IRS Notice CP49 | What It Is and How to Respond

June, 01 2023 by Kate Ferreira

Getting mail used to be a fun experience. Maybe you would wait at the end of the street to catch the mail carrier, hoping to catch a glimpse of a small white envelope that had your name perfectly scribbled on the “to” section. After weeks of waiting for some type of correspondence, whether it be a postcard from a friend traveling abroad or a letter from your grandma, you finally receive a handwritten note, sprawled with details of their life and comings and goings. It was a much simpler time.

Now, our mailboxes are filled with bills, junk mail, and sometimes, letters from the IRS. If you found yourself on this page, it is likely you received a letter from the IRS – an IRS Notice CP49. You are probably curious why you got this letter and how to respond. In this blog, I will answer both of these questions, as well as provide answers to other frequently asked questions.

What is an IRS Notice CP49?

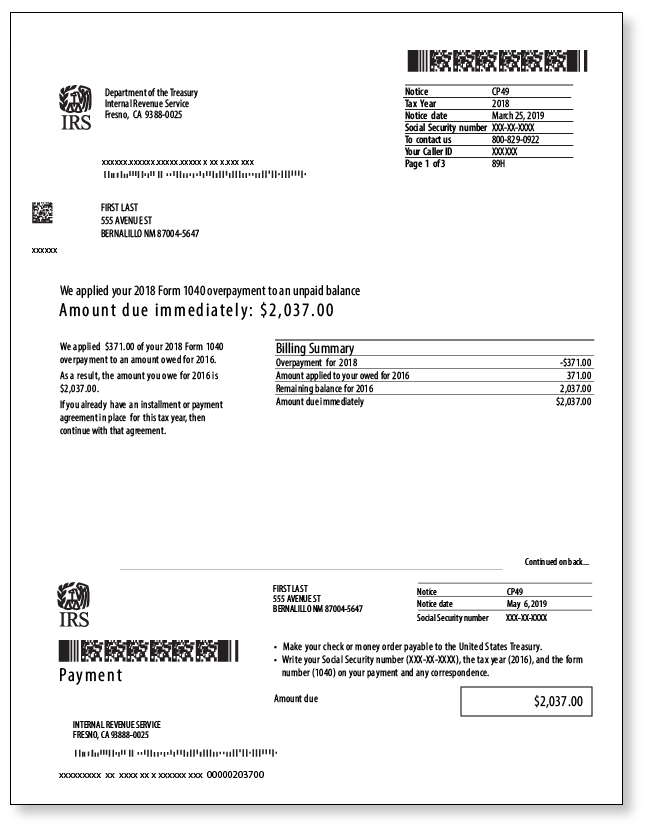

An IRS Notice CP49 is a letter from the IRS informing you that they used all or part of your tax refund to pay a past-due tax debt that you have. The first page of the notice will tell you which year you owed back taxes and the amount that was applied to this debt. Depending on the amount of your refund and back taxes due, you will either receive a check for any remaining refund or notification of a new balance due. Be aware that your federal tax refund may be offset for another debt besides taxes. Sometimes the Treasury Department’s Bureau of Fiscal Services (BFS) will seize a taxpayer’s federal income tax refund and apply it to pay back child support, student loan payments that are in arrears, to repay state unemployment compensation debts, or pay for past-due state income taxes. If it appears your refund was not applied to past-due taxes, it is likely the refund was seized by the BFS for one of the above-listed reasons.

Do I need to respond?

Whether you need to respond depends on if you agree with the notice. If you agree with the amount owed for the year indicated by the IRS, then you do not need to respond. If the full balance owed was fulfilled by your tax refund, then no action is required on your part. If the refund did not satisfy the entire balance due, and the notice still indicates an “amount due immediately,” you will need to contact the IRS to set up a payment plan (if you are unable to pay the remaining balance in full). You can click here and here to learn more about setting up payment plans with the IRS.

If you do not agree with the IRS notice, you will need to contact the IRS directly at the toll-free number in the top right corner of your notice. Please be sure to have any appropriate paperwork available when you call.

If your refund was offset for a debt collected through the BFS and you do not agree with the seizure, then you will need to contact the BFS.

What if only part of my refund was used? Where does the rest go?

If only a portion of your tax refund was used to pay for past owed debt, the remaining amount will be issued to you.

What if I know I owe no back taxes and none of the other debt the Bureau of the Fiscal Service collects? Or, what if I know I did not file a return for the year showing the refund? What do I do?

If you are certain you did not file a return for the tax year that is showing a refund and do not owe any back federal taxes or have any debt the BFS collects, then it is possible you may be a victim of tax-related identity theft. In this case, you will want to contact the IRS as soon as possible.

Do you have any tips to prevent this from happening?

If you currently file your returns by mail, you could consider filing your taxes electronically. This will not only help you avoid mistakes but, by filing online, you might find additional credits and deductions you qualify for. If you are concerned about tax identity theft, you can obtain an Identity Protection Pin (IP PIN). This is a six-digit number that is known only by the taxpayer and the IRS and helps prevent someone that is not you from filing a return using your identity. For more information on the IRS IP PIN program and how to obtain one, please review their “Get An Identity Protection PIN (IP PIN)" webpage.

The amount I owe is overwhelming, can you help me?

If your tax debt is over $10,000, and you would like assistance in getting set up on a payment plan or assistance with any other type of tax debt relief, such as an Offer in Compromise, click here to sign up for a free consultation. Our tax experts have over 1,700 years of combined tax experience and will be happy to get you back on the right track.