IRS Notice CP32A | Call to Request Your Refund Check

September 27, 2023 by Kaylie Jonutz

Every year, you spend hours on your taxes. You ensure that every number is correct and try to maximize your refund potential. The grueling process is an annual chore that everyone must endure to some effect, even if you have a tax preparer. The process can feel like it is lasting forever; however, most of the time, it is worth it in the end. Finally, you submit your return and anticipate when your refund will arrive—alas, freedom! Once you submit, you are able to see what your return is and, whether this is what you were expecting to get or not, you are relieved it is over. This value might already be spent in your mind before you get the check. It’s your money to spend however you see fit, but now you must play the waiting game, and anticipate its arrival.

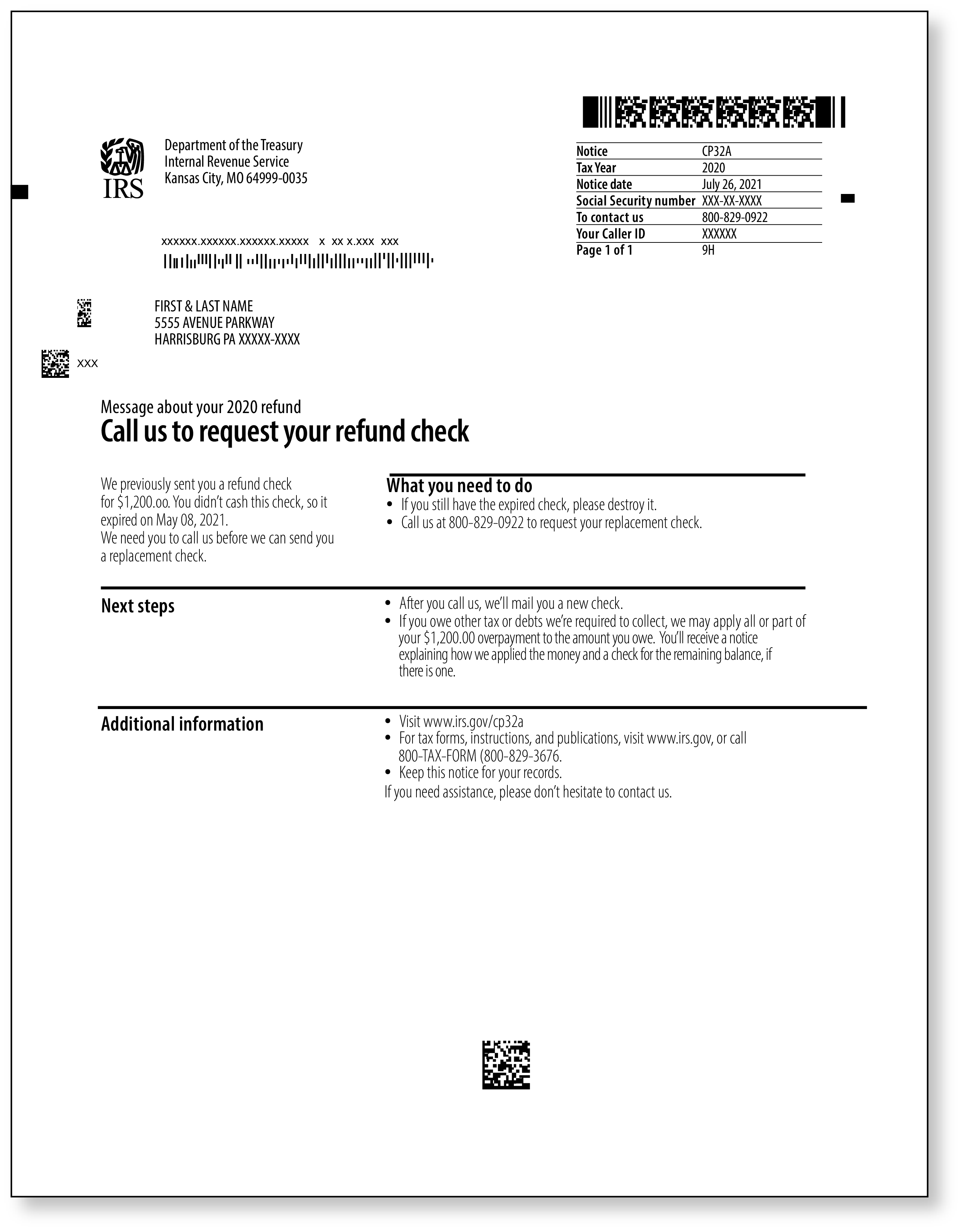

Time goes away, and you do not receive your refund check. Then you receive an IRS CP32A notice – but, before you panic, take a deep breath. This notice does not involve you having to pay the IRS more money and doesn’t even include an audit process. On the contrary: you owe the IRS nothing; they owe you!

What is an IRS notice CP32A and why did I receive it?

An IRS Notice CP32A is informing you that your refund check has not been claimed. To resolve this notice, you must call to request a new refund check. After you call the IRS, you should receive your refund check within 30 days. If you do have your previous refund check, please destroy it as it is no longer valid.

What if I owe the IRS money for another tax year?

If you owe any taxes or debts to the IRS, they will pay these outstanding balances using this unclaimed refund money. If the IRS does this, they will send you another notice breaking down the allocations as well as a check, if there is a remaining overpayment balance.

What can I do to avoid this?

Filing your taxes online can help you avoid mistakes and find credits/deductions you might not have known you could claim. Another way to prevent this in the future would be to request a direct deposit for your refund, which can be done electronically or by paper file. Direct deposit will get you your return faster and it is a more secure way to receive a refund.

Don’t want to deal with this notice alone? If you have an Audit Defense membership for the year in question, you do not have to deal with the IRS alone. All you must do is, contact us immediately, and you will have both a Case Coordinator and Tax Professional on your side to help handle this notice and any potential future notices for the tax year. The assigned Tax Professional will make calls for you, attend all meetings, and submit the correct information on your behalf. Lastly, our tax professionals will make sure that you are getting all the money you are entitled to from the IRS.

If you are not a member, consider signing up for our world-class Audit Defense membership. Whether it is assistance with this notice or dealing with a larger audit, TaxAudit can handle it, so you can have peace of mind.