IRS Notice CP90 | Intent to Levy Assets for Unpaid Taxes

August, 23 2023 by Kate Ferreira

You just received an IRS Notice CP90 in the mail. The words “Intent to seize your assets and notice of your right to a hearing” are scrawled across the top of the page with a tax amount due. The main thing you might want to do in this moment is panic. However, if you found yourself reading this blog, clearly you are wanting more information about why you received this letter and what your next steps are.

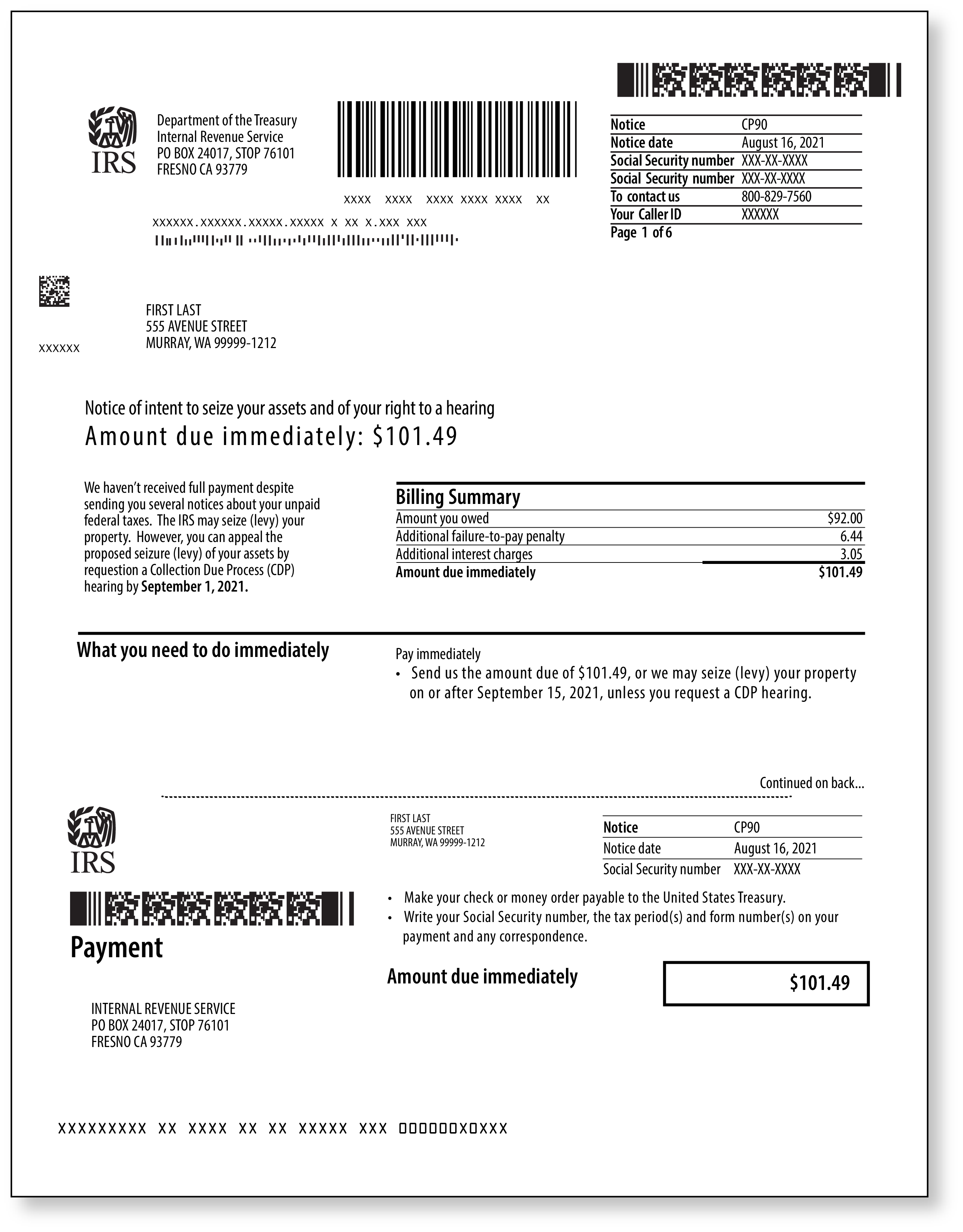

What does an IRS Notice CP90 look like?

