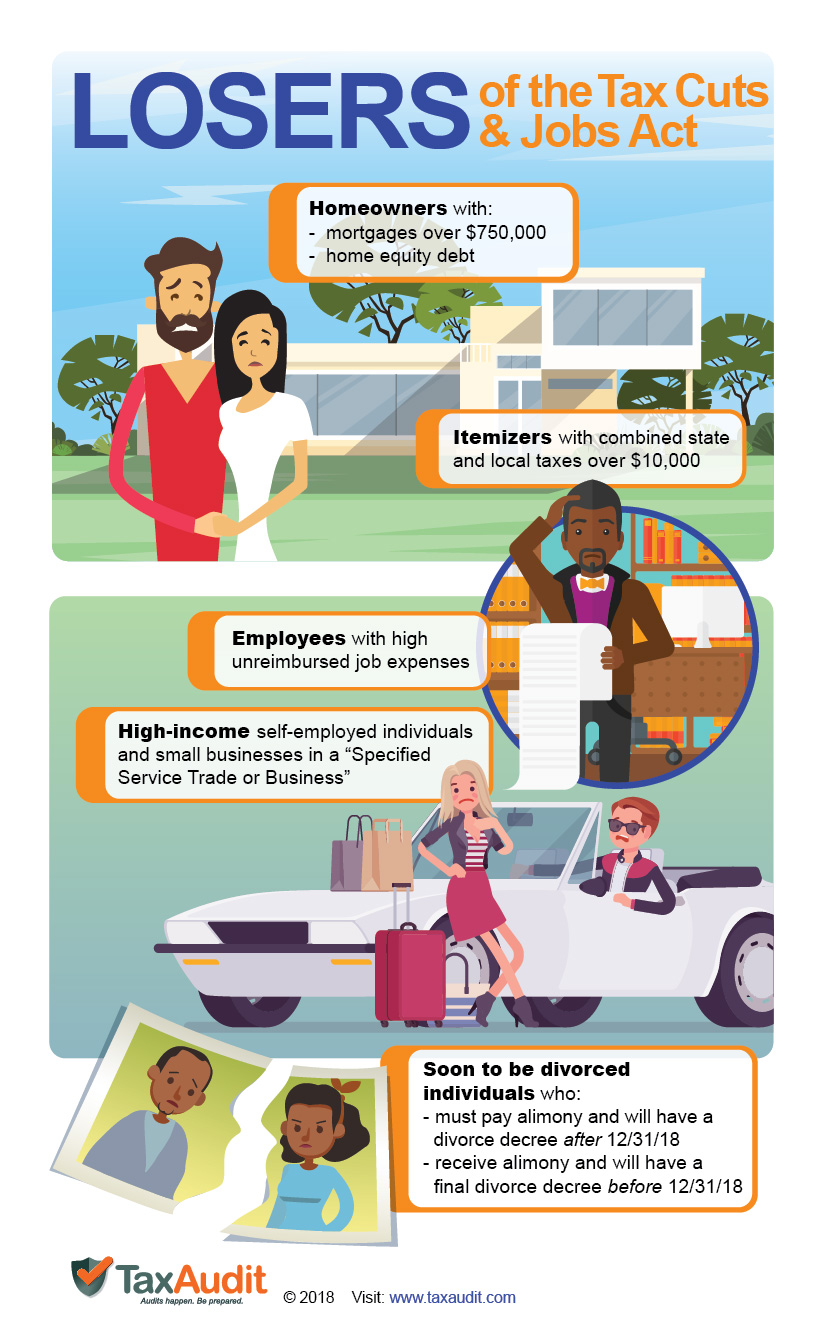

Potential losers of the Tax Cuts and Jobs Act

December 04, 2018 by Dave Du Val, EA

Many taxpayers will be surprised that they owe more than usual this year. In addition, many more people will likely owe extra money as a result of inadequate withholding because the new withholding tables were not accurate.

Among the taxpayers who could pay more this year are certain homeowners with high loan balances, homeowners with nonqualified home equity debt, itemizers whose combined state and local taxes are over $10,000, and parents whose dependents are 17 and older.

Here is a list of some of the taxpayers likely to be most harmed by the new tax law:

Homeowners

- Taxpayers whose home mortgage loans are above $750,000 and loans were originated after 12/15/17. These taxpayers are subject to the new $750,000 mortgage loan limit.

- Taxpayers with acquisition debt of more than $1 million from loans originated on or before 12/15/17. (Previously, interest from an additional $100,000 in acquisition debt was deductible.)

- All taxpayers that have a HELOC (home equity line of credit) that was NOT used for acquisition, building, or improvements on their principal home – interest is no longer deductible.

Itemizers

- Taxpayers who have combined state and local taxes over $10,000 due to the new $10,000 cap.

- Taxpayers who pay foreign property taxes, as this is no longer a deduction under the new rules.

- Employees who are no longer allowed to deduct their unreimbursed expenses (e.g. office-in-home, mileage, travel, meals, and entertainment).

Self-Employed Taxpayers

- Self-employed taxpayers whose income is above the threshold will be ineligible for the new Section 199A deduction if they are in a “Specified Service Trade or Business (SSTB).”

Parents and Taxpayers with Dependents

- Taxpayers with dependents 17 and over will lose the dependent exemption and the Child Tax Credit.

Soon to be Divorced Taxpayers

- Taxpayers who must pay alimony and were divorced after 12/31/18. The deduction of alimony is no longer a valid deduction.

- Taxpayers who receive alimony and will have a final divorce decree before 1/1/19 will have to claim the alimony as ordinary income.

- Certain factors, such as a home office (not as an employee, however), can help to maximize your home mortgage interest deduction.

- Taxpayers with foreign taxes paid generally would benefit by using Form 1116 if they are over the $10,000 limit.

- There is a new $500 credit for eligible taxpayers who support a dependent that is not eligible for the Child Tax Credit.

Please note: This is only a short list of some of the tax changes. Please spend time learning about the rules at IRS.gov so you are knowledgeable about qualifying deductions, exemptions, and more that may help to reduce your tax burden.