once, you have the option to enter into a payment plan with the IRS. If you would like to try and take advantage of this option, you should call the number listed on the notice or visit IRS.gov for more information.

If you do not agree with the changes the IRS is making to your tax return, you will need to call them to find out your next steps. You may have the option to file for an Audit Reconsideration or appeal your case. More information about how to take these courses of action can be found here: https://www.irs.gov/individuals/understanding-your-cp21e-notice.

However, if you have an Audit Defense membership with TaxAudit and are unsure about your next steps, please contact us immediately. We will request copies of all the notices you’ve received, the tax return, and any corresponding documentation and assign you to one of our Tax Professionals who will advise you on what you should do next. If it appears that you do owe the tax the IRS is requesting, your Tax Pro will advise you on the steps you should take regarding payment. If the IRS notice is incorrect, however, your Tax Pro will step in to represent you. They will handle phone calls and audit appointments on your behalf with the goal of making sure you pay no more tax than what you rightfully owe.

If you do not have an Audit Defense membership but would like to have peace of mind in the event that you do receive an audit or notice from either the IRS or the state, please check our website or contact our Customer Service Team at 800.922.8348 and they will be happy to help you get started.