Below is an example of an IRS Notice CP90.

Why did I receive this letter?

An IRS Notice CP90 is sent by the IRS to notify you of their intent to levy certain assets for unpaid taxes. At this point, the tax has been assessed by the IRS and is now past due. Generally, taxpayers receive this letter after the IRS previously sent multiple notices regarding unpaid federal taxes.

What if I didn’t receive any prior notices?

If you moved within the past few years and did not update your address directly with the IRS, there is a likelihood that these notices went to a prior address. Unfortunately, whether you were previously aware of these notices or not, taking a proactive approach to resolving this issue is important. Something you can do to get a better understanding of your tax situation is to request an IRS transcript for the year of your CP90 notice, which will be indicated in the top right-hand corner. The IRS has several types of transcripts available, and the good news is they are free of charge. Transcripts can be requested online, ordered by mail, or obtained by phone. They provide useful information, such as the changes the IRS made to your account, the wages and other income reported to the IRS by third parties, and the basic data that was included in your return, if filed. Information about the different types of transcripts and how they can be obtained can be found by clicking here.

What are my options?

Whether you were aware of the previous notices or not, unfortunately, the tax situation has escalated to a place where the IRS is taking action to receive the amount owed. The first thing you will want to do is read the notice in its entirety to understand what the IRS is requiring.

If you agree with the contents of the notice, you will want to make arrangements to pay the notice. This can be done by paying the balance due on the IRS website by clicking here. The IRS also accepts checks by mail. If you decide to mail a check or money order to the IRS, be sure to write your Social Security number and tax period(s) in the memo section of the check. This might seem a bit unorthodox considering the rise in identity theft, but this is how the IRS traces the check to the correct taxpayer account. The check should be made out to the United States Treasury, and not the IRS. And remember, when mailing correspondence to the IRS, especially a payment, you want to send it certified with return receipt request.

If you are unable to pay the balance in full, you can request a payment plan with the IRS. For general information on the various payment plans available and what it takes to qualify for each payment plan, click here to learn more.

If you disagree with the notice, you have the option to request a Collection Due Process hearing with the IRS. To move forward with this option, you will need to complete an IRS Form 12153 which can be found by clicking here. Keep in mind, you only have 30 days from the notice date to request a Collection Due Process hearing. Generally, this due date is also listed on the notice, so make sure to take note of that as it is very important to file the request for this hearing in a timely manner. With a Collection Due Process hearing, a taxpayer still has the option to petition the Tax Court if they do not agree with the IRS Independent Office of Appeals decision. If you do miss the 30-day window to request a Collection Due Process hearing, you may still request an Equivalent Hearing within one year from the date on the Notice of Intent to Levy. An Equivalent Hearing is requested by submitting IRS Form 12153, the same form that is used to request a Collection Due Process hearing. However, you will not have the option of petitioning the Tax Court if you disagree with the decision.

Planning to vacation or visit family outside the U.S.? Your plans could be foiled if you owe the IRS more than $59,000 in taxes, including penalties and interest.

Another important thing to consider is if you owe the IRS more than $59,000 (for 2023) in taxes, the IRS will notify the State Department of the unpaid debt, certifying that the balance due qualifies as a seriously delinquent tax debt. Once the State Department is notified of your seriously delinquent tax debt, the State Department may revoke your passport. By paying the entire balance due, entering into a payment plan, or timely filing a Collection Due Process hearing, a passport revocation can be avoided, or at the minimum, postponed. More information about the revocation or denial of a taxpayer’s passport due to a seriously delinquent tax debt can be found by clicking here.

What if I don’t want to do this alone?

We understand that receiving an IRS Notice CP90 can be scary. If you do not want to go through the process alone, we offer Tax Debt Relief services to help resolve tax debts over $10,000. Our Tax Debt Relief Department can help get you set up on a payment plan or investigate other types of tax relief. We have helped over 350,000 clients with their tax needs and have over 1,700 years of combined tax experience. We offer free consultations to review your options and hopefully relieve some of your stress. For more information about our services, click here. If you would like to sign up for one of our free consultations with one of our excellent Tax Professionals, click here.