All About IRS Notice CP75D | Send Supporting Documentation

November 29, 2023 by Charla Suaste

So, you’ve received an IRS Notice CP75D. What is it? Why did you get it? And what should you do next?

Let’s jump in.

What is an IRS Notice CP75D?

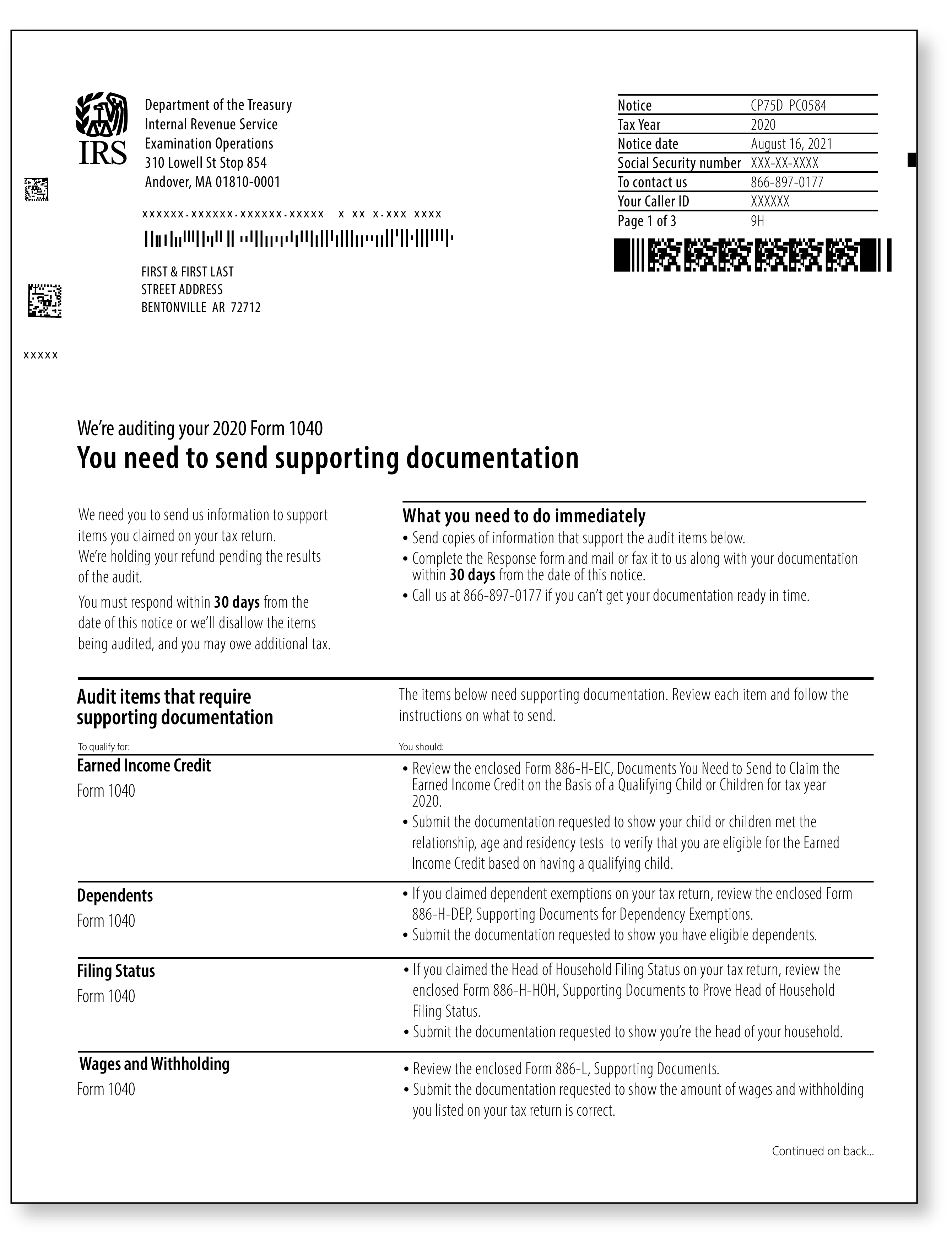

At the top of the notice, the IRS will make it very clear what type of document this is by stating that they are auditing your tax return and they are requiring you to submit specific documentation to verify the claims you made on the corresponding tax return.

Why did you get this notice?

A CP75D is issued when the IRS needs you to verify your income and/or withholding on a particular tax return. Because your income can impact other things on your return, such as your filing status or certain credits or dependents, the IRS needs to confirm that your income and withholding are correct.

In turn, this could affect whether you receive a refund or owe the IRS additional tax.

What should you do next?

First, the most important thing you should do is read the notice in its entirety. Take note of the date listed on the notice, the date by which you need to respond, the tax forms the IRS is questioning, and any documentation they are requesting in turn. The dates, in particular, are extremely important because the IRS typically only allows you 30 days to respond from the date of the notice – which is not a lot of time.

The second thing you need to do, if you are a TaxAudit member, is to call us immediately. Customer Service will start by creating a case for you and provide you with instructions on the next steps. One of the instructions you will be given will be not to contact the IRS (unless otherwise instructed) at this time so we can review your documentation and, if necessary, have one of our Tax Professionals contact them on your behalf.

Once your case has been created, it will be assigned to one of our Case Coordinators. This person will provide administrative support throughout the entirety of your case and will start by getting you set up in our secure message portal as well as requesting certain documentation your tax professional will need to begin working on your case.

After we have received your documentation, one of our Tax Professionals will be assigned, and they will immediately get to work! This person will handle everything from reviewing your documentation, explaining your options, developing a strategy, scheduling and attending phone calls and meetings with the IRS, and defending your tax return through the entire audit process. Not only do our Tax Professionals represent you throughout the audit, but they will also educate you throughout the process and provide tips on how you can try and avoid receiving such a notice in the future. Overall, our goal is to provide support and education for our members while also making sure they never pay more tax than what they rightfully owe.

If you do have an audit notice and would like to get a case started, please contact our Customer Service team at 800.922.8348 as soon as possible – they are standing by and ready to help! And if you are not already a member with us, make sure to check out our website for more information on our memberships. We never want you to have to face the IRS alone!