IRS Notice CP501 – Unpaid Taxes Due | How to Respond

May 26, 2023 by TaxAudit

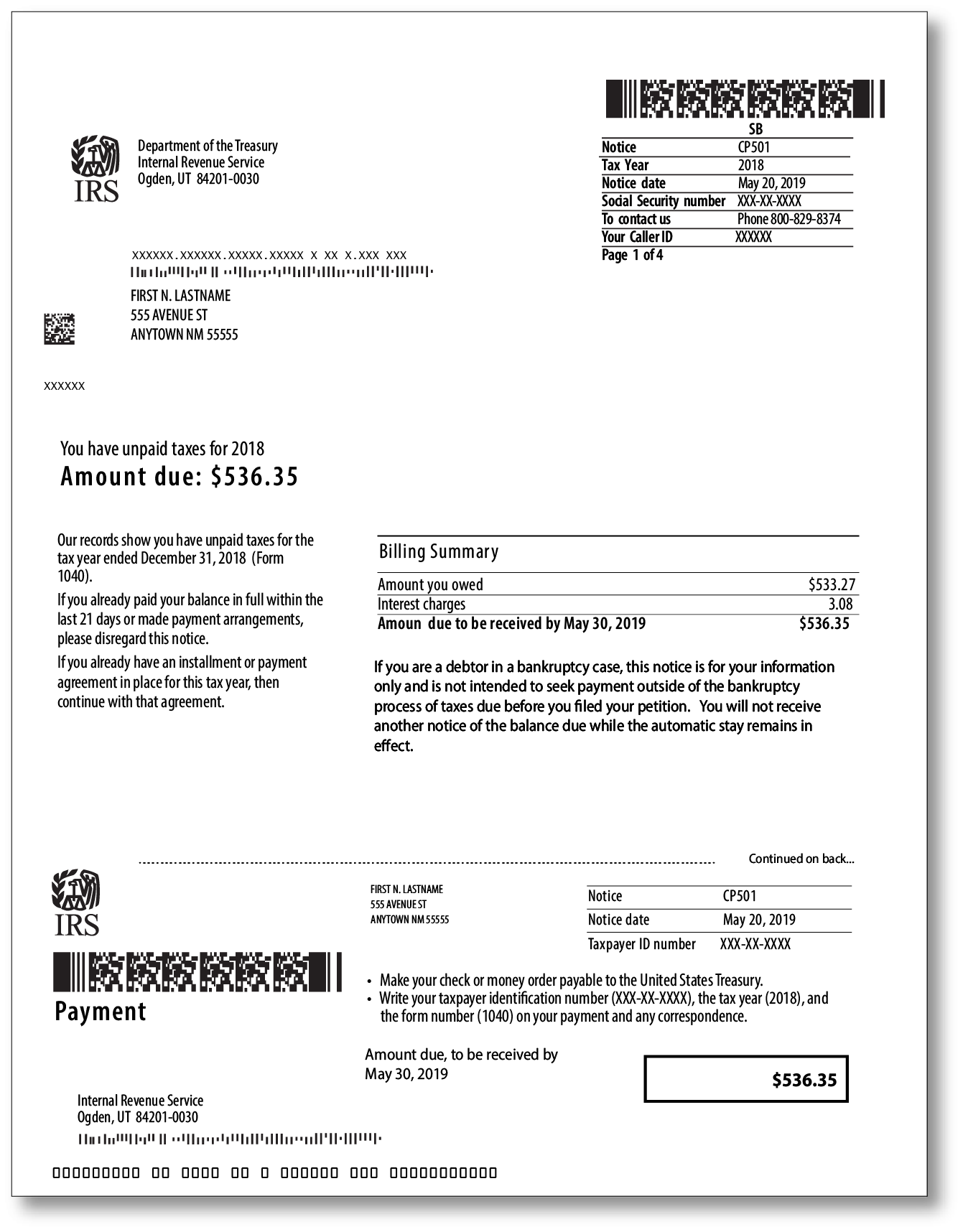

An IRS CP501 is an official notice from the IRS Collections Unit that is sent to taxpayers to inform them that they have an outstanding debt. The notice is used to inform taxpayers of the amount owed, including any penalties and interest that have accrued on their federal tax debt. It also provides taxpayers with a deadline to pay the tax debt in full, and explains options to set up a payment plan, if it is determined that they qualify for one.

If you received this notice, it is important to read it carefully and ensure that you understand what it means, how to respond, and what steps you should take to resolve the issue. Generally, before the IRS sends a taxpayer a CP501 notice, the taxpayer receives IRS CP14, Notice of Tax Due and Demand for Payment. If the IRS does not get a response from the taxpayer, they may send the taxpayer IRS CP501, which is considered the first reminder notice. The IRS considers a response from a taxpayer to be any one of the following actions:

- Payment for the entire balance due;

- Requesting a payment plan; or

- The taxpayer notifying the IRS that they believe the notice was sent in error.

If you fail to respond to the letter, the IRS may send another reminder notice before issuing a notice of intent to place a lien on your assets or issue a levy. If you owe past due taxes on more than one tax year, the IRS may forgo the reminder notices and go straight to issuing a notice of intent to place a lien or issue a levy. They may also impose additional penalties and interest on the tax debt, which can result in a higher overall amount due.

The CP501 also includes information on what to do if the taxpayer disagrees with the amount of tax debt owed. If you believe that the notice is inaccurate, they have a right to dispute the amount with the IRS. The notice will provide information on how to file a dispute, including what supporting documents will be necessary to do so.

How to respond to an IRS CP501

One of the most important steps in responding to the CP501 notice is to act quickly. If a taxpayer notices any errors in the notice, it should be corrected as soon as possible with the IRS. If the amount due on the notice is correct, it’s important to take the necessary steps to resolve the situation before further collection actions are taken.

Taxpayers who receive CP501 may have different options to resolve the issue, such as setting up a payment plan – often referred to as an installment agreement – with the IRS. Payment plans allow taxpayers to postpone payment for an agreed-upon time or pay the balance due in monthly installments. Eligible taxpayers may qualify for an Offer in Compromise, which allows you to settle your tax debt for less than the full amount due.

Another important thing to remember when responding to a CP501 is knowing your rights as a taxpayer. When communicating with the IRS, you have a right to representation, and taxpayers who are facing challenges with the IRS can seek out help.

If you’ve received a notice like this one, the good news is that, with an Audit Defense membership, our team of enrolled agents, CPAs, and attorneys are happy to help. As the largest tax representation provider in the country, we believe that no one should have to face the IRS alone.

If you have a tax debt of over $10,000, our tax debt relief department can help you get on a payment plan, or assist with other types of tax relief. You can sign up for a free consultation here, or by calling us at 855-839-2308.