IRS Notice CP518 | Tax Return Overdue | What To Do

January 24, 2024 by Charla Suaste

There are things most of us dread universally – dentist appointments, traffic jams, phone calls from solicitors, and, yup, you guessed it: getting mail from the IRS. Even if we are expecting a refund or some other good news from the IRS, it is still nerve-wracking to open your mailbox and see an envelope with the letters I-R-S stamped in the top left-hand corner.

Unfortunately, most letters that taxpayers receive from the IRS do not bear good tidings about an incoming refund. Rather, they are correspondences that require action on the part of the taxpayer. An IRS notice CP518 is no exception.

What is a CP518, you might be wondering?

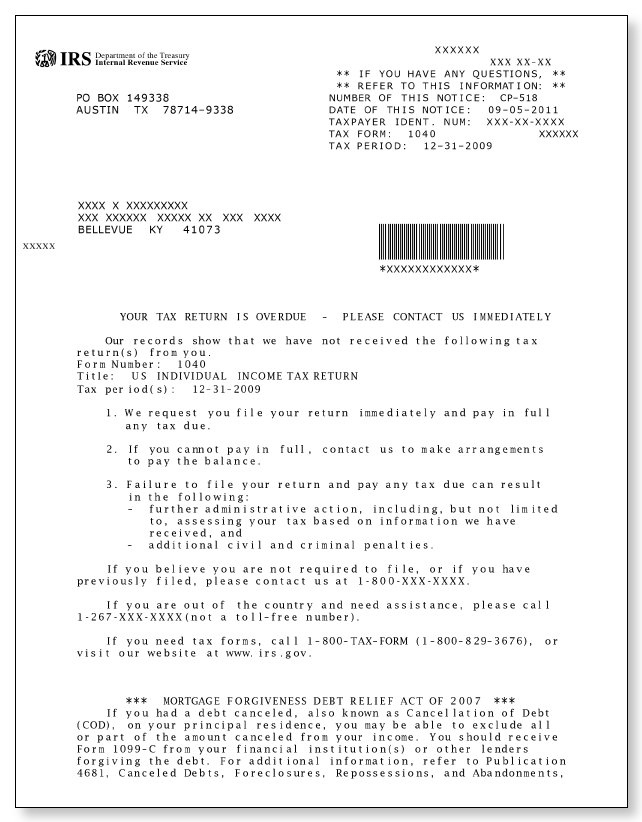

A CP518 notice is issued by the IRS to taxpayers because they have no record of a tax return being filed for the year listed on the notice.

Usually, a CP518 is furnished to a taxpayer only after the IRS has sent other reminder notices with no response and believes there is tax due. Under most circumstances, CP518 is the final notice a taxpayer will receive before the IRS takes further action by preparing a tax return on behalf of the taxpayer for the year at issue. A tax return that is prepared by the IRS using the information they have received from other third parties is known as a Substitute for Return. In many instances, the information is gained from Forms W-2 and Series 1099s, such as a 1099-NEC for miscellaneous income, 1099-K for payment card and third-party network transactions, Form 1099-B for sales of stock, etc. Frequently, the return the IRS prepares will generate a higher tax liability than the return prepared by the taxpayer or tax professional. This is because a substitute for return does not take into consideration itemized deductions, optimal filing statuses like married filing joint or head of household, dependents that qualify a taxpayer for credits such as the Child Tax Credit, and other tax credits and adjustments.

So, what does this mean for you? And what should you do next?

With any IRS letter, the first thing you should always do is read the notice top to bottom, front to back. Make sure you understand what the letter is claiming and make note of both the tax year in question as well as any pertinent deadlines.

Next, you need to determine if the IRS’ claims are correct.

- If you know that you did not file the tax return for that particular year, you should do one of the following:

- If you have a filing requirement, prepare your income tax return. Next, complete Form 15103, Form 1040 Return Delinquency. This form is used to explain to the IRS the circumstances surrounding why you are filing your return late. Be sure to submit your return as soon as possible and include a completed Form 15103 and the return stub from your CP518 notice. You can file your return by mail or using the fax number listed on the notice.

- If you do not believe you need to file a tax return, you still will need to complete Form 15103 and send it to the IRS, making sure to explain on the form why you believe you do not need to file. You can send this information to the IRS using the fax number listed on the notice or by responding via mail.

- If you already filed your tax return within the past eight weeks of receiving the notice, you do not need to do anything at this time. This includes sending a completed Form 15103. However, if 8 weeks have passed and you have not heard back from the IRS, complete Form 15103, indicating you already filed your return. When mailing back the completed form, include a signed and dated copy of the return you already filed as verification of filing. Additionally, enclose a copy of your e-file confirmation, certified mailing receipt, or overnight mailing label if you have it.

Whether you are just now filing your return, explaining you were not required to file a return, or have already filed your return, it is important to mail the correspondence to the IRS either certified with a return receipt request or by using a private mail service, such as UPS or Federal Express, that traces and records when a package is delivered.

Of course, if you have an Audit Defense membership with us for the year in question and don’t want the hassle of having to deal with the IRS, give us a call or report your notice online as soon as possible! We will assign your case to one of our Tax Professionals who can review the notice and advise you on the best plan of action to take in order to come to the quickest and easiest resolution with the IRS! If you don’t have a membership with us, but would like to see what it’s all about, click here for more information. We are here to defend our members and make sure they never have to face the IRS alone.