Learn About IRS Notice CP25 | Account Balance Is Zero

November 02, 2023 by Kaylie Jonutz

Tax season is always taxing for everyone involved. Even if you are not the one preparing your taxes, it can be a tense season. How much will you receive back this year? Will you end up owing any money? You spend hours on your taxes and hope for the best in the end. Did you make sure to include everything?

Everyone tries to be diligent when working on tax materials; however, we are all only human, and mistakes happen even to the best of us. Sometimes, no matter how careful we are, we can add up numbers wrong by counting them twice, three times, or not at all. It is also possible we have forgotten to account for an estimated tax payment made months ago.

What is an IRS notice CP25 and why did I receive it?

All those fears and anxieties around the preparation and filing process are then amplified when you receive an IRS letter – especially if you receive an IRS CP25 notice.

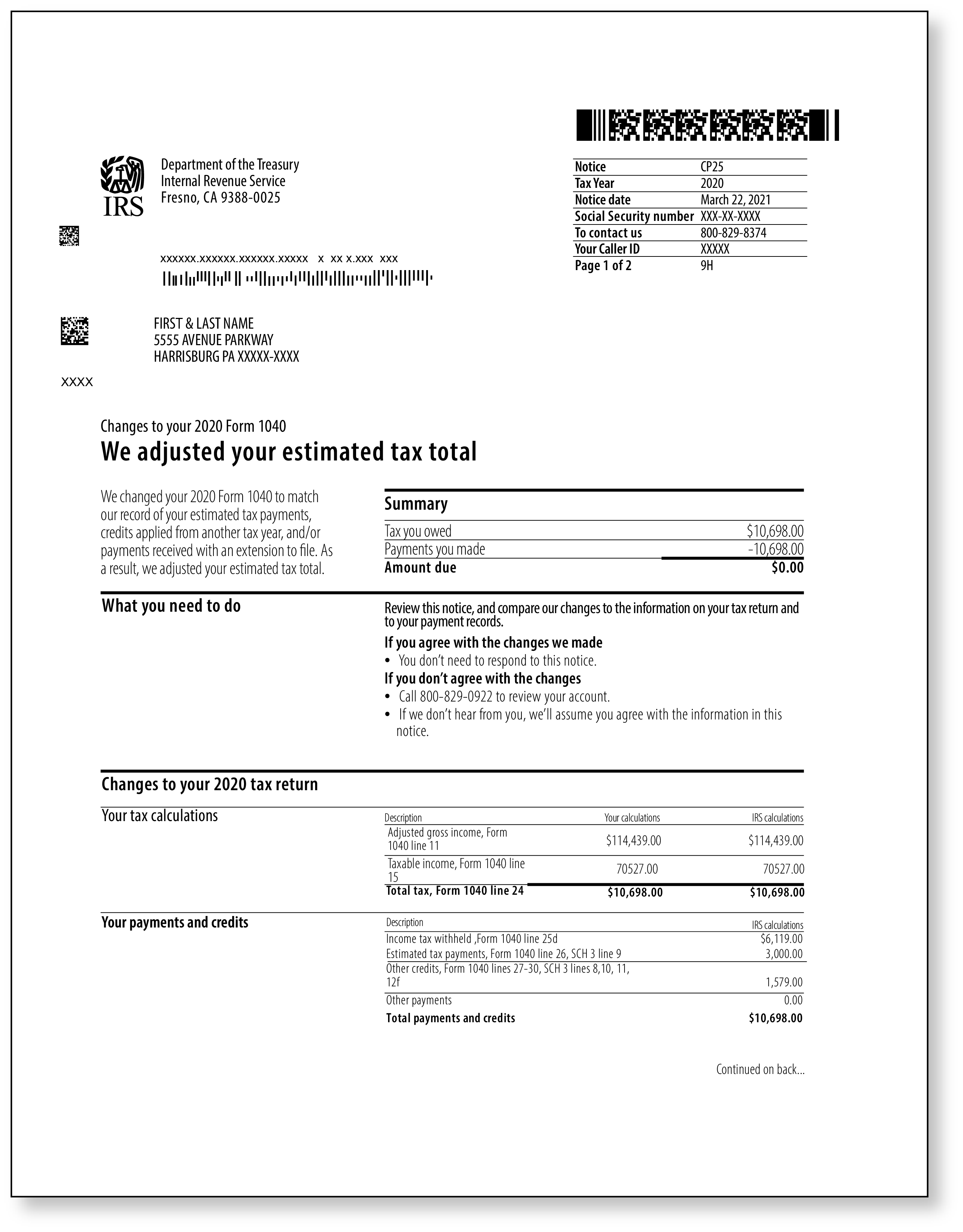

This notice informs you that there was a difference between the estimated tax payments you reported on your tax return and the amount that the IRS posted to your account. However, while there is a difference between the IRS’ records and yours, this notice also informs you that the IRS doesn’t owe you – and you don’t owe them!

What should I do now?

The first thing you want to do when you receive an IRS CP25 notice is to read it carefully. The notice explains the changes the IRS made on your return. After reading, the second thing you will want to do is compare the list of payments the IRS applied to your return and see if they applied all the payments you made. After this comparison, if you are still not sure why the IRS made the changes they did, we recommend you contact the IRS using the telephone number listed on the notice. If you agree with the changes the IRS made, you do not need to do anything other than correct the copy of your tax returns for your records.

What if I disagree with the notice?

If you disagree with the notice after reviewing the IRS’ claims alongside your records, you should contact the IRS. Please note that you must contact the IRS within 60 days of the date listed on the notice. You can contact the IRS using the telephone number on the notice or by mailing a letter. If you decide to respond by mail, make sure to fill out the Contact Information section of the notice and include it with your correspondence, which should include any documentation about your position. Remember, never send original documents to the IRS as, more than likely, the documents will not be returned to you. Only include copies of any documents you send. When sending any correspondence to the IRS, it is good practice to mail it certified with return receipt request to verify the letter was sent and received timely.

Is there anything else I can do?

Always review your estimated tax payments to avoid any underpaying/overpaying when you file your future tax return. The use of electronic filing may be able to aid you through the process of accounting for all your estimated tax payments so you can minimize the potential risk of receiving an IRS CP25 notice.

If you are an Audit Defense member, you will not have to deal with this notice alone if you disagree with the letter. All you must do is contact us immediately and we will guide you through the next steps.

If you are not a member, consider signing up for our Audit Defense membership. Whether it is assistance with any future notice or dealing with a larger audit, TaxAudit will be able to represent you in the audit process!