Understanding your IRS CP13 Notice

January, 19 2023 by Charla Suaste

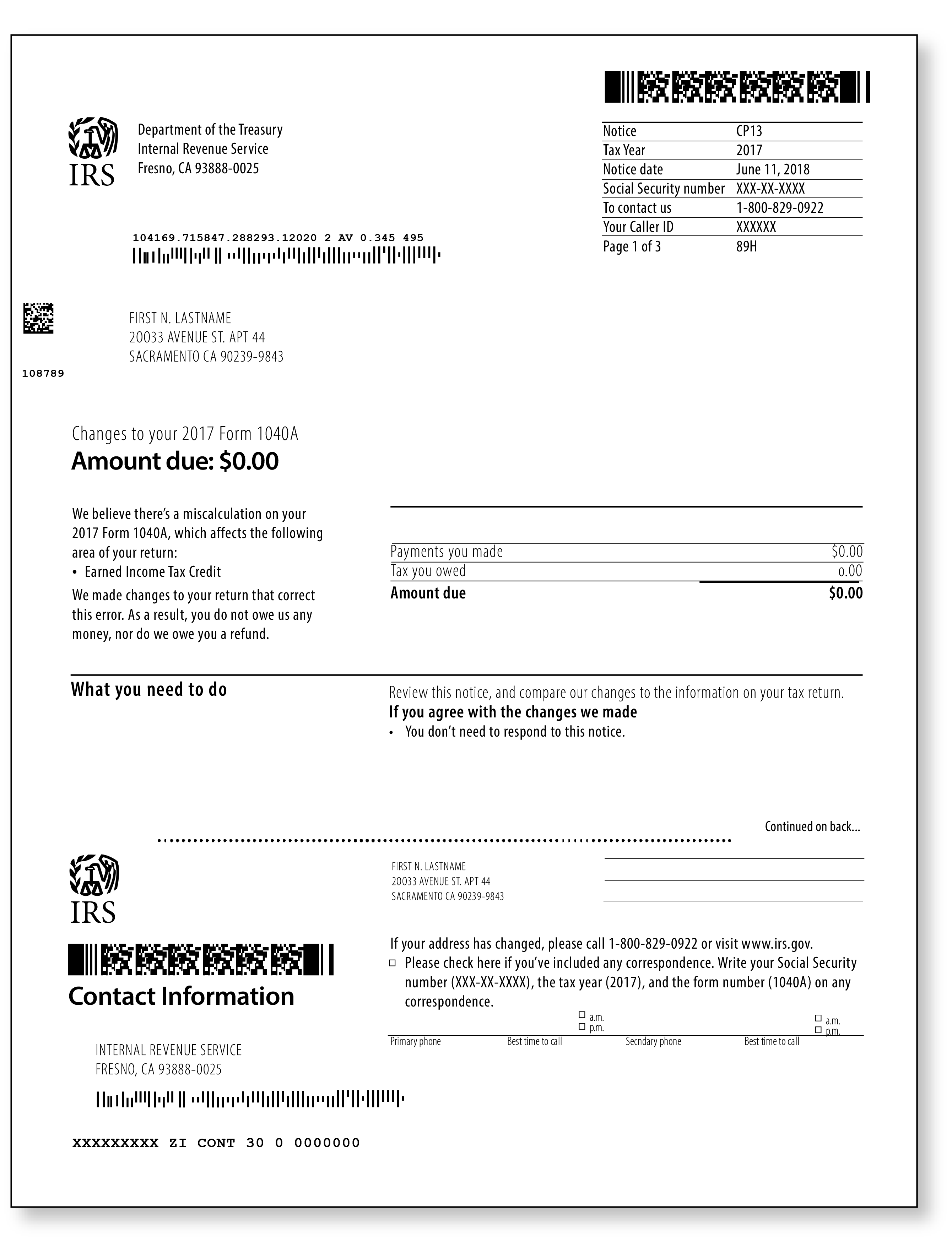

One of the most common notices a taxpayer might receive is the IRS CP13 notice. This letter will state that the IRS believes a miscalculation was made on your tax return and that you do not owe any additional tax. However, if you were expecting a refund, you will no longer be receiving one.

Let’s talk about the contents of the notice, what they mean, and what your next steps should be. Please keep in mind that every part of this notice has critical information, so it is imperative that you read it carefully.

In the top right-hand corner of the notice, it will list the tax year in question and the notice date. This date is important because this is when the clock starts ticking in terms of the time period by which you have to respond to the IRS notice.

Below that, on the left-hand side of the notice, it will list an amount due and the areas of the tax return in which the IRS believes miscalculations were made. The second page of the notice will have more details about what changes the IRS made to your tax return and why. It will then list the corresponding calculations and adjustments.

At this point, if you are a member with us, it is important that you contact us as soon as possible. Do not assume that the IRS notice is correct. You can reach us by visiting our website, where you can quickly and easily report your notice or by calling our Customer Service team at 877.829.9695.

Our Customer Service Representatives will advise you on the next steps and then assign you to one of our Case Coordinators. This person will be there to provide administrative and technical support throughout the duration of your case. They will start by requesting a copy of the notice and the corresponding tax return for one of our tax professionals to review.

Once we receive your documentation, you will be assigned to one of our world-class Tax Professionals. This person will review the notice and tax return in detail and determine what the next steps need to be. In the event that the notice is incorrect and a response is warranted, your Tax Professional will handle the correspondence with the IRS and will make sure that your case is resolved properly. Overall, our goal is to make sure that you pay no more tax than you rightfully owe or receive any refund that you are due.

While getting any type of notice from the IRS or state is scary, the most imperative thing you can do is to take action right away. It might be tempting to throw the letter into your nearest drawer or junk pile, but waiting on any type of notice will only prolong the inevitable of having to face the IRS or state.

And if you have not yet received any type of IRS or state audit or notice but you want the peace of mind that comes with an audit defense membership, now is the time to purchase one. For one low-cost fee, your membership includes full audit representation and the relief of knowing you never have to face the IRS alone.