Winners of the Tax Cuts and Jobs Act

January, 03 2019 by Dave Du Val, EA

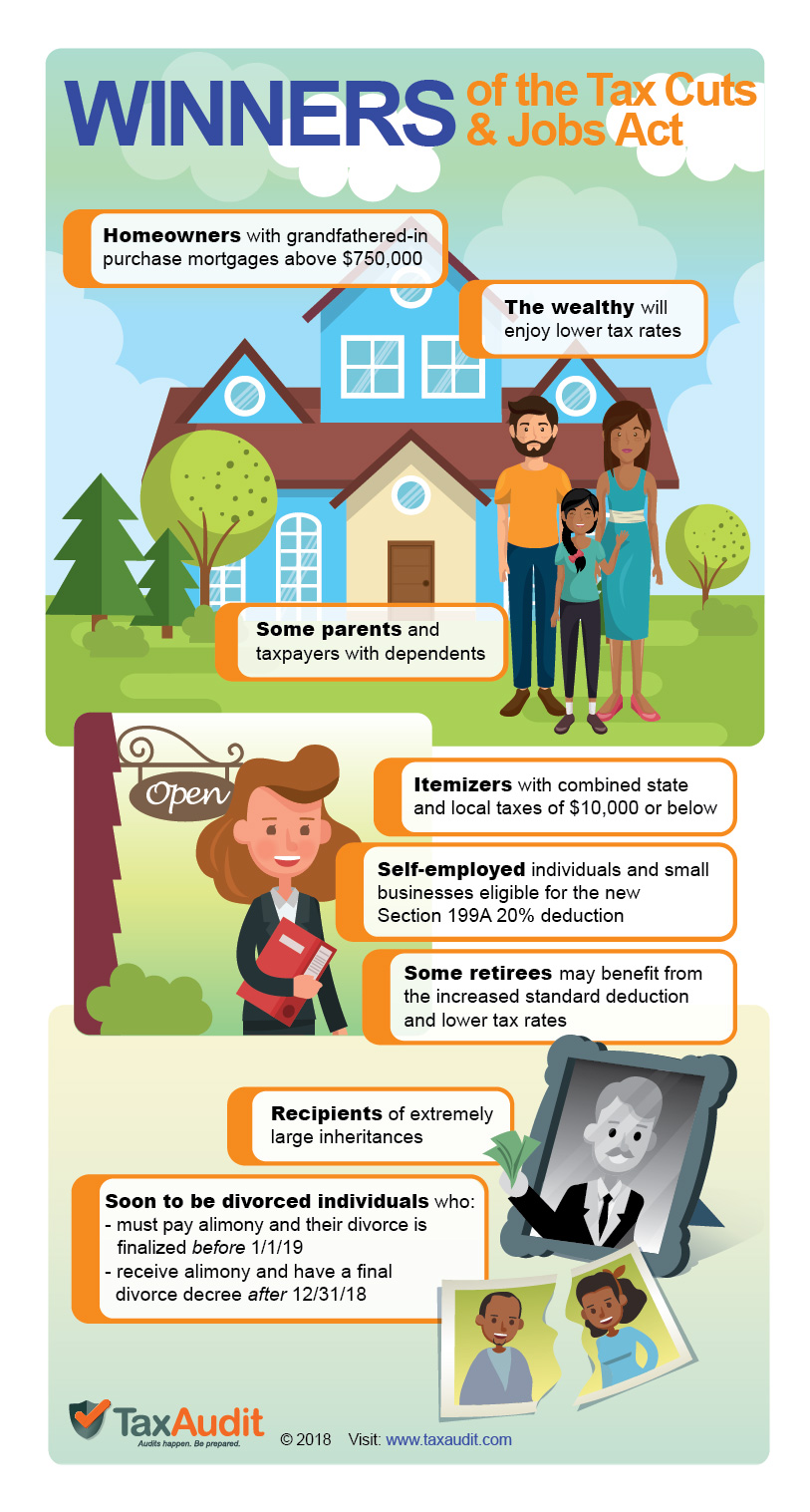

Here is a list of some of the taxpayers who will generally benefit from the new tax law:

Homeowners

- Those with home mortgage loan amounts above $750,000 and equal to or less than $1,000,000 for home acquisition, building, or improvements, and the loans were originated prior to or on 12/15/17.

Itemizers

- Taxpayers in states with low or no state income tax rates and property tax rates, and whose combined state and local taxes are below $10,000, and whose total itemized deductions exceed the new standard deduction.

Self-Employed Taxpayers

- Self-employed taxpayers whose income is within the limits for the new Section 199A deduction for business will benefit from the new 20% deduction.

Retirees

- Some retired individuals may benefit from the increased standard deduction if they have not been able to itemize in the past. They may also benefit from a lower marginal tax rate.

Parents and Taxpayers with Dependents

- Taxpayers whose children are under the age of 17 will benefit from the increased child tax credit which has a much higher income limitation.

- Eligible taxpayers with non-child dependents will benefit from a new $500 credit.

Wealthy Taxpayers

- Wealthy taxpayers will enjoy lower tax rates.

- People who will inherit extremely large amounts of money. The Estate and Gift Tax Exemption for 2018 went up to $11,180,000 after considering the necessary inflation adjustment on $10,000,000.

Soon to be Divorced Taxpayers

- Taxpayers who must pay alimony and whose divorces were finalized before 1/1/19 will still be able to deduct alimony. The deduction of alimony will no longer be a valid deduction for those that are divorced after 12/31/18.

- Taxpayers who receive alimony and will have a final divorce decree after 12/31/18. The requirement to include alimony as income is no longer required.

And here are some tips that may help you maximize your tax refund:

- Certain factors, such as a home office (not as an employee, however), can help to maximize your home mortgage interest deduction.

- Taxpayers with foreign taxes paid generally would benefit by using Form 1116 if they are over the $10,000 limit.

- There is a new $500 credit for eligible taxpayers who support a dependent that is not eligible for the Child Tax Credit.

Please note: This is only a short list of some of the tax changes. Please spend time learning about the rules at IRS.gov so you are knowledgeable about qualifying deductions, exemptions, and more that may help to reduce your tax burden.