Understanding IRS CP30 Notice | What to Do

April 20, 2023 by Charla Suaste

You hit the “SUBMIT” button as you complete the filing of your taxes and breathe a sigh of relief. Not only is that chore done, but you also believe you are getting a refund!

However, not long after filing, you find yourself rifling through the mail only to stumble across an envelope with the letters I-R-S in the top left-hand corner. You quickly tear open the letter to find an IRS notice CP30 tucked inside.

So, what is a CP30, anyway?

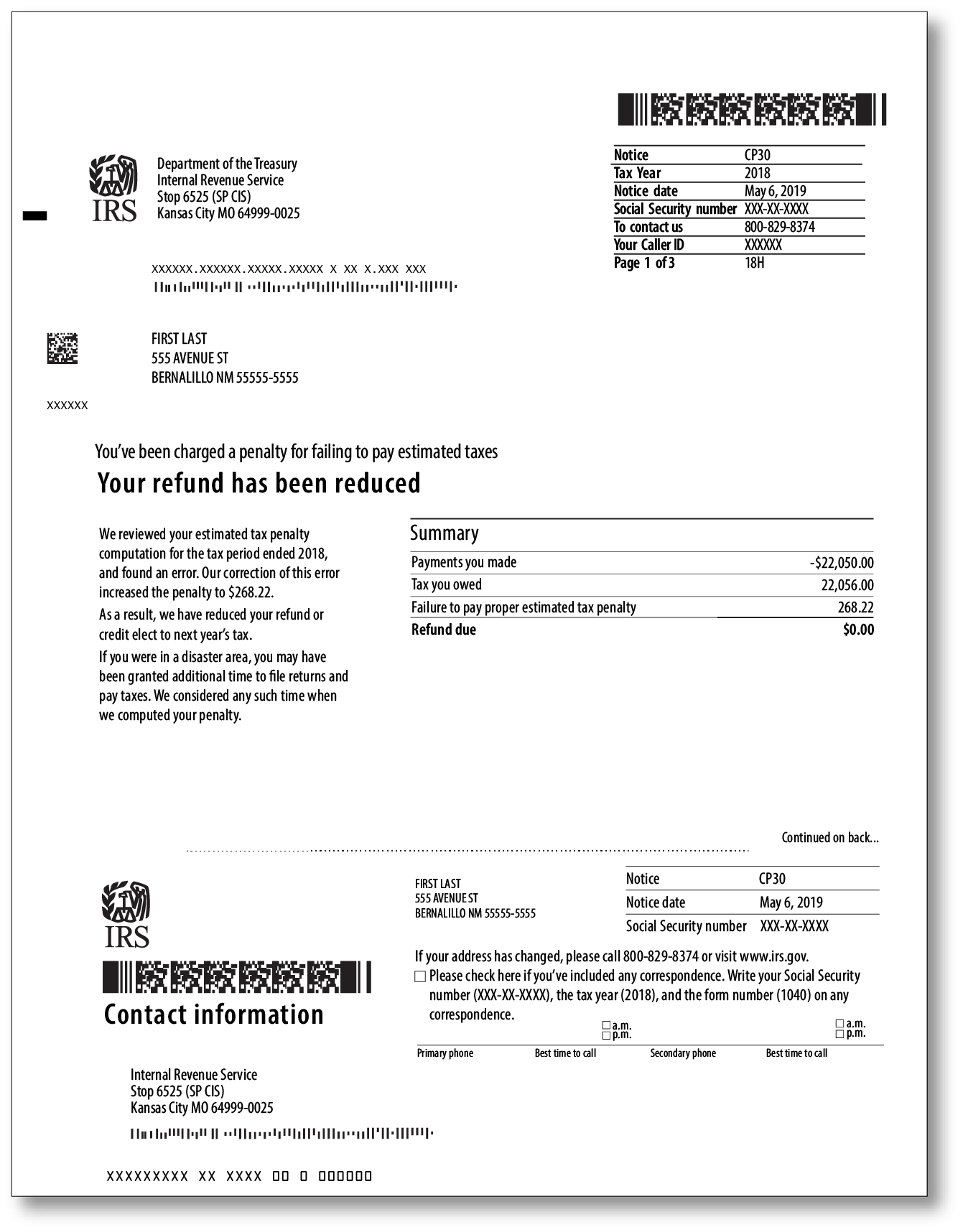

A CP30 notice is sent to inform you that your anticipated refund has, unfortunately, been reduced. On the first page of the letter, the IRS will have outlined why your refund was reduced and list the new refund amount you will be receiving. This amount may sometimes even be reduced to $0.

The reason why your refund was reduced may be due to one of two things. The first may be in regard to withholding. For a withholding issue, it's likely the IRS has no record of withholding reported on the return, either because the withholding was overstated or a number was transposed somewhere on the return. Another reason why your refund was reduced could be that you owed but missed one or more estimated tax payments – and you not only owe the payments that were missed, but you also are required to pay a penalty for missing the payment(s).

This is news that no one wants to hear – but if you have a membership with TaxAudit, we can step in to help!

The first thing to do if you ever receive a notice from the IRS or the state is to call us immediately or go to our website to report your notice. All income tax notices have a deadline by which we need to respond, so it is important we try and get ahead of this deadline as quickly as possible.

Upon receipt of your phone call or submission on our website, one of our Customer Service Representatives will verify your membership and get a case started for you. They will begin by getting you set up in our secure portal, and then they will assign a Case Coordinator to work with you. This individual will provide administrative support to you throughout the duration of your case. They will start by requesting a copy of the notice and the tax return in question before assigning you to one of our expert tax professionals.

Once your case has been assigned to a tax professional, they will review your documentation to determine whether the notice is correct. If they determine the notice is correct, they will provide recommendations on the best next steps to get the issue resolved and advise you on what can be done to prevent this issue from happening again in the future. If they determine the notice is incorrect, they will work with the IRS or state on your behalf. This includes explaining your options and developing a strategy, reviewing your documentation before presenting it to the taxing authority, scheduling and attending all audit appointments on your behalf, and making sure you pay no more tax than what you rightfully owe.

However, if you are not a member with us and would like to get the peace of mind that comes with an audit defense membership in the event you ever receive an audit or notice, we would love to have you be a member with us! Click here for more information and to get signed up